Market Focus

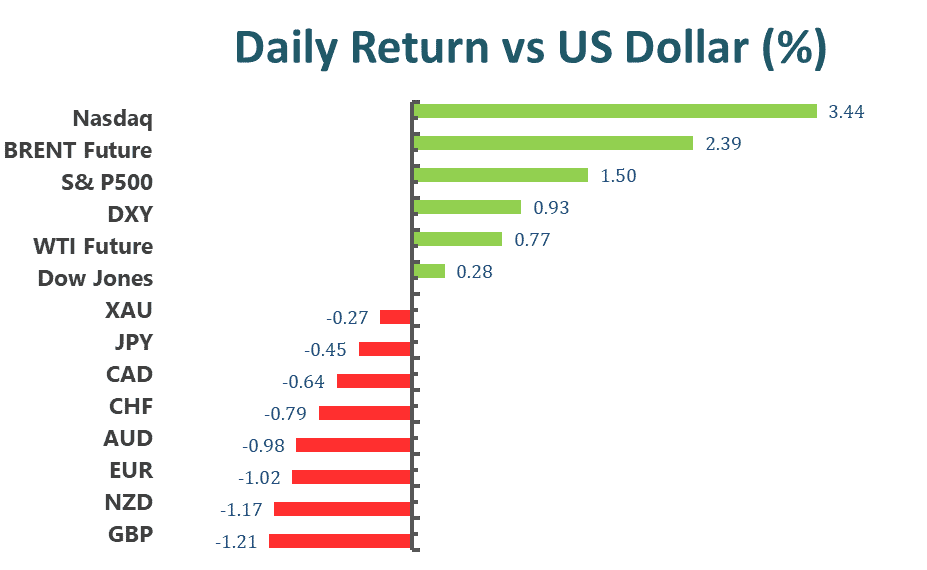

U.S. stocks staged a massive reversal Thursday after Wall Street’s main benchmarks each plunged more than 2% in early trading as Russia’s military invasion of Ukraine roiled financial markets around the globe. Nasdaq Composite rebounded from a morning sell-off that saw the index tumble more than 3% to close 3.4%, or 436 points higher, at 13,473.58 in its best day of 2022. The Dow Jones Industrial Average closed in positive territory after plunging more than 800 points during intraday trading, and the S&P 500 bounced back from a drop of 1.5% to close 1.5% higher at 4,288.69.

President Joe Biden imposed stiff sanctions on Russia over its invasion of Ukraine as Western nations warned that Kyiv could fall. As Russian tanks, troops and aircraft pushed closer to Ukraine’s capital city, Biden, speaking to the nation from the White House, promised to inflict a “severe cost on the Russian economy” that will hamper its ability to do business in foreign currencies.

“This is a dangerous moment for all of Europe,” Biden said, adding that the “next few weeks and months will be hard on the people of Ukraine.” The Russian military effectively eliminated Ukraine’s air defenses and rapidly advanced across the neighboring country, meaning Kyiv could quickly be overrun as well, a senior Western intelligence official said.

After weeks of warnings that an attack would bring about a “massive” economic response, Biden announced that the U.S. would sanction Sberbank — Russia’s largest lender — and four other financial institutions that represent an estimated $1 trillion in assets, as well as a broad swath of Russian elites and their family members. Treasury said the penalties target “nearly 80 percent of all banking assets in Russia.”

Main Pairs Movement:

Panic took over financial markets as Russia launched a military attack on Ukraine. Moscow attacked not only the Donbas region but got near Kyiv during US trading hours. Russia ignores global sanctions and seems determined to take full control of Ukraine.

Gold soared to $1.974.40 a troy ounce, its highest since September 2020. The yellow metal then retreated and plummeted to the intraday lows at $1,880.00 price zone during US trading hours, as investors unwind fear-related trades following US President Biden’s statement.

Meanwhile, Federal Reserve Raphael Bostic noted that Fed policy is poised to return to a more normalized stance. Among other things, he added that he is “very open” to going for more than 3 rate hikes this year.

EUR/USD recovered from a fresh 2022 low of 1.1105 to currently trade around 1.1195. The GBP/USD pair stands at around 1.3380, while commodity-linked currencies dropped significantly during Thursday’s trade. Crude oil prices also dipped into negative territory after reaching multi-year highs. WTI traded as high as $100.50 a barrel, now changing hands at around $94.50. Brent trades at $99.50.

