Market Focus

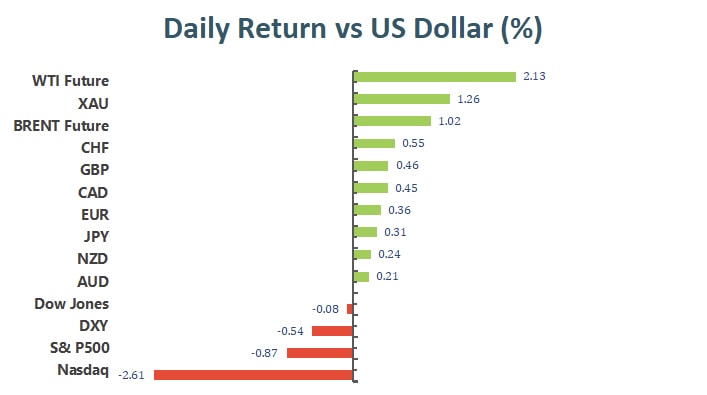

The three indexes started to rise on Thursday and then fell back. Earlier, the Federal Reserve announced that it would speed up the end of stimulus measures and promote investors to shift to more economically sensitive industries. However, the decline in technology stocks hurt the Nasdaq index, S&P 500 index and Philadelphia Semiconductor index. Besides, The Bank of England made a surprising decision on Thursday, becoming the first major central bank to raise interest rates since the pandemic began, raising its benchmark interest rate from 0.10% to 0.25%. At the same time, the European Central Bank also stated on Thursday that it will further slow down asset purchases under its Pandemic Emergency Purchase Program (PEPP) in the first quarter of next year, and stop purchases in March. However, ECB President Christina Lagarde reiterated that the possibility of interest rate hikes in 2022 is still very small. Although the Fed has not taken any major moves recently, news of other central banks’ announcements of monetary policy tightening has made the market even more tense. At the end of the market, the Dow Jones Industrial Average declined 0.1% to 35,897.64 points, the S&P 500 index fell 0.9% to 4,668.67 and the Nasdaq Composite Index slumped 2.47%.

Nine of the 11 major sectors of the S&P 500 index rose, led by economic financial stocks, energy and materials stocks, of which the financial stock index rose 1.21%. The Nasdaq Index is under pressure from a sharp decline in technology and other growth industries, Apple fell 3.93%, Amazon dropped 2.56% and Microsoft dropped 2.91%, moreover, Adobe Systems was also a big loser that day, with its stock price falling more than 10% after the software manufacturer’s 2022 fiscal year performance fell below Wall Street expectations.

Main Pairs Movement:

Following the Fed’s decision the day before to accelerate the reduction of asset purchases and the announcement of three times interest rate hikes in 2022, the Swiss National Bank, the Bank of England and the European Central Bank have successively announced monetary policy decisions.

