Market Focus

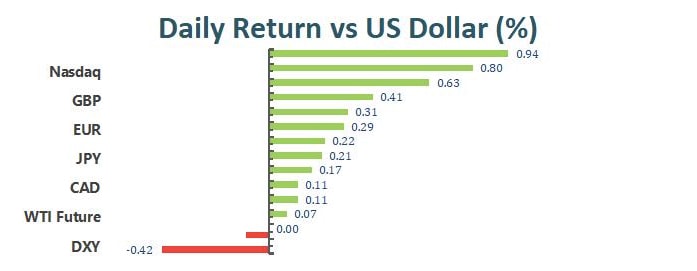

US equities rose for four consecutive days despite that private payroll fell by 301,000 for January as Omicron slammed labor market. The Dow Jones Industrial Average climbed 0.6% while the S&P 500 rose 0.9%. In meantime, the Nasdaq climbed 0.5%, led by Alphabet after its strong earning report. Notably, even though the Nasdaq closed in green, it plunged more than 1% in the last minute; the main culprits were Meta Platforms Inc and Spotify Technology SA, which both sank nearly 20% after the forecasts fell short of estimates. Further market movements eye on Thursday and Friday’s economic data.

While the markets closely monitored the possibility hike of interest rates in several countries, a Russian invasion of Ukraine can potentially draw attention as it can possibly send shockwaves through the financial markets. Tensions between two countries have not yet had much impact on the stock markets, however they have impacted some commodities already, such as crude oils. Even though some believes that the invasion might not happen as the US and the UK have promised swift retaliation in the form of economic sanctions, there are still high stakes.

Main Pairs Movement:

The precious metal, gold, advanced as the US economic data showed US’s shedding jobs. Gold received helps as concerns eased over the outlook for a strong hawkish tone on interest rates by the US Fed. Moreover, none of the Fed officials are going to speak this week, gold’s bear gets a temporary relief. Gold was up 0.32% at the end of the day, hovering nearly $1,800.

AUD/USD was up 0.1% as the Australia’s yield curve flattened after RBA speech. From the technical perspective, the currency pair was capped by a critical daily resistance block, which was guarding the double tops neckline near 0.7165.

GBP/USD closed with a positive action as the markets eyed on its interest rates decision. Its rival currency, the US dollar, weakened on Wednesday after the ADP report, showing a surprising decline in January. GBP/USD was up 0.41% at the end of the day.

Technical Analysis:

