Stock futures showed a slight decline in anticipation of crucial financial reports, with Dow Jones Industrial Average futures falling by 0.1% and both S&P 500 and Nasdaq-100 futures edging lower by the same margin. United Airlines and J.B. Hunt faced notable declines due to soft guidance and disappointing results, respectively. As earnings season continues, companies are exceeding earnings and sales expectations, while investors are closely monitoring interest rates. In the currency market, the US dollar remained stable despite brief fluctuations, the EUR/USD pair saw a minimal increase, and the GBP/USD pair depreciated due to concerns about the UK’s economic conditions. The USD/JPY pair recorded modest gains, influenced by various factors, including monetary policies and the situation in the Israel-Hamas conflict. Federal Reserve Chair Jerome Powell’s statements later in the week are eagerly anticipated.

In the stock market update, stock futures showed a slight decline as Wall Street was anticipating key financial reports. Dow Jones Industrial Average futures dipped 0.1%, or 37 points, while S&P 500 futures and Nasdaq-100 futures both edged lower by 0.1%. Notable stocks that faced declines included United Airlines, which fell more than 4% due to soft guidance, and J.B. Hunt, which lost more than 3% due to disappointing results. The previous trading session saw modest movement, with the Dow Jones Industrial Average rising 0.04%, the S&P 500 inching 0.01% lower, and the Nasdaq Composite falling 0.25%. Bond yields rose on stronger-than-expected September retail sales, and the yield on the 10-year U.S. Treasury note reached its highest level since October 6. Chip stocks like Nvidia and Advanced Micro Devices declined as the U.S. announced plans to tighten restrictions on AI chip exports to China. Wall Street was also monitoring the impact of the Israel-Hamas conflict and analyzing third-quarter earnings reports, with many companies surpassing earnings and sales expectations.

As earnings season continues, the outlooks and the direction of interest rates will play a crucial role in determining the near-to-intermediate term direction of stocks. So far, 83% of companies have exceeded earnings expectations, and approximately 70% have exceeded sales estimates. The reporting season continued with results expected from Morgan Stanley, Procter & Gamble, and Travelers before the opening bell on Wednesday, with Netflix and Tesla set to release their results after the market close. Additionally, the market was awaiting housing starts and building permits data for September on the economic front.

