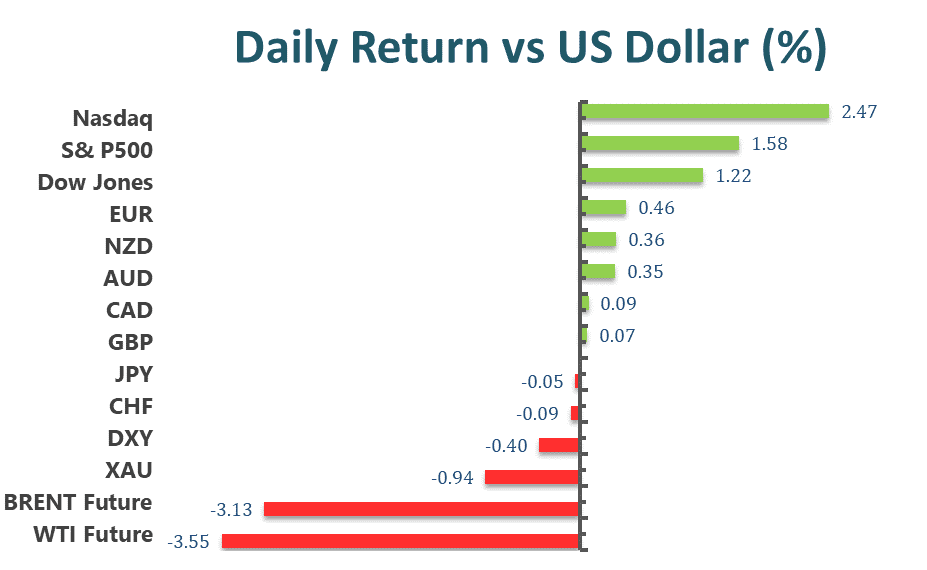

Market Focus Stocks advanced, while bonds fell with the dollar as speculation that geopolitical tensions could be easing overshadowed data showing inflation is still running hot. The equity market halted a three-day drop as Russian President Vladimir Putin announced a partial pullback of thousands of troops massed near the Ukrainian border. Tech shares led gains in the S&P 500, while energy producers joined a slump in oil. Dow Jones closed 1.22% higher to 34,988.84, while the Nasdaq Composite saw its best day in two weeks, advancing 2.53% to 14,139.76.

President Joe Biden said it remains possible that Russia will invade Ukraine because its troops remain in a “threatening position,” and said that the U.S. has not verified Moscow’s claims that it has withdrawn some forces.

“We should give the diplomacy every chance to succeed, and I believe there are real ways to address our respective security concerns,” Biden said at the White House on Tuesday. “To the citizens of Russia: You are not our enemy. And I do not believe you want a bloody, destructive war against Ukraine.”

Biden and his team have sought to deter a Russian invasion, which would plunge Europe into its biggest security crisis in decades and pose a new challenge for his embattled presidency. He said the U.S. stood ready to respond to a Russian attack with crippling economic sanctions, but warned Americans they could pay even higher fuel prices as a result. Russian President Vladimir Putin has repeatedly denied he intends to invade Ukraine, even while massing tens of thousands of troops as well as tanks, artillery and other equipment on the country’s borders. Biden said Russia now has about 150,000 troops in place around Ukraine.

Main Pairs Movement:

The sentiments improved on Tuesday as traders rushed to price in a de-escalation of the Russia-Ukraine tensions after the Russian Minister of Defense announced that some of the troops at the border would return to their bases. However, words from Russian President Vladimir Putin released during the American afternoon seemed not that cheering. Putin said that he is not satisfied with assurances that Ukraine will not become a NATO member in the near future and wants the issue to be settled right now or soon through a negotiating process.

Demand for the dollar receded, but its decline was partially offset by renewed strength in government bond yields. The US benchmark 10-year Treasury yield rose to 2.05% on Tuesday.

The Euro pair settled in the 1.1360 region, while Cable lingers around 1.3540. Commodity-linked currencies advanced despite weakness of gold and crude oil prices. The AUD/USD pair regained 0.7150, NZD/USD recovered to 0.6640 levels, while Loonie trades around the 1.2720 price zone. Commodities plummeted, with gold nosediving to the current $1,850 area, and crude oil prices shed a good bunch of their recent gains, with WTI closing Tuesday at around $92.10 a barrel, and Brent at $93.36.