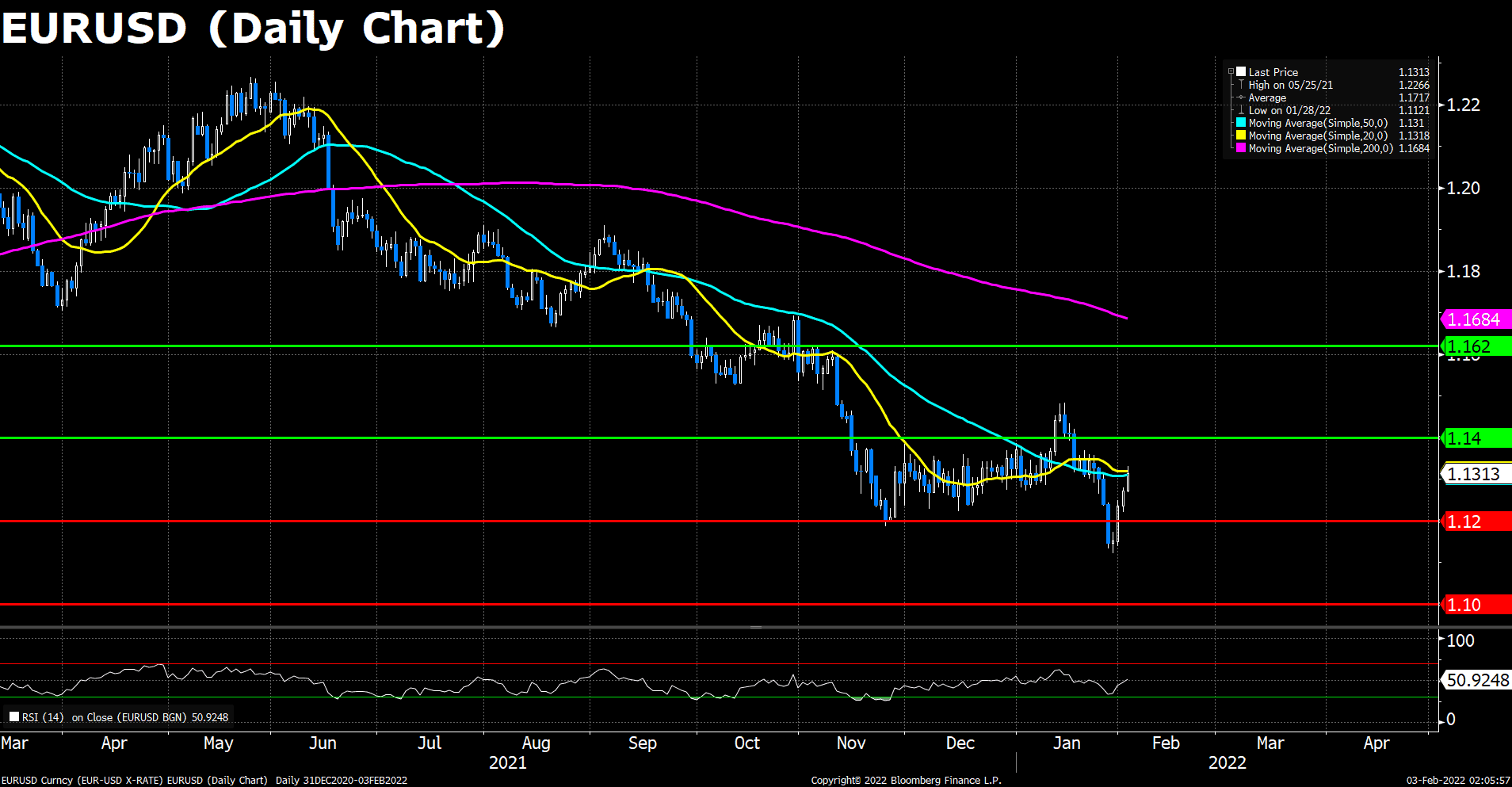

The EUR/USD pair rose above 1.1300 with the initial reaction to the EU inflation data, which showed that the EU CPI edged higher to 5.1% in January from 5% in December. This print surpassed the market expectation of 4.4% by a wide margin and helped Euro gather strength. However, as the Wall Street opening turned out mixed, with NASDAQ opened high but slumped heavily later on, the pair pared some of its intraday gains, and it trades around 1.1310 at the moment.

For technical aspect, the RSI for Euro has finally come back to 50, first time in two weeks, and the price actions has breached the 50 DMA, only one step ahead of the 20 DMA, indicating the improvement of the market sentiments. To the upside, if the pair could close above its 20 and 50 DMAs, then it is expected to knock on its next resistance 1.1400. On the contrary, if the pair fails to cling on the 1.1200 threshold, then a sharp decline to its yearly low is anticipated.

