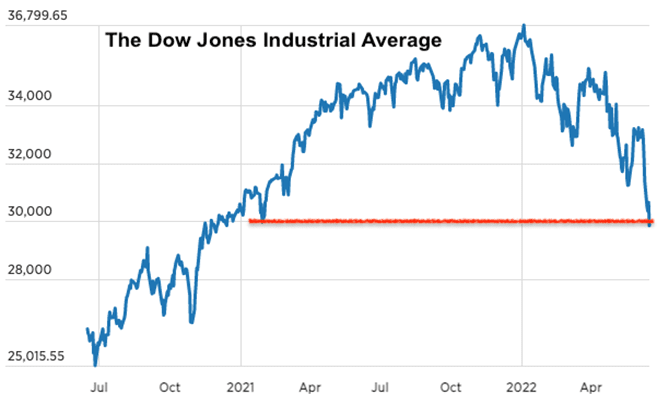

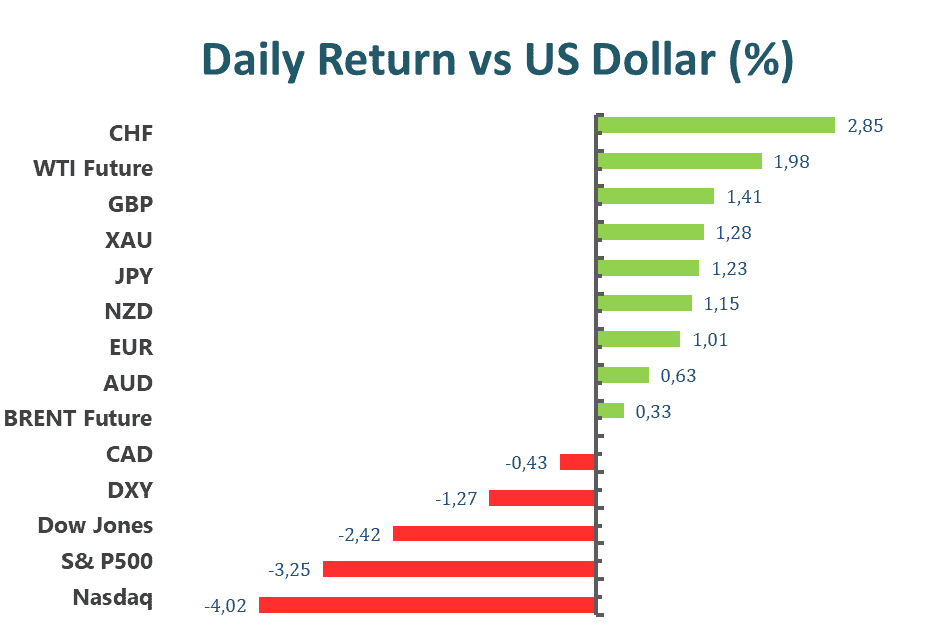

US equity markets sank on Thursday and reversed the gains from Wednesday as investors worried the Fed’s aggressive monetary policy might lead the US economy into a recession. The Dow Jones Industrial Average tumbled below the psychological and key 30,000 level for the first time since early 2021. And the S&P 500 shed 3.25% while the Nasdaq Composite plunged more than 4%, to 10,646.10, the lowest level since late 2020.

The market sentiment appeared to sour and intensify once again on Thursday as several central banks started adopting a more tightening monetary policy cycle. The Swiss National Bank raised its interest rates for the first time in more than a decade; it increased its rate from -0.75% to -0.25% and in the meantime raised its inflation prediction for 2022 to 2.8%, 0.7% higher than the prediction made in March. Moreover, the Bank of England also raised rates for the fifth time in a row as the inflationary pressure continued and the UK economy shrank 0.3% in April and a 0.1% contraction in March. Its monetary policy committee decided to raise another 25 basis points to 1.25%, attempting to ease the inflation.

Main Pairs Movement

EUR/USD soared above the 1.0500 level for the first time in a week following the US Fed’s interest rate hikes. EUR/USD was up 1.01%, finishing with 1.05459 at the end of the day.

