European stocks showed a cautious upward trend as the US markets remained closed, with the Stoxx 600 index edging up by 0.3%. Despite oil price falls from the postponed OPEC meeting, oil and gas stocks surged while travel stocks faced a decline. Eurozone’s PMI data revealed worrying employment drops, yet signs of a slowing decline in business activity emerged. Meanwhile, attention shifted to the Dutch election’s potential impact. In the US, the Thanksgiving holiday bolstered positive sentiment despite a modest dollar decline. Wall Street futures mirrored gains in European markets, while attention shifted to S&P Global PMI projections amid a lack of major US releases. Currencies like the Euro and Pound remained steady against the dollar, driven by encouraging PMI data, while others, including the Aussie and Kiwi Dollars, saw mixed movements influenced by domestic indicators and market sentiments.

With the US markets closed, European stocks closed slightly higher on Thursday. The pan-European Stoxx 600 index edged up by 0.3%, showcasing a cautious upward trend amidst investor uncertainty. Despite the ongoing fall in oil prices stemming from OPEC’s postponed meeting, oil and gas stocks surged by 1.4%, countering the downward pressure. However, travel stocks faced a contrasting fate, experiencing a 1% decline. The preliminary purchasing managers’ index data for November in the eurozone painted a worrisome picture, revealing a significant drop in employment for the first time in nearly three years. Even as business activity continued to contract, there were glimmers of hope as the rate of decline in both output and new business showed signs of slowing down. Meanwhile, attention turned to the Dutch election results, particularly an exit poll suggesting the potential for a substantial victory by right-wing populist Geert Wilders and his Freedom Party, the PVV.

In the U.S., stocks saw an increase on Wednesday, buoyed by the benchmark 10-year Treasury yield’s temporary dip to a two-month low. The broadening of the November market rally extended into the Thanksgiving holiday, fostering positive momentum in the market.