Technical Analysis:

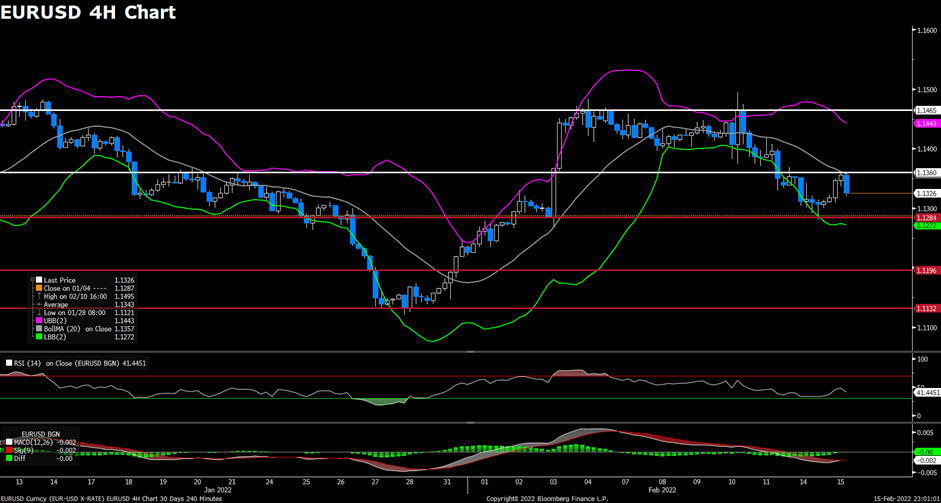

EURUSD (4-Hour Chart)

The EUR/USD pair advanced on Tuesday, starting to rebound after the news earlier in the session showed that the tensions between Russia and Ukraine have eased. The pair consolidated in 1.1310~1.1320 area during Asian session, then started to see fresh buying and edged higher in early European session. The pair is now trading at 1.1325, posting a 0.19% gain on a daily basis. EUR/USD stays in the positive territory amid weaker US dollar across the board, as the safe-haven greenback struggles to find demand amid improving market sentiment. Russia’s Defense Ministry announced that Russian troops are returning to their bases following the completion of military drills, which support the market mood and acted as a tailwind for the EUR/USD pair. In Europe, Eurostat released the Q4 GDP growth figures today, which came in marke’s expectations of 0.3%.

For technical aspect, RSI indicator 41 figures as of writing, suggesting bear movement ahead. As for the Bollinger Bands, the price is falling from the moving average, which indicates that the pair could witness some short-term downside momentum. In conclusion, we think market will be bearish as long as the 1.1360 resistance line holds. But if the pair rises above that level and starts using it as support, it could target 1.1400 mark.

Resistance: 1.1360, 1.1465 Support: 1.1284, 1.1196, 1.1132

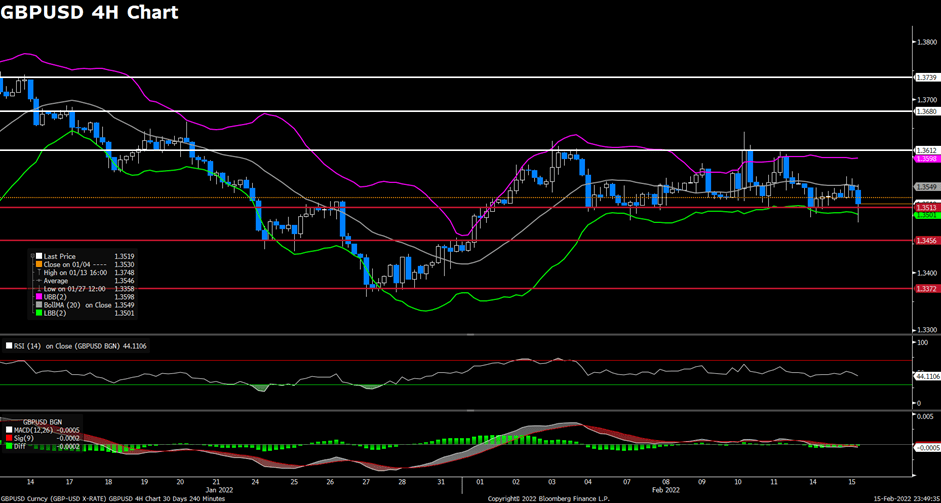

The pair GBP/USD edged lower on Tuesday, failing to preserve its bullish momentum amid renewed US dollar strength. The pair touched a daily high above 1.3560 level in early European session, then lost its traction and dropped to the lowest level since February 1 during early American session. At the time of writing, the cable stays in negative territory with a 0.03% loss for the day, trying to bounce back slightly. The improving market mood has lend some supports to the cable, as some Russian troops are returning to their base meanwhile eased the tensions between Russia and Ukraine. But now investors awaits new developments on the Russia-Ukraine conflict to decide next direction for cable. For British pound, the UK Claimant Count Change showed that the number of people claiming unemployment-related benefits fell by 31.9K in January as against 43.3K previous.

