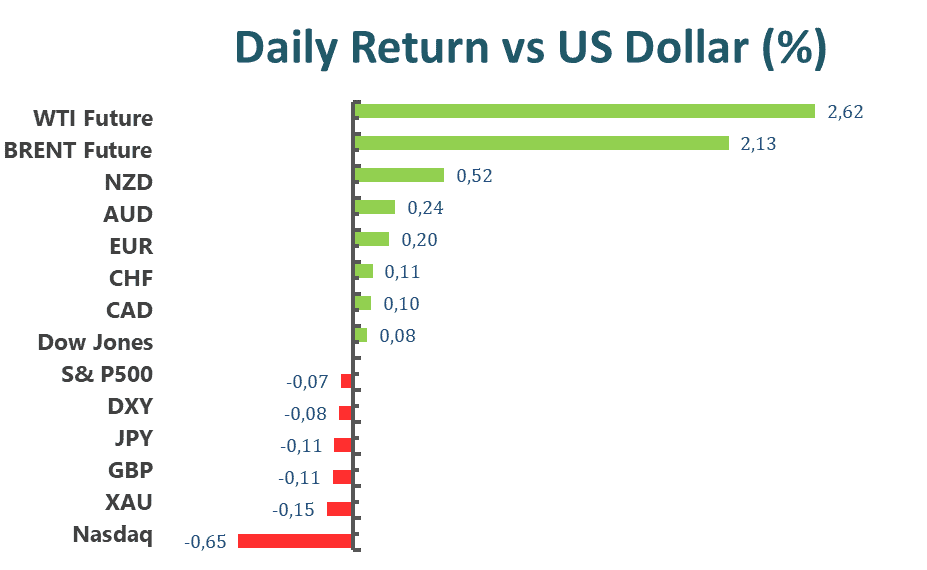

US stock little declined on Tuesday, as Federal Reserve officials implied the next move of the central bank will be more hawkish to calm runaway inflation. Investors are keeping their eyes out for comments from Fed officials about the necessity of a more aggressive interest rate policy. It’s also worth noting that, Pelosi’s trip has created new geopolitical tensions for investors already consuming the prospects of the US recession, global interest rate hikes and Russia’s war in Ukraine. Fresh economic data also showed that US openings in June fell to a nine-month low, which is a signal to tell investors that demand for the labour market is moderating as higher economic pressure.

The benchmarks, S&P500 and Dow Jones Industrial Average both slid on Tuesday. S&P 500 fell with a 0.67 % losses on a daily basis as Nancy Pelosi’s arrival in Taiwan prompted China to do missile test, undermined the geopolitical tensions, and all eleven sectors stayed in negative territory as Real Estate and Financial sectors performed worst among all groups, falling 1.3% and 1.07% respectively. Moreover, the Dow Jones Industrial Average dropped 1.1% for the day, Nasdaq has little changed with 0.3% losses and the MSCI world index rose 0.1% on Tuesday.

Main Pairs Movement

US dollar surged with a 0.85% gain on Tuesday, the market is surrounded by a risk-aversion mood as tensions caused by the news of US House Speaker Nancy Pelosi’s visit to Taiwan. The DXY index eased at the beginning of Tuesday, but regain bullish momentum after the hawkish comments from Federal Reserve officials, which resumed the consecutive days’ losses and back to the level above 106.1.

The GBP/USD dropped 0.65% for the day, as the market amid a risk-aversion mood and a strong save greenback across the board. The cables slip almost all day on Tuesday, as a huge selling pressure caused by Pelosi’s trip may undermine the relationship between US and China. The GBPUSD touched a daily low level during the US trading session around 1.218. Meanwhile, EURUSD also lost the previous day’s gain and fell back to a level under 1.018 at end of the day. The pairs dropped 0.94% on Tuesday.