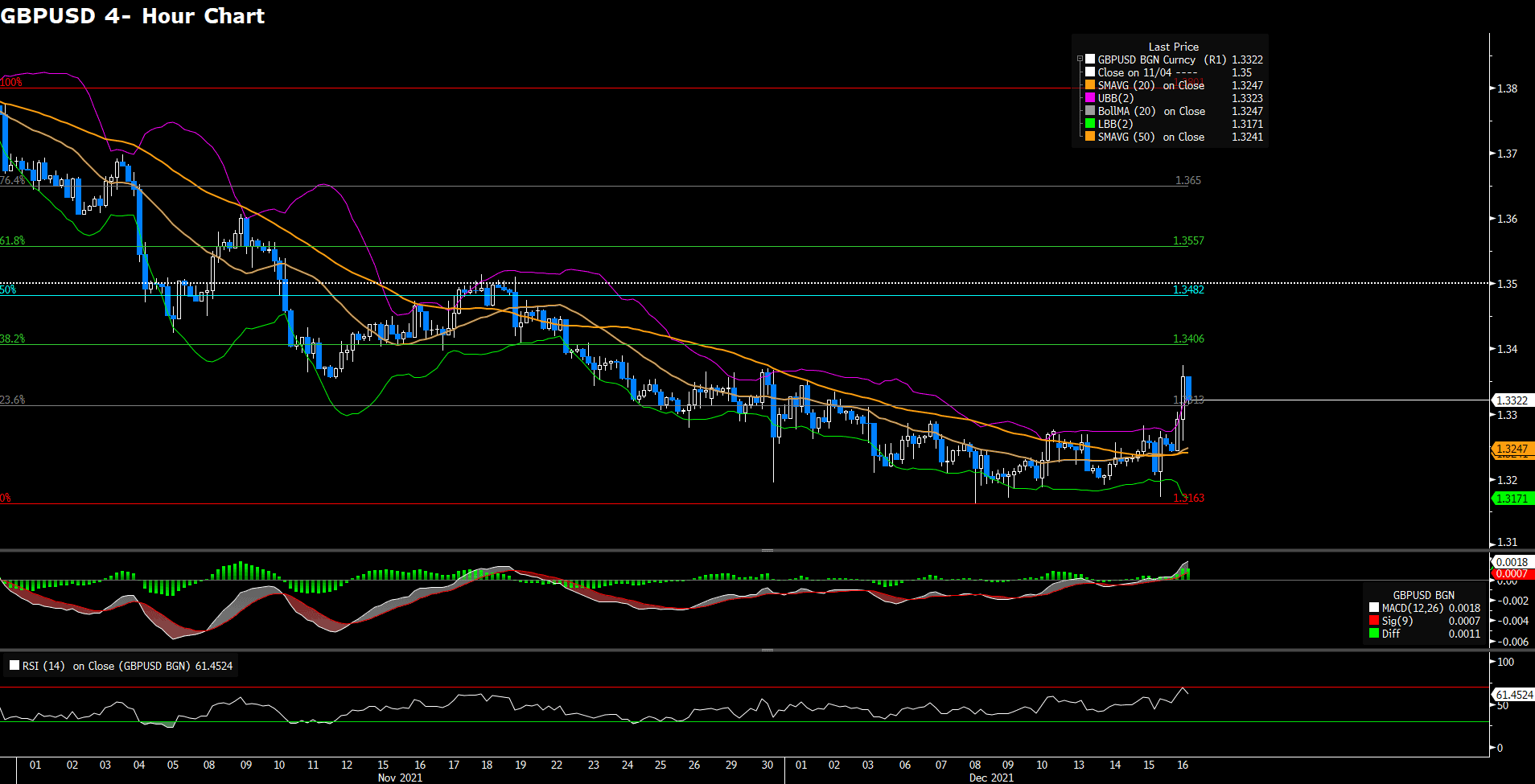

The Bank of England’s monetary policy unexpectedly raised the benchmark interest rate to 0.25% and maintained the quantitative easing amount at £895.