Data by Bloomberg

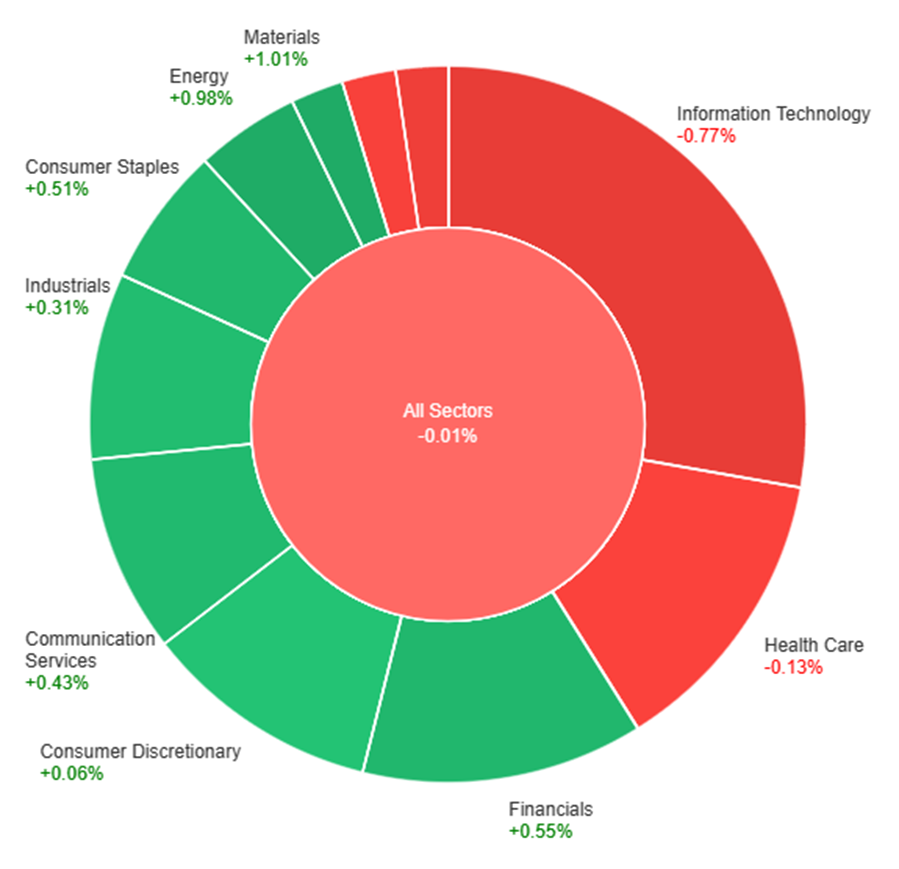

On Tuesday, the overall performance of the stock market showed a slight decline of 0.01%. Among the sectors, Materials and Energy had the most significant gains, with increases of 1.01% and 0.98%, respectively. Financials and Consumer Staples also saw positive returns, rising by 0.55% and 0.51%. Communication Services and Industrials followed with smaller gains of 0.43% and 0.31%. Consumer Discretionary had a marginal increase of 0.06%. However, Health Care, Utilities, Real Estate, and Information Technology sectors all experienced declines, with Health Care and Utilities decreasing by 0.13% and 0.24%, respectively, and Real Estate and Information Technology declining by 0.54% and 0.77%.

In recent currency market updates, the US dollar remained relatively stable despite a brief dip. This stability came despite favorable US data, except for a miss in the NAHB data. The dollar has been consolidating its substantial gains since July. The Federal Reserve’s stance that rising Treasury yields have diminished the necessity for another interest rate hike has contributed to this consolidation. The EUR/USD pair experienced a minimal 0.01% increase. It briefly dipped in response to unexpectedly strong US retail sales data but subsequently rebounded to reach a high of 1.0595 on EBS. However, it faced resistance just below the 1.0600 level and along the downtrend line from July’s highs. To initiate a more significant correction to the upside, a close above October’s high at 1.0640 is required.

The GBP/USD pair depreciated by 0.35% due to concerns over the UK’s economic conditions, particularly amid upcoming inflation data. Meanwhile, the USD/JPY pair recorded a 0.2% rise but struggled to surpass the high established on October 3, 2023, at 150.165, as well as the more formidable 32-year peak from 2022 at 151.94. The modest gains were attributed to growing spreads between Treasury and JGB yields, even as 10-year JGB yields reached their highest point since 2013 at 82bp, nearing the Bank of Japan’s hard yield cap of 100bp. Speculation regarding the Bank of Japan raising its inflation forecasts, the divergence in monetary policies, and the possibility of Ministry of Finance (MoF) foreign exchange intervention all played a role in these developments. Additionally, market participants continue to monitor the situation in the Israel-Hamas conflict and eagerly await statements from Federal Reserve Chair Jerome Powell and other policymakers regarding monetary policy later this week.

EUR/USD Surges Despite Positive US Data and Rising Treasury Yields; ECB Policy Meeting Looms

The EUR/USD pair defied positive US economic data and surging Treasury yields on Tuesday, reaching a high of 1.0595 before retreating slightly. The Eurozone exhibited encouraging signs with the ZEW survey reporting an improved Eurozone Sentiment Index, while the German ZEW also exceeded expectations. The European Central Bank (ECB) is expected to maintain its interest rates unchanged next week. Although both US and European bond yields increased significantly, the robust US data may limit the EUR/USD pair’s upside potential, as it experienced a brief drop before reversing course. Upcoming economic indicators and the ECB meeting will likely continue to influence this currency pair.

Based on technical analysis, the EUR/USD was slightly higher on Tuesday, pushing towards the upper band of the Bollinger Bands. Currently, the EUR/USD is trading just below the upper band, suggesting the potential for another higher movement. The Relative Strength Index (RSI) stands at 55, indicating that the EUR/USD is still in neutral bias.

Resistance: 1.0616, 1.0655

Support: 1.0557, 1.0502

XAU/USD Rebounds to Weekly High as Strong US Data Boosts Market Sentiment Despite Rising Bond Yields

In the world of precious metals, spot Gold (XAU/USD) made a significant recovery, trading around $1,923 per troy ounce and hitting a fresh weekly high of $1,913.57, though still slightly below the previous week’s peak. The rally was fueled by upbeat US data, including a 0.7% increase in September Retail Sales, surpassing market expectations, and positive reports on Capacity Utilization and Industrial Production. Meanwhile, global concerns over inflation eased as New Zealand and Canada reported declining inflation rates, providing a further boost to market sentiment. However, rising government bond yields, particularly the 10-year Treasury note, which reached 4.80%, tempered the decline of the US Dollar.

Based on technical analysis, XAU/USD is moving slightly higher on Tuesday and consolidating between the upper and middle bands of the Bollinger Bands. Currently, the price of gold is moving higher with the potential of reaching the upper band. The Relative Strength Index (RSI) currently registers at 70, indicating a bullish bias for the XAU/USD pair.

Resistance: $1,946, $1,959

Support: $1,928, $1,913

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | CPI y/y | 14:00 | 6.6% |