GBP/USD rallied more than 1.40% on Thursday following the Bank of England aggressively lifted its interest rates for the fifth time in a row, boosting the British Pound.

USD/JPY’s rally took a pause two days in a row as investors await ahead of the Bank of Japan’s monetary policy report on Friday. In the meantime, investors also stay cautious before the speech from Fed Chairman Jerome Powell. On Thursday, USD/JPY pared 1.23% and closed at 132.156.

AUD/USD established above 0.7040 level, was up 0.58%. The Aussie stayed strong for a two-consecutive days as the Reserve Bank of Australia Philip Lowe mentioned that he is confident to bring back the inflation rate back to the 2% to 3% range. In the meantime, the demand for the US dollar stayed quite ahead of the speech from Jerome Powell.

Technical Analysis

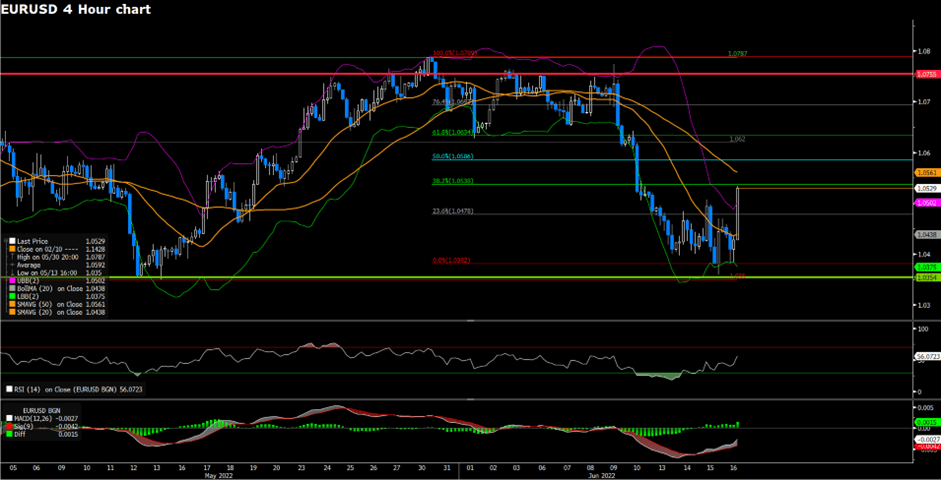

EURUSD (4-Hour Chart)

EURUSD extends its gain for the second consecutive day after the Federal Reserve hiked interest rates by 75 basis points. The Dollar continues to lose steam as Fed chair Jerome Powell leaves an additional 75 basis point interest rate hike on the table for July. The weak U.S. job report also weakened the U.S. Greenback and added worries to a slowing U.S. economy. Eurozone CPI is set to release during the European trading session on the 17th.

On the technical side, EURUSD has rebounded strongly from our previously estimated support level of 1.03783. The 50% Fibonacci retracement at 1.0586 presents a near-term resistance level. RSI for the pair sits at 46.75, as of writing. On the four-hour chart, EURUSD currently trades below its 50, 100, and 200-day SMA.