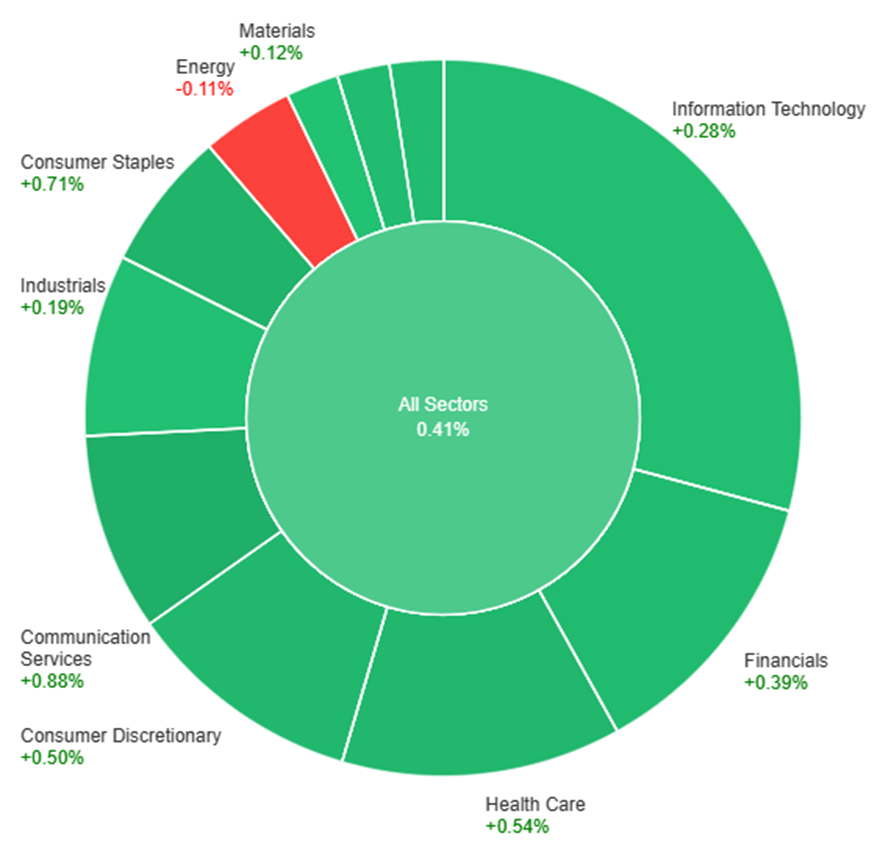

Data by Bloomberg

Stock markets were closed on Thursday, here it is the latest updates from Wednesday, across various sectors, the market generally saw positive gains, with the Communication Services sector leading the way with a rise of 0.88%. Following closely were Consumer Staples at 0.71% and Health Care at 0.54%. Sectors such as Financials, Real Estate, and Consumer Discretionary also experienced moderate gains, ranging from 0.37% to 0.50%. However, some sectors did not fare as well, with Energy being the only sector to experience a decrease, falling by 0.11%. Sectors like Information Technology, Industrials, and Materials saw gains ranging from 0.12% to 0.28%, contributing to the overall positive trend in the market for the day.

In a truncated trading session due to the Thanksgiving holiday, the US Dollar experienced a modest decline, settling around 103.75 in the US Dollar Index (DXY), lingering below the 104.00 mark. Despite the closure of US markets, positive sentiment prevailed in Wall Street futures following gains in European markets. With no major US data scheduled for release on Friday and a shortened Wall Street session, attention turned to the S&P Global PMI projection, indicating a slight anticipated downturn in both the Services and Manufacturing sectors.

Meanwhile, the performance of other currencies against the dollar varied. The Euro maintained a relatively stable position around 1.0900 against the dollar, buoyed by encouraging Eurozone PMI figures and an uneventful account of the European Central Bank’s latest meeting. The Pound exhibited strength, reaching a two-month high against the dollar at 1.2530, driven by positive UK PMI data. Other currencies like the Japanese Yen, New Zealand Dollar, Canadian Dollar, and Australian Dollar displayed mixed movements against the US Dollar, influenced by domestic economic indicators and market sentiment. Despite subdued price action, the Australian Dollar managed to rise against the dollar, hovering around 0.6550, while the New Zealand Dollar awaited Q3 Retail Sales data and the Canadian Dollar looked toward the release of September Retail Sales figures.

EUR/USD Inches Up Amidst Low Volume Consolidation: Eurozone Data Insights and ECB Outlook

The EUR/USD saw a modest rise amidst low trading volume, hovering around 1.0900 while the US Dollar Index weakened slightly, fostering support for the pair amid subdued market activity. Eurozone PMI figures showed improvements in both the Manufacturing and Services sectors, yet remaining below the growth threshold. The data initially boosted the Euro but lacked sustained momentum due to minimal trading. The upcoming German GDP report and ZEW survey are anticipated to impact market sentiment. ECB’s recent meeting minutes revealed a consensus on maintaining policy rates and addressing heightened economic uncertainty. Despite ECB President Lagarde and council members slated to speak, clear insights into monetary policy adjustments aren’t expected, especially amid the US market’s closure for Thanksgiving, likely leading to thin trading conditions.

On Thursday, the EUR/USD moved flat as the US market holiday. Currently, the price is moving just below the middle band of the Bollinger Bands with a potential of moving in consolidation as the US market will also close earlier today. The Relative Strength Index (RSI) stays at 54 which reflects a neutral position for the currency pair.

Resistance: 1.0956, 1.1004

Support: 1.0885, 1.0832

XAU/USD Struggles to Hold $2,000 Amidst Quiet Trading Session

Gold Spot experienced a fluctuating journey, initially surging towards $2,000 in the Asian session, propelled by a weaker US Dollar, only to retract gains and settle around $1,990 during American hours amid limited trading activity with US markets closed. Despite benefiting from increased risk appetite and a weakening dollar, bolstered by favorable Eurozone PMIs, the precious metal fell short of reclaiming the $2,000 mark. With expectations of continued thin trading and a shortened US market session on Friday, Gold faces a landscape favoring consolidation, although the bullish bias persists for XAU/USD.

On Thursday, the XAU/USD moved flat as the US market holiday. Currently, the price is moving just below the middle band of the Bollinger Bands with a potential of moving in consolidation as the US market will also close earlier today. The Relative Strength Index (RSI) stays at 55 which reflects a neutral position for the pair.

Resistance: $1,996, $2,008

Support: $1,988, $1,973

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Flash Manufacturing PMI | 22:45 | 49.9 |

| USD | Flash Services PMI | 22:45 | 50.4 |