Market Focus

Eurozone’s October inflation rate hit a 13-year high of 4.1%, well above the European Central Bank’s 2% target, prompting some investors to bet that the European Central Bank will raise interest rates next year. But the Council of the European Central Bank believed that many of the factors driving inflation higher this year may subside next year, albeit at a slower pace than recently predicted.

Although the possibility of raising interest rates at the earliest next year is small, investors can still look forward to the European Central Bank’s December meeting. Most people expect that the central bank will decide on the 1.85-ton bond purchase plan launched last year in response to the epidemic and stop new purchases in March 2022.

As a compromise between the doves and the hawks, the European Central Bank continues to expect to supplement the monthly pace of the asset purchase plan of 20 billion euros with a fixed-scale envelope of approximately 200 billion euros. In addition, the European Central Bank also proposed a new bond purchase plan that can cope with market fluctuations.

Main Pairs Movement:

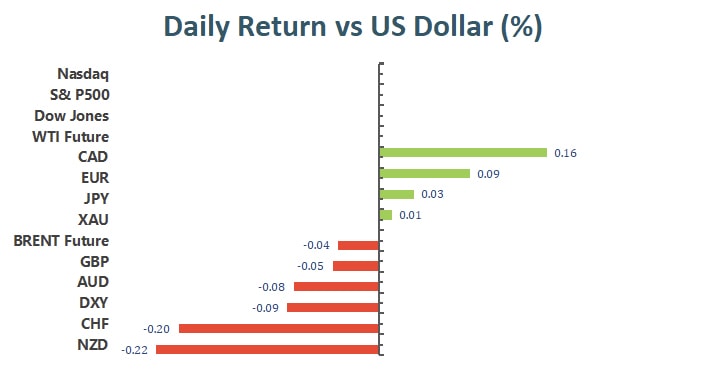

As the US market was closed for the Thanksgiving holiday, the market is quiet on Thursday. The market will shorten working hours on Friday, and trading is expected to continue to be quiet.

GBP/USD fell to a new low of 1.33053 in 2021 and closed at 1.33181. Affected by concerns about Brexit, the price trend has hardly changed and maintained a downward trend.

USD/JPY basically remained above the 115.3 area. With the Thanksgiving holiday, the momentum of the dollar has eased, and the yen has also respite. At the time of writing, the currency has fallen below the 115 level and hovered at 114.9.

