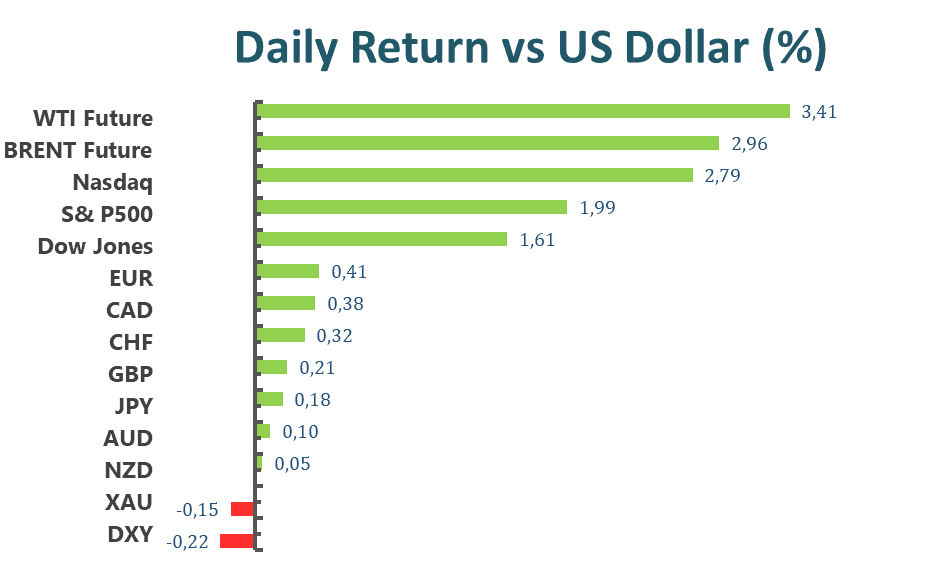

U.S. equities markets rallied on Wednesday’s trading. The Dow Jones Industrial Average rose 1.61% to close at 32637.19. The S&P 500 climbed 1.99% to close at 4057.84. The Nasdaq composite gained 2.68% to close at 11740.65. Wednesday’s rebound could be a short-term recovery after equities saw heavy selling over the past month. Global macro-economic factors remain weak, thus market participants should still be aware of downside risks and enhance risk management.

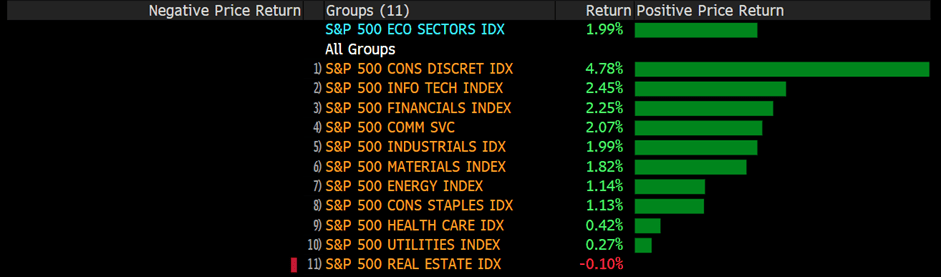

The consumer discretionary sector built on Tuesday’s momentum and gained the most out of all sectors in the S&P 500 index. Macy’s raised its 2022 profit outlook, while retail giant William Sonoma beat earnings estimates—Macy’s soared 19.3%, and William Sonoma shot up 13%. Dollar Tree, a major discount retailer in the U.S., also enjoyed a 21.9% boost in share price after the company announced earnings that were better than estimated.

The benchmark U.S. 10-year Treasury yield continued to fall and is currently sitting at 2.752%.

Elon Musk increased his commitment to the purchase of Twitter. Twitter’s share price surged 6.3% after Musk announced that he will increase his takeover bid to $33.5 billion; however, Musk is still on a mission to rid Twitter of “bot users” and will not commit until a full vet of Twitter’s user base.

Main Pairs Movement

The Dollar Index sold off on Wednesday’s trading. Market participants rotated out of the money market into equity markets as risk sentiment improved on Wednesday. The Dollar Index currently sits at around 101.717, which is a near-term support level for the index.

EURUSD rose 0.43% throughout yesterday’s trading. The Euro rose against the Dollar amidst broad-based Dollar weakness. The weak U.S. GDP report also allowed Euro bulls to push the shared currency higher.

GBPUSD rose 0.16% throughout yesterday’s trading. The British Pound has gained back substantial ground against the Dollar over this month. Recently announced FOMC minutes, however, show the Fed is ready to hike rates at least by 100 basis points throughout the next two meetings.