Resistance: 1.1400, 1.1620

Support: 1.12000, 1.1000, 1.0780

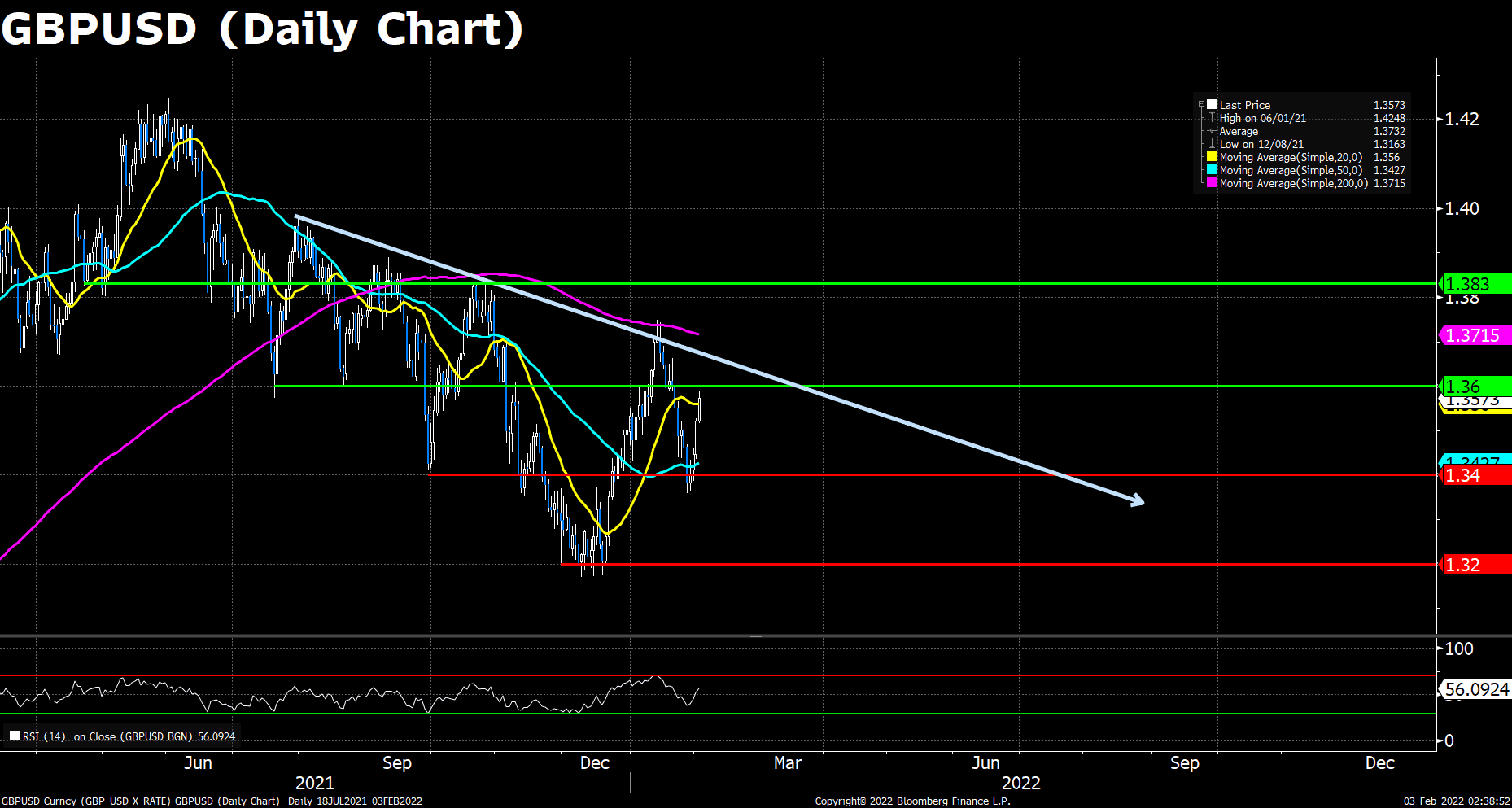

Cable currently trades at 1.3580, around 0.40% higher on the day as it tracks down the start of the New York sessions highs of 1.3587 again during midday trade. Sterling is climbing on Wednesday for the fourth session in a row, reaching a 5-day high against its U.S peer. Traders bet the Bank of England (BoE) will raise rates on Thursday, along with a disappointment in US jobs data, softer greenbacks, and rebounding US stocks, supporting Cable to stretch further north.

On the technical front, the RSI for Cable reads 56.09 as of writing, indicating the bulls have outplayed the bears on the spot, depicted as the pair penetrated the 1.3500 psychological resistance/support and is approaching the critical resistance at 1.3600. The pair now trades above its 20 and 50 DMA, but still far away from the pivot point at around 200 DMA to fully reverse to a bullish trend. To the north, Cable is going to face the heavy 1.3600 resistance, followed by the long-tern downtrend, and then the 200 DMA currently at 1.3717; in cases to the south, the pair is underpinned by the year-to-date lows around 1.3400, followed by the December lows around 1.3200.