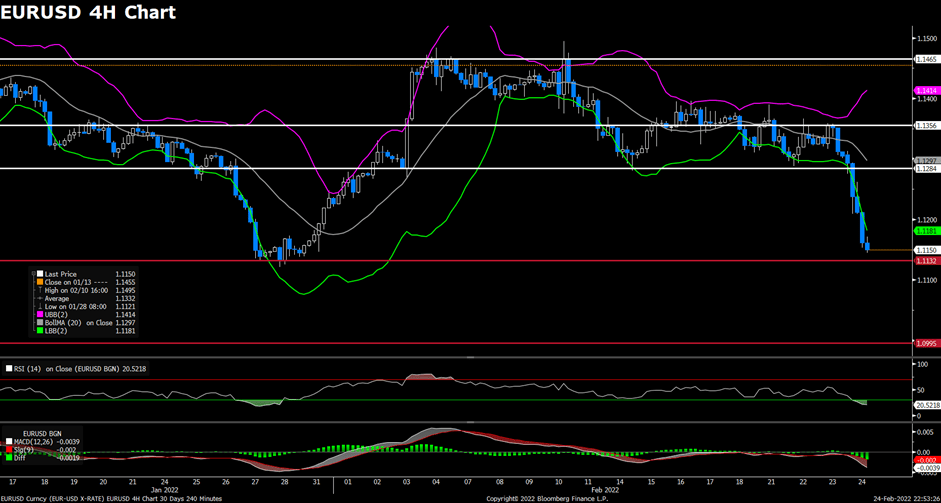

EURUSD (4-Hour Chart)

The EUR/USD pair tumbled on Thursday, extending its previous slide from 1.1360 level amid panic through financial markets. The pair was surrounded by heavy bearish momentum most of the day, collapsing to monthly lows below 1.1160 mark in early American session. The pair is now trading at 1.1148, posting a 1.36% loss on a daily basis. EUR/USD stays in the negative territory amid risk-off market sentiment, as Russia launched a full scale of invasion on Ukraine earlier in the day. The fact that Russia started the military assault on Ukraine bolstered the demand for the safer assets like the US dollar, meanwhile acting as a headwind for the EUR/USD pair. For the Euro, the latest geopolitical developments and risk appetite trends will keep deciding near-term direction for the currency, as there are no releases in the Eurozone calendar.

For technical aspect, RSI indicator 20 figures as of writing, suggesting that the pair is in oversold zone now, a trend reversal could be expected. But for the Bollinger Bands, the price is dropping out of the lower band, indicating a strong trend continuation for the pair. In conclusion, we think market will be bearish as the pair is heading to test the 1.1132 support. The pair is clearly bearish in its 4-hour chart, with technical indicators heading firmly lower within negative levels.

Resistance: 1.1284, 1.1356, 1.1465

Support: 1.1132, 1.0995

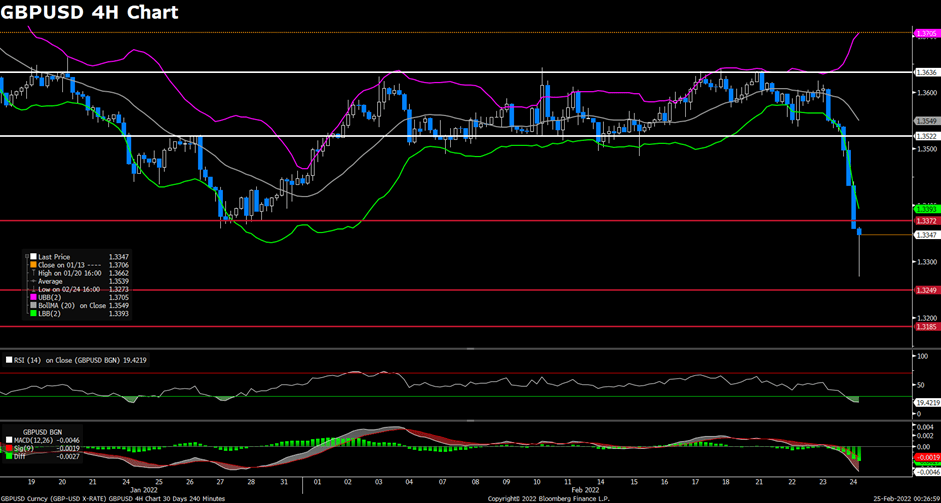

GBPUSD (4-Hour Chart)