USDCAD fell 0.34% throughout yesterday’s trading. Commodities, specifical oil, surged once again as the WTI offshore rose above $114 per barrel, thus favoring the commodity-linked Canadian Loonie.

Technical Analysis

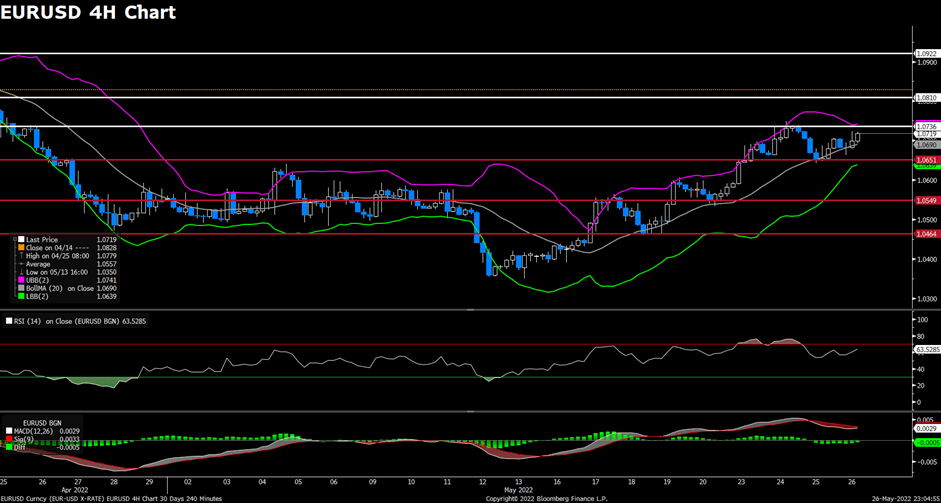

EURUSD (4-Hour Chart)

The EUR/USD pair advanced on Thursday, ending its slide that started yesterday and recovered toward the 1.072 area amid the risk-on market sentiment. The pair dropped to a daily low below 1.067 level in the late Asian session, but then regained upside momentum and recovered all of its daily losses. The pair is now trading at 1.0718, posting a 0.40% gain daily. EUR/USD stays in the positive territory amid a weaker US dollar across the board, as the generally positive tone around the equity markets and downbeat US data both undermined the safe-haven greenback. The US GDP report showed that the US economy contracted by a 1.5% annualized pace during the first quarter of 2022, adding to the concerns about the worsening global economic outlook. For the Euro, the expectations that the European Central Bank could raise rates at some point in the summer keep acting as a tailwind for the pair, as the rising eurozone inflation is pressing the ECB to announce quantitative restrictions.

For the technical aspect, the RSI indicator is 63 figures as of writing, suggesting that the upside is more favored as the RSI stays above the mid-line. As for the Bollinger Bands, the price rose from the moving average and climbed toward the upper band, therefore a continuation of the upside trend could be expected. In conclusion, we think the market will be bullish as the pair is heading to test the 1.0736 resistance. Further gains could be expected if the pair break above that level.

Resistance: 1.0736, 1.0810, 1.0922

Support: 1.0651, 1.0549, 1.0464

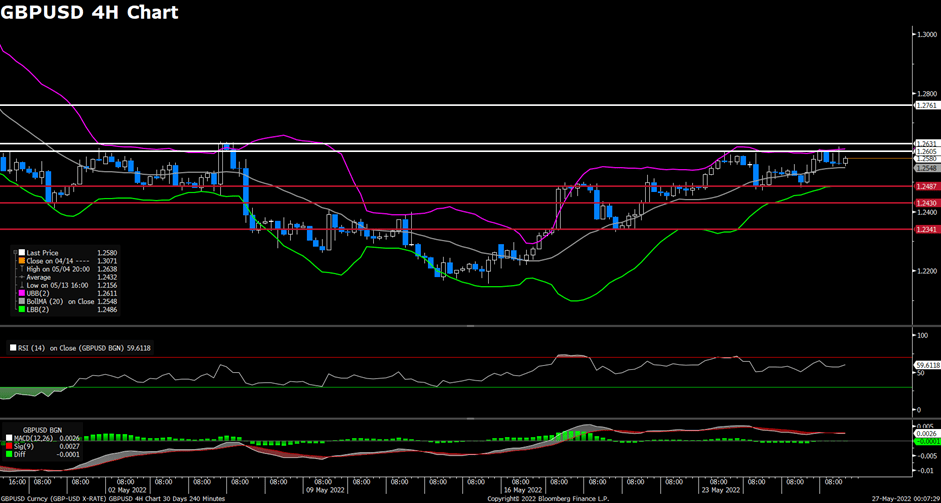

GBPUSD (4-Hour Chart)