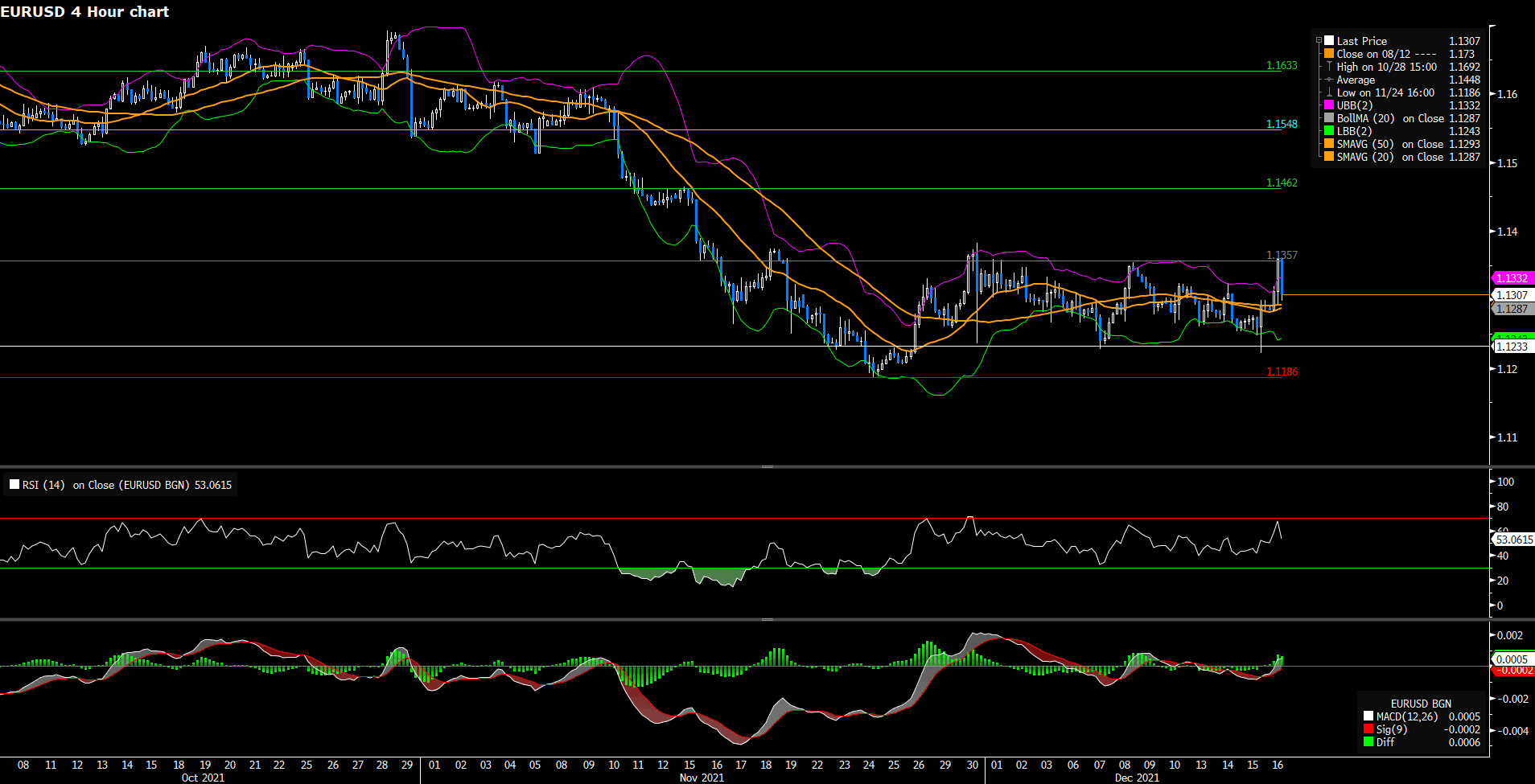

The European Central Bank announced a cautious reduction in scale, which is basically in line with market expectations. The European Central Bank kept interest rates unchanged and confirmed that the pandemic emergency purchase plan will end in March 2022.

The EUR/USD closed at the 1.13298 level, and finally broke through the 1.13000 level, and even reached the 1.1360 level. The GBP/USD closed at 1.33200, and rose to the level of 1.33743 when the Bank of England unexpectedly announced an interest rate hike.