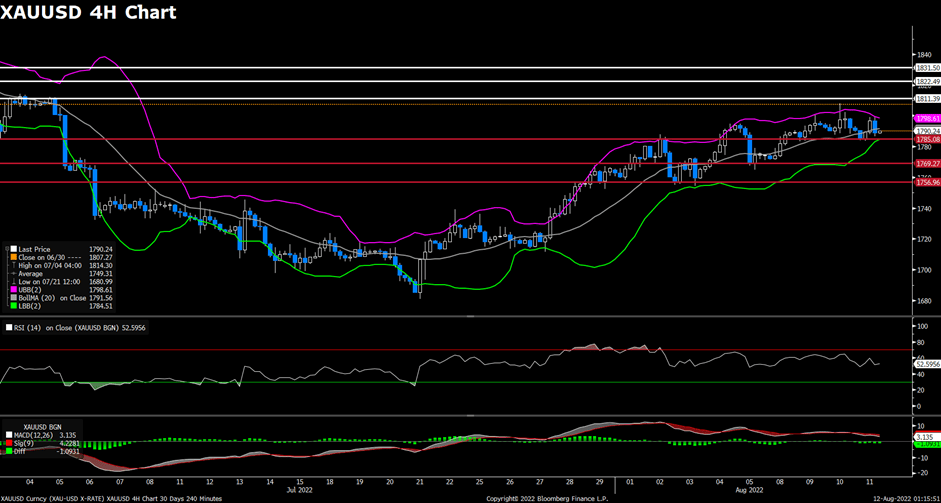

The Gold declined by 0.66% daily as the risk aversion market makes a save greenback strong across the board and US yields have rallied recently weighing on the gold price. WTI and Brent oil rose 0.56% and 0.51% on Tuesday.

Technical Analysis

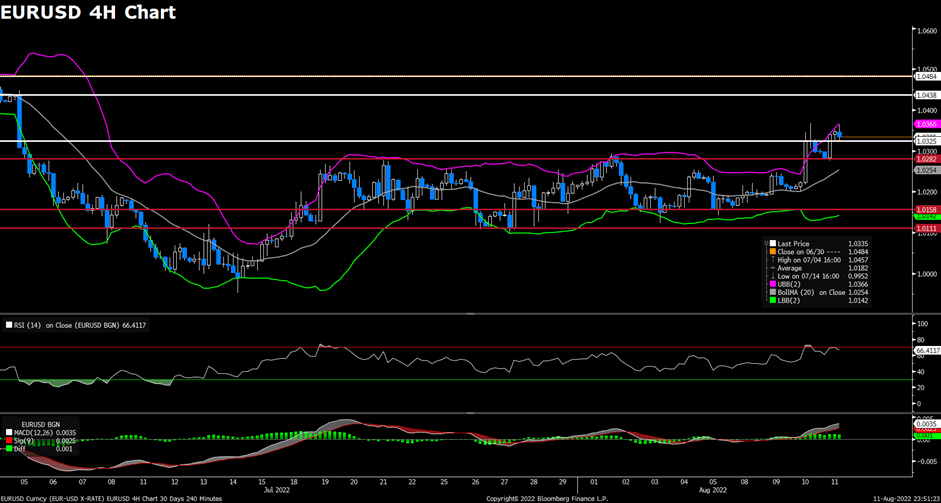

EURUSD (4-Hour Chart)

The EUR/USD pair declined on Tuesday, remaining under bearish pressure and dropped to a daily low below 1.019 level amid the risk-averse environment. The pair is now trading at 1.0203, posting a 0.58% loss daily. EUR/USD stays in the negative territory amid a stronger US dollar across the board, as the risk-off market mood underpinned the safe-haven greenback and acted as a headwind for the EUR/USD pair. Tensions between the US and China have escalated as Nancy Pelosi, the speaker of the US House of Representatives is expected to meet Taiwan’s President on Wednesday. News also reported that several Chinese warplanes fly close to the median line of the Taiwan strait this morning. For the Euro, investors await the PMI and the Retail Sales data that will release on Wednesday.

For the technical aspect, the RSI indicator is 47 figures as of writing, suggesting that the downside is more favoured as the RSI stays below the mid-line. As for the Bollinger Bands, the price preserved its downside traction and dropped below the moving average, therefore the bearish momentum should persist. In conclusion, we think the market will be bearish as the pair tests the 1.0175 support line. The bearish case is clear as the technical indicators head firmly lower crossing their midlines into negative territory.