The pair GBP/USD edged higher on Thursday, regaining bullish traction, and rebounded slightly from the 1.255 area amid the improving market mood. The pair gather bullish momentum and touched a daily high during the European session, but then lost its strength and surrendered most of its intra-day gains. At the time of writing, the cable rebounds back slightly and stays in positive territory with a 0.02% gain for the day. The minutes of the FOMC’s May policy meeting failed to provide standout hawkish surprises, as market participants now expect that the Fed could pause or slow down the rate hike cycle once rates have reached the neutral level later in the year. For the British pound, reports showed that the UK Chancellor of the Exchequer Rishi Sunak could be about to announce a fiscal stimulus plan for UK consumers and low-income households, which has lent some support to the cable.

For the technical aspect, the RSI indicator is 59 figures as of writing, suggesting that the buyers retain control of the pair’s action as the RSI stays above the mid-line. For the Bollinger Bands, the price regained upside traction and climbed toward the upper band, indicating that the upside momentum should persist. In conclusion, we think the market will be bullish as the pair is heading to test the 1.2605 resistance. On the downside, a four-hour close below the 1.2487 support could favor the sellers and cause the pair to drop toward 1.2430.

Resistance: 1.2605, 1.2631, 1.2761

Support: 1.2487, 1.2430, 1.2341

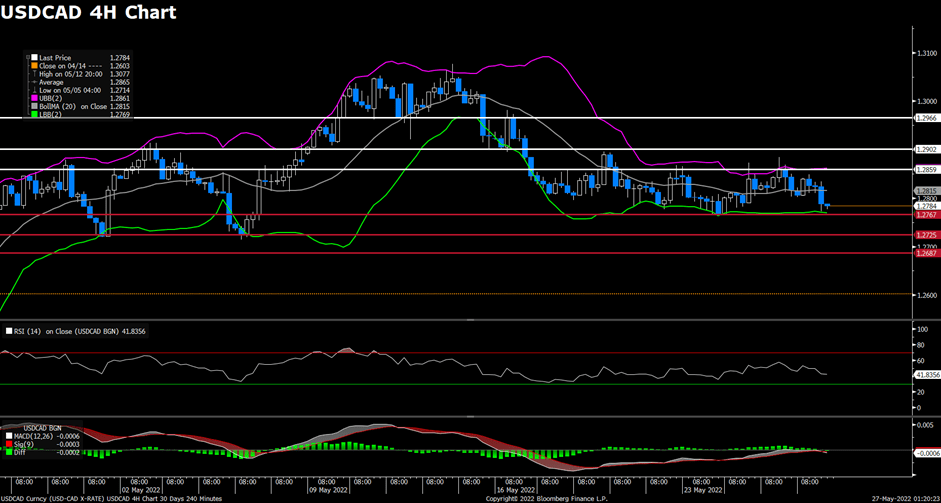

USDCAD (4-Hour Chart)

As the risk-on market mood and the strong rally in the equity markets drove flows away from the US dollar on Thursday, the pair USD/CAD extended its slide and refreshed daily lows below the 1.2780 mark. The pair reached a daily top above the 1.2845 level in the late Asian session, but then failed to preserve its upside traction and retreated toward the 1.2780 area heading into the US session. USD/CAD is trading at 1.2785 at the time of writing, losing 0.24% daily. The speculations that the Fed could pause or slow down the rate hike cycle later this year exerted some bearish pressure on the greenback, as the Fed could reassess the need for further tightening once rates have reached the neutral level. On top of that, the surging crude oil prices also provided strong support to the commodity-linked loonie as WTI rose to a weekly high near $114 per barrel area. The black gold was underpinned by the expectations for rising oil demand in the US as the peak driving season approaches.

For the technical aspect, the RSI indicator is 41 figures as of writing, suggesting that the downside is more favored as the RSI stays below the mid-line. For the Bollinger Bands, the price remained under pressure and crossed below the moving average, therefore the downside traction should persist. In conclusion, we think the market will be bearish as the pair is heading to test the 1.2767 support. A break below that support will lead to further losses and technical readings also favor a bearish continuation.

Resistance: 1.2859, 1.2902, 1.2966

Support: 1.2767, 1.2725, 1.2687

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | Retail Sales (MoM) (Apr) | 09:30 | 0.9% |