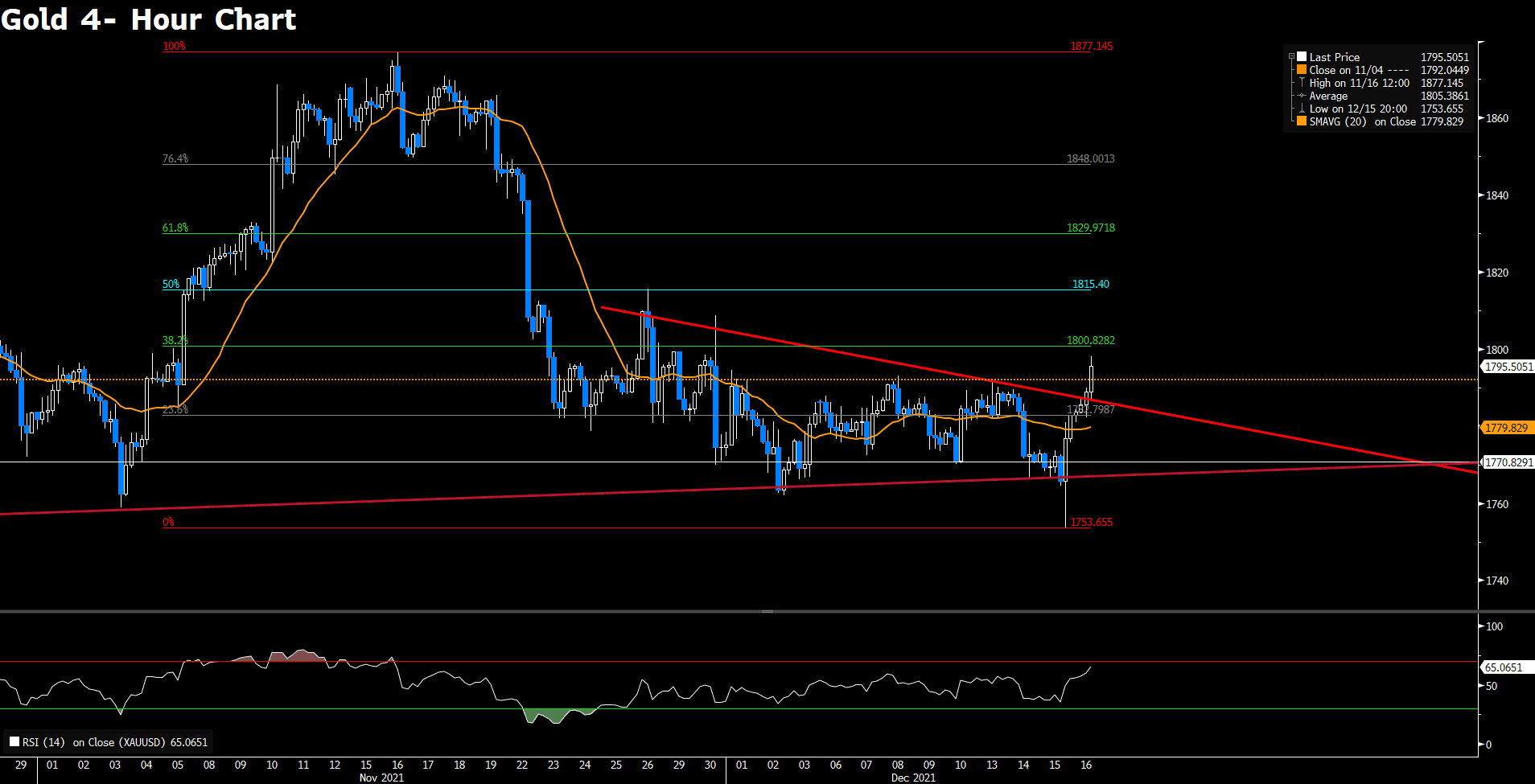

Gold has the best performance, rising for the second day in a row, and closed is close to 1800 level. Crude oil prices also rose up, and WTI is currently trading at approximately $71.96 per barrel.

Technical Analysis:

Gold advances to monthly highs near 1800 during the American trading session after the ECB announced that it will further cut its bond purchases but continue its unprecedented monetary policy support; more importantly, the ECB decides to leave the interest rates unchanged at 0%. From the technical perspective, the outlook of gold turns bullish on the 4- hour chart since it has officially breached the bearish wedge; meanwhile, gold has kept its sustained strength above the 20 simple moving averages, suggesting a near- term appreciating price action. On the upside, gold is going to test the immediate psychological resistance at 1800; this level would be considered as critical as the RSI is nearly at the overbought territory; that being said, the upside momentum might be reduced. On the flip side, any meaningful pullback below the bearish wedge and 1782 will be seen as a fresh trigger for bearish trades.

Resistance: 1800, 1815, 1829

Support: 1782, 1770, 1753

GBPUSD advances to its highest level in December after the BOE announced that it is going to raise its policy rate to 0.25%; The BOE became the first major bank to raise interest rates since the pandemics. From the technical aspect, a hawkish BOE opens the door for additional upside momentum for the pound, challenging the immediate hurdle at 1.3313. The near- term outlook turns slightly bullish as the currency pair trades above the 20 and 50 simple moving averages on the 4- hour chart. However, the rally seems to run out of steam ahead of 1.3406 as the RSI has reached above 61st mark as the time of writing. On the upside, the positive price action is still supported by a firm positive MACD. On the contrary, the relevant support is at 1.3163.

Resistance: 1.3321, 1.3419, 1.3499

EURUSD trims most of the gain from the ECB’S confirmation of ending the PEPP in March 2022, currently trading at 1.1309. From the technical perspective, the outlook of the currency pair remains neutral stance, although it trades with substantial strength intraday, testing the immediate barrier at 1.1357. Failing to breach 1.1357 level discourages the buyers for further price action. In order to reclaim a bullish stance, EURUSD needs to climb above the resistance. As the time of writing, both technical indicators, the RSI and MACD head firmly higher within positive levels, reflecting persistent buying interest. On the contrary, if EURUSD falls below the simple moving averages, it will turn slightly bearish in the near- term, possibly testing its support at 1.1233.

Resistance: 1.1357, 1.1462, 1.1548

Support: 1.1233, 1.1186

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

JPY |

BoJ Monetary Policy Statement |

10:30 |

N/A |

|

|

JPY |

BoJ Press Conference |

10:30 |

N/A |

|

|

GBP |

Retail Sales (MoM) (Nov) |

15:00 |

0.8% |

|

|

EUR |

German Ifo Business Climate Index (Dec) |

17:00 |

95.3 |

|

|

EUR |

CPI (YoY) (Nov) |

18:00 |

4.9% |

|

|

RUB |

Interest Rate Decision (Dec) |

18:30 |

8.50% |

|