Resistance: 1.0245, 1.0289, 1.0438

Support: 1.0175, 1.0111, 0.9991

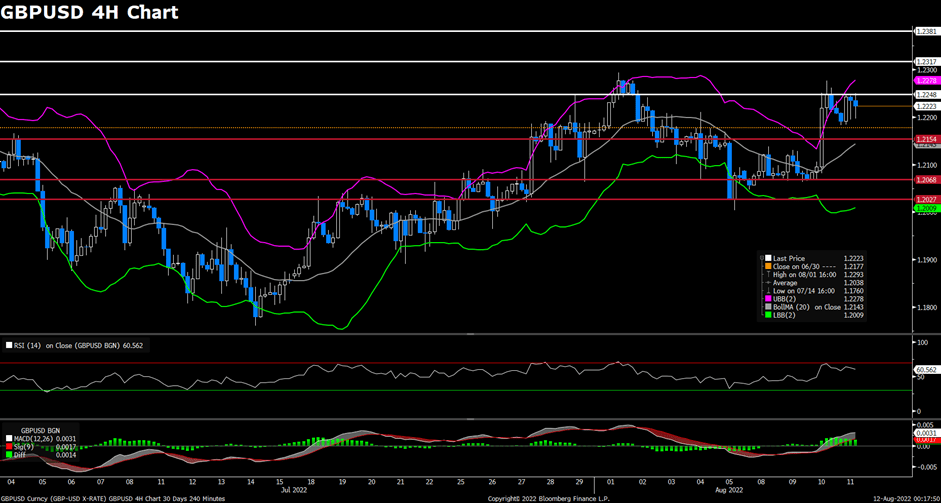

GBPUSD (4-Hour Chart)

The GBP/USD pair slipped on Tuesday, retreating from a multi-week high and dropping below the 1.2200 mark in the early US session amid renewed strength witnessed in the US dollar. At the time of writing, the cable stays in negative territory with a 0.20% loss for the day. The concerns about a global economic downturn and escalating US-China tensions ahead of US House Speaker Pelosi’s arrival in Taiwan both weighed on market sentiment, helping the greenback to find demand. For the British pound, the Bank of England is scheduled to announce its monetary policy decision on Thursday, which could be a main driver for the cable and market participants are also rising their bets for a 50 bps rate hike by the BoE.

For the technical aspect, the RSI indicator is 57 figures as of writing, suggesting that the near-term bullish bias stays intact with the RSI indicator holding above 50. For the Bollinger Bands, the price regained upside strength and rebounded from the moving average, so a continuation of the upside trend can be expected. In conclusion, we think the market will be slightly bullish as long as the 1.2178 support line holds. On the upside, a break above the 1.2277 resistance line could favour the bulls and lead to additional gains for the pair.

Resistance: 1.2277, 1.2317, 1.2381

Support: 1.2178, 1.2115, 1.2039

USDCAD (4-Hour Chart)

As the recession fears and US-China tensions over Taiwan drive safe-haven flows toward the US dollar, the pair USD/CAD witnessed some buying and touched a daily high near 1.2880 level during the US trading session. USD/CAD is trading at 1.2843 at the time of writing, rising 0.03% daily. The latest news showed that the plane of US House speaker Pelosi have landed in Taiwan, which increases tensions between the US and China. On top of that, the surging crude oil prices have provided stronger support to the commodity-linked loonie and capped gains for the USD/CAD pair as WTI rebounded towards the $96 per barrel area. The markets expect a further gradual increase of the production targets from the OPEC+ meeting on Wednesday.

For the technical aspect, the RSI indicator is 50 figures as of writing, suggesting that the upside is losing momentum as the RSI indicator drops toward the mid-line. For the Bollinger Bands, the price failed to preserve the upside strength and retreated toward the moving average, therefore some downside tractions could be expected. In conclusion, we think the market will be slightly bearish as the pair failed to break above the 1.2891 resistance line. The falling RSI also reflects bear signals.

Resistance: 1.2891, 1.2944, 1.2986

Support: 1.2823, 1.2785

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | Retail Sales (MoM) | 09:30 | 0.2% |

| GBP | Composite PMI (Jul) | 16:30 | 52.8 |

| GBP | Services PMI (Jul) | 16:30 | 53.3 |

| USD | ISM Non-Manufacturing PMI (Jul) | 22:00 | 53.5 |

| USD | Crude Oil Inventories | 22:30 | -0.629M |