Resistance: 1.07691

Support: 1.03783

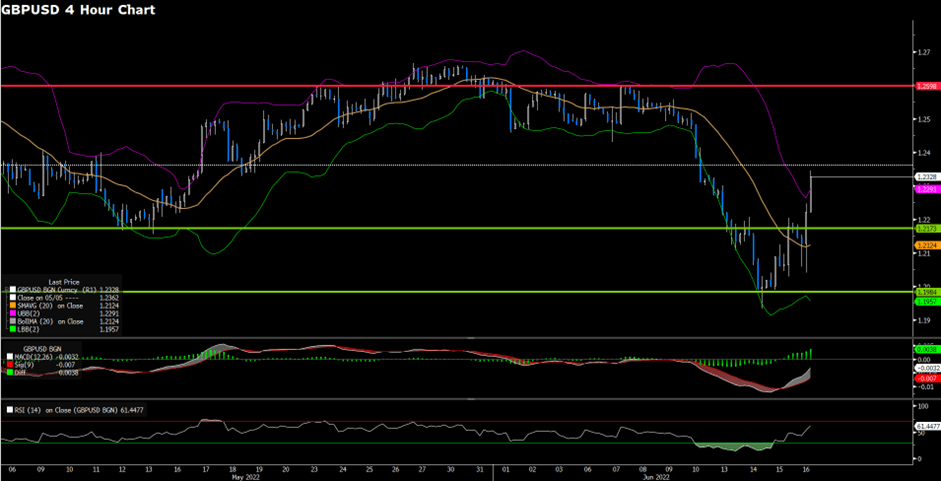

GBPUSD (4-Hour Chart)

GBPUSD extends its gains from the previous trading day. The BoE has hiked its rates for the fifth time of the year in an attempt to tame inflation. Economic guidance provided by the BoE remains gloomy as energy and food prices continue to soar; furthermore, the BoE has forecasted inflation to rise slightly above 11% by October. While the BoE is adamant about raising interest rates, the central bank is still juggling the possibility of stagflation in the near term.

On the technical side, GBPUSD has bounced strongly off our estimated support level of 1.20824. Near-term resistance sits at 1.25047 and 1.27143. RSI for the pair has recovered to 47.24, as of writing. On the four-hour chart, GBPUSD is currently trading below its 50, 100, and 200-day SMA.

Resistance: 1.25944

Support: 1.20824

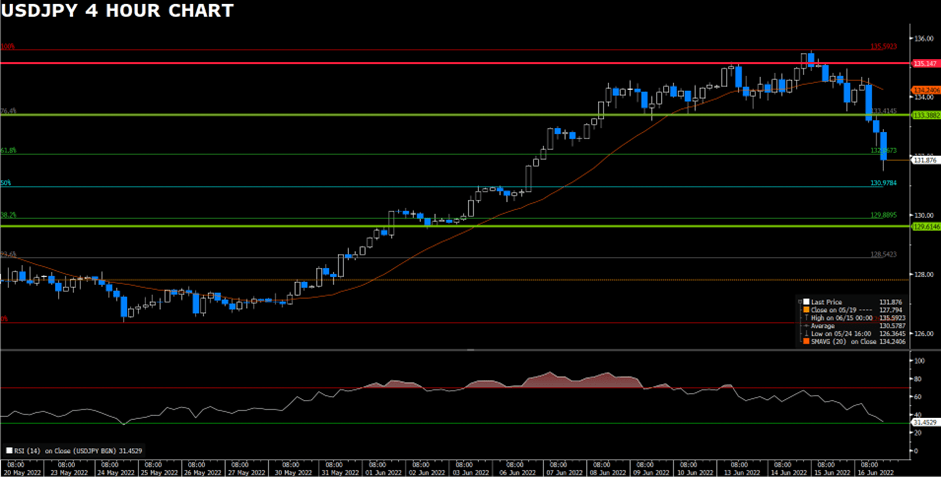

USDJPY (4-Hour Chart)

USDJPY enters its second day of retreat as the U.S. Greenback loses demand. As the U.S. 10-year Treasury yield retreats below 3.4%, market participants are now turning their focus on the BoJ’s monetary policy announcement scheduled during the Asia trading session on the 17th. In the near term, the Japanese Yen remains weak compared to the U.S. Greenback as the Japanese central bank remains firm with their easy money policy.

On the technical side, USDJPY enters its second day of correction but support levels still hold firm at our previously estimated levels of 133.5 and 132.5. RSI for USDJPY currently indicates 56.2, retreating from overbought territory. On the four-hour chart, USDJPY currently trades above its 50, 100, and 200-day SMA.

Resistance: 134.56

Support: 133.5, 132.5

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| JPY | BoJ Monetary Policy Statement | 11:00 | – |

| EUR | CPI (May) | 17:00 | 8.1% |

| USD | Fed Chair Jerome Powell Speaks | 20:45 | – |