Resistance: 1.3600, 1.3715, 1.3830

Support: 1.3400, 1.3200

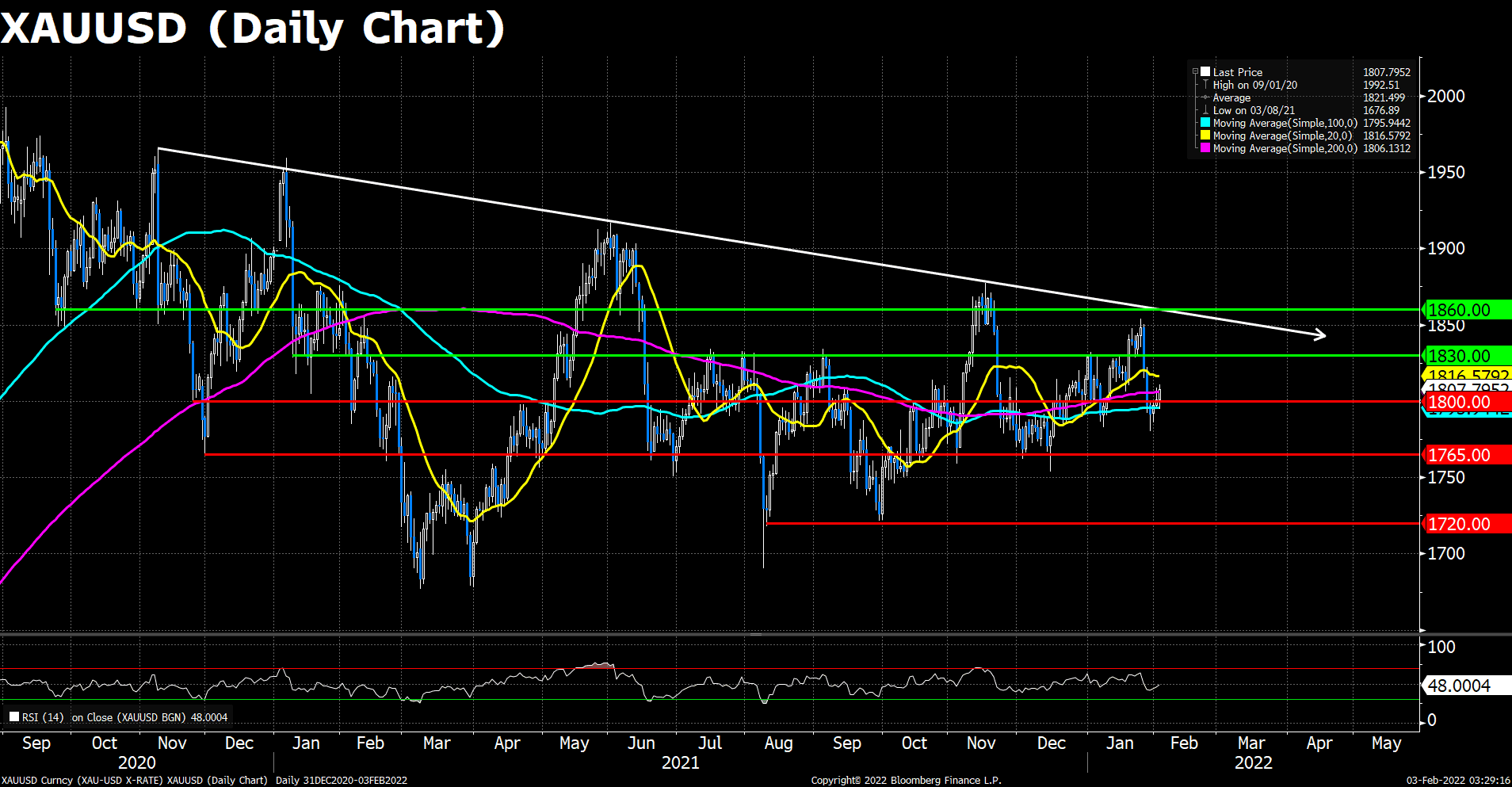

XAUUSD (Daily Chart)

Gold climbs in the North American session as US T-bond yields fall amid risk-on market mood, undermining the greenback. As of writing, XAU/USD is trading at $1,808 a troy ounce, up 0.40% during today’s trades. The market sentiment is mixed, as European bourses remain in the green, while US equity Nas100 indices fluctuate between gains and losses amid the dismal ADP Jobs report. Meanwhile, the Dollar Index extends its losses throughout the week to three straight days, down 0.34%, sitting at 95.94.

As to technical, Gold’s price is again capped by the $1,810 resistance and pulled back, lingering around the $1,800 to $1,810 area. If XAU/USD fails to break the $1,810 area, the upside would remain limited and a break higher could clear the way for a rally initially to the 20 DMA at $1,816.6; above the next key resistance lies in the $1,830 area. On the flip side, a slide back under $1800 would increase the bearish pressure. A daily close under $1,790 is needed to suggest more losses ahead. Key support levels are eyeing on $1,765.

Resistance: 1816.6, 1830, 1860

Support: 1800, 1765, 1720

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

GBP |

Composite PMI (Jan) |

17:30 |

53.4 |

|

|

GBP |

Services PMI (Jan) |

17:30 |

53.3 |

|

|

GBBP |

BoE Inflation Report |

20:00 |

||

|

GBP |

BoE Interest Rate Decision (Feb) |

20:00 |

0.5% |

|

|

GBP |

BoE MPC Meeting Minutes |

20:00 |

||

|

EUR |

Deposit Facility Rate (Feb) |

20:45 |

-0.5% |

|

|

EUR |

ECB Marginal Lending Facility |

20:45 |

||

|

EUR |

ECB Monetary Policy Statement |

20:45 |

||

|

EUR |

ECB Interest Rate Decision (Feb) |

20:45 |

0% |

|

|

USD |

Initial Jobless Claims |

21:30 |

245K |

|

|

EUR |

ECB Press Conference |

21:30 |

||

|

GBP |

BoE Gov Bailey Speaks |

22:15 |

||

|

USD |

ISM Non-Manufacturing PMI (Jan) |

23:00 |

59.5 |