The pair GBP/USD plunged on Thursday, suffering heavy losses and dropping to 1.3300 area after Russia’s invasion of Ukraine. The pair remained under massive selling pressure and refreshed its monthly low near 1.3310 mark, extending its heavy intraday losses heading into American session. At the time of writing, the cable stays in negative territory with a 1.43% loss for the day, preserving its downside traction on renewed US dollar strength. Investors now abandon their riskier assets and turned to safe-haven assets after Russian President Vladimir Putin authorized a special military operation in Donbas earlier in the day. A massive sell-off was also seen in the equity markets. For British pound, the currency is now undermined by the fact that the escalating tensions between Russia and Ukraine could dampen prospects for a 50 bps rate hike by the BoE at its March meeting.

For technical aspect, RSI indicator 19 figures as of writing, suggesting that a trend reversal could be possible as the pair is in oversold zone now. For the Bollinger Bands, the price is moving out of the lower band, indicating a strong trend continuation. In conclusion, we think market will be bearish as the pair just dropped below the previous 1.3372 support. If the bear can find constant strength below that level, short-term additional losses could be expected.

Resistance: 1.3522, 1.3636

Support: 1.3372, 1.3249, 1.3185

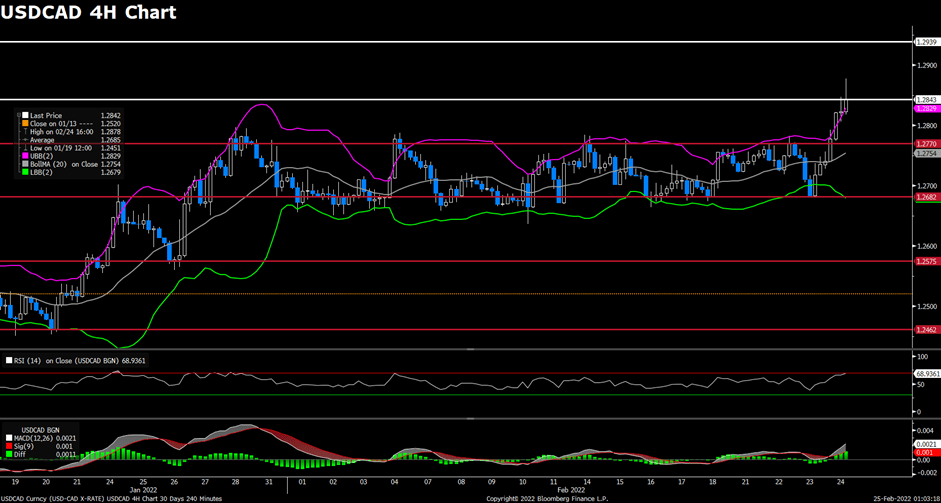

USDCAD (4-Hour Chart)

After Russia launched a full scale of invasion on Ukraine today, the pair USD/CAD came under slightly upside momentum amid stronger US dollar across the board. The pair witnessed fresh buying most of the day and reached the highest level since December 2021, now retreated slightly to surrender some of its daily gains. USD/CAD is trading at 1.2841 at the time of writing, rising 0.83% on a daily basis. Russian troops continued to cross the Ukrainian border and have reportedly destroyed Ukrainian military bases. Therefore, the worsening situation in Ukraine help the greenback to find strong demand and pushed USD/CAD higher. However, surging crude oil prices had underpinned the commodity-linked loonie and limit further gains for USD/CAD pair. WTI advanced to around $100 a barrel for the first time in eight years, as concerns about disruptions on global oil supply elevate following the attack from Russia.

For technical aspect, RSI indicator 69 figures as of writing, suggesting that the pair is technically oversold in the near term. As for the Bollinger Bands, the price moved out of the upper band so a trend continuation is possible. In conclusion, we think market will be bullish as the pair is testing the 1.2843 resistance. On the upside, the pair could push lower toward 1.2900 if that resistance fails.

Resistance: 1.2843, 1.2939

Support: 1.2770, 1.2682, 1.2575, 1.2462

Economic Data:

| Currency | Data | Time (GMT + 8) | Forecast |

| EUR | German GDP (QoQ) (Q4) | 15:00 | -0.7% |

| EUR | ECB President Lagarde Speaks | 19:15 | |

| USD | Core Durable Goods Orders (MoM) (Jan) | 21:30 | 0.4% |

| USD | Pending Home Sales (MoM) (Jan) | 23:00 | 1.0% |