For technical aspect, RSI indicator 44 figures as of writing, suggesting that downside is more favored as the RSI stays below the mid-line. As for the Bollinger Bands, the price is moving towards the lower band after crossing below the moving average, therefore the downside traction should persist. In conclusion, we think market will be slightly bearish as the pair is heading to test the 1.3513 support. But if market mood continues to improve, this could lift the pair up and a break above 1.3612 level could extend its recovery.

Resistance: 1.3612, 1.3680, 1.3739 Support: 1.3513, 1.3456, 1.3372

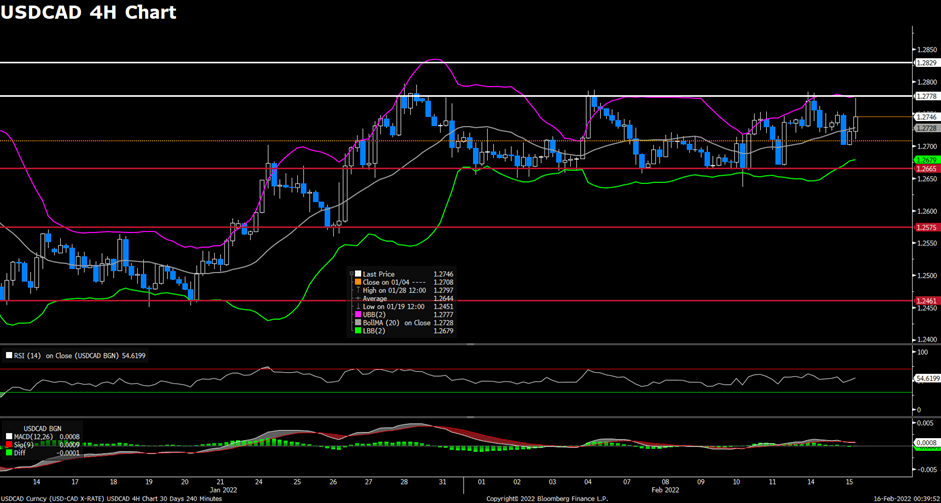

USDCAD (4-Hour Chart)

As the risk of geopolitical conflict eases, the pair USD/CAD witnessed upside momentum and recovered its intraday’s losses amid falling crude oil prices. The pair dropped to a daily low during European session, but then staged a goodish rebound towards 1.2760 area after American session started. USD/CAD is trading at 1.2743 at the time of writing, rising 0.13% on a daily basis. The positive turnaround in market mood weighed on the safe-haven US dollar and acted as a headwind for the major earlier in the session. But a sharp pullback in crude oil prices has lent strong support to USD/CAD pair, as WTI fell sharply from multi-year highs back to the $91.00 area. Russian President Vladimir Putin said that a decision on partial troop withdrawal had been taken, which eased the concerns about a potential disruption of oil supply.

For technical aspect, RSI indicator 55 figures as of writing, suggesting that the pair could remain its upside movement as the RSI start heading north. As for the Bollinger Bands, the price crossed above the moving average, indicating a possible upside traction for the pair. In conclusion, we think market will be slightly bullish as the pair is testing the 1.2778 resistance. If the pair break above that level, the bullish momentum could further get extended towards the 1.2850 area.

Resistance: 1.2778, 1.2829

Support: 1.2665, 1.2575, 1.2461

Economic Data:

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | CPI (YoY) (Jan) | 15:00 | 5.4% |

| USD | Core Retail Sales (MoM) (Jan) | 21:30 | 0.8% |

| USD | Retail Sales (MoM) (Jan) | 21:30 | 2.0% |

| CAD | Core CPI (MoM) (Jan) | 21:30 | 0.0% |

| USD | Crude Oil Inventories | 23:30 | -1.769M |