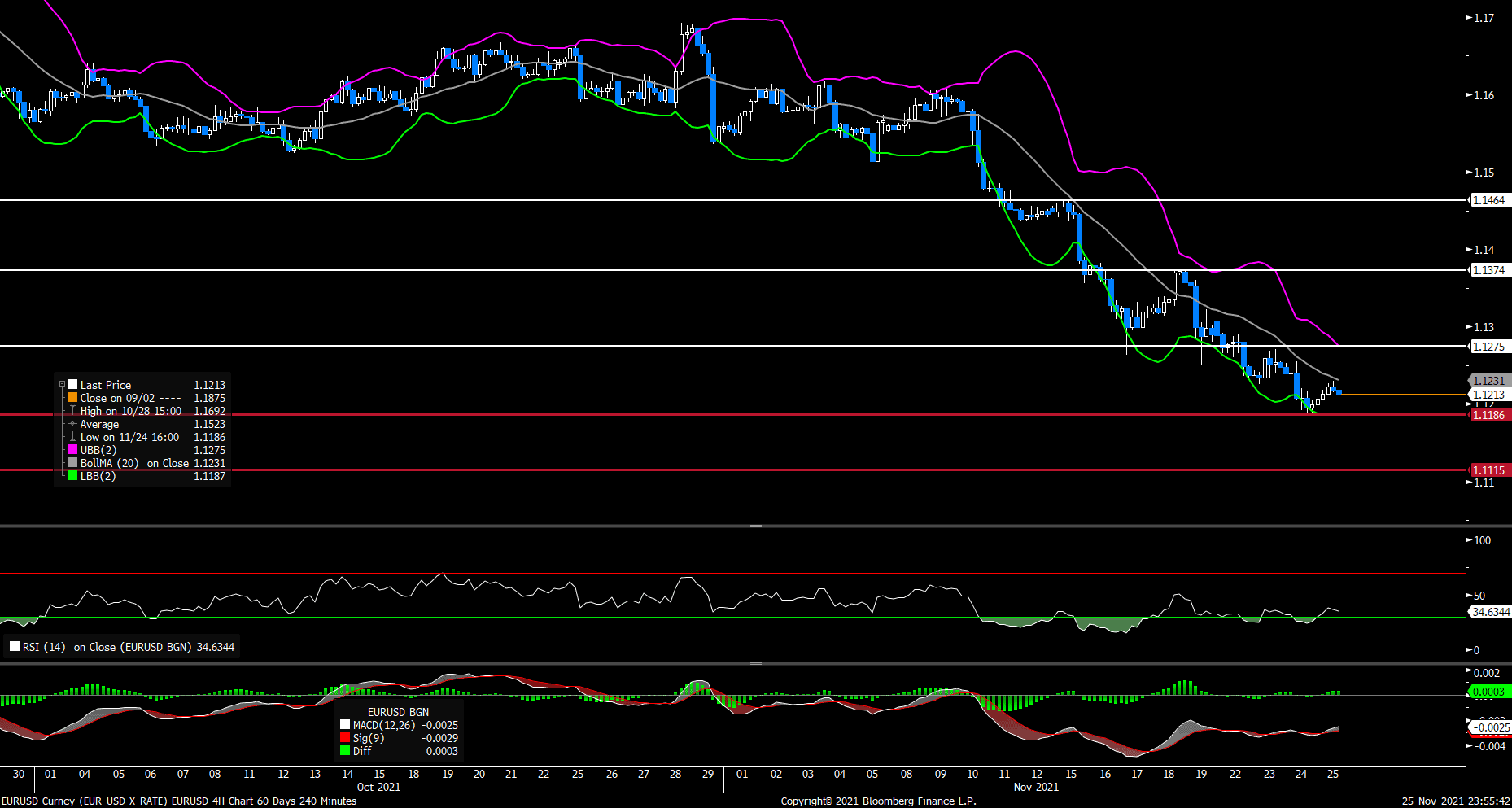

After touching the 1.1190 area for two consecutive days, the EUR/USD surged to 1.1229 today and closed above 1.1200. It seems that it has finally gained some support and successfully rebounded.

The gold market is also very calm, with precious metals stable at around $1,790 per troy ounce. Crude oil prices fell slightly, but WTI crude oil prices remained above $78.00 per barrel.

Technical Analysis:

After previous day’s slide to a 2021 low under 1.119 level, the pair EUR/USD regained bullish momentum and rebounded back on Thursday. The pair was trading higher at the start of the day and touched a fresh daily high near 1.123 area, but now has pulled back slightly at the time of writing. EUR/USD was supported by US dollar weakness, currently rising 0.14% on a daily basis at the time of writing. In the US, markets are likely to be flat due to Thanksgiving holiday, and the greenback dropped to 96.74 area after reaching yearly tops. In Europe, ECB Publishes Account of Monetary Policy Meeting released today highlighted that net purchases under the PEPP could be expected to come to an end by March 2022, which did not contain any surprises.

For technical aspect, RSI indicator 33 figures as of writing, suggesting that the bearish momentum should persist for a while before there’s a trend reversal. Looking at the Bollinger Bands, the price is falling from the moving average, which means that the downward trend is likely to persist. In conclusion, we think market will be bearish as the pair is heading to re-test the 1.1186 support, a beark below that level would target 1.1115 support that touched in June 2020.

Resistance: 1.1275, 1.1374, 1.1464

Support: 1.1186, 1.1115

The pair GBP/USD updated its yearly low on Thursday, following previous slide to 1.331 area for the fifth day. The pair climbed higher during Asian session and touched a daily high, but then failed to preserve its bullish momentum. At the time of writing, the cable stays in negative territory with a 0.04% loss for the day. The GBP/USD pair remained under pressure despite US dollar weakness, but the greenback’s corrective pullback should be alleviated amid growing market expectation of a more aggressive policy from the Fed due to rising inflationary pressures. Meanwhile, the worsen situation over the post-Brexit fishing rights between France and UK keep acting as a headwind for the cable.

For technical aspect, RSI indicator 33 figures as of writing, suggesting that the downside appears more favored as the RSI still holding below the midline. Looking at the MACD indicator, the MACD is now sitting below the signal line, which means a downward trend for the pair. As for the Bollinger Bands, the price still staying between the lower band and moving average, therefore the downward trend should remain. In conclusion, we think market will be bearish as a drop to the 1.32 area appears likely.

Resistance: 1.3390, 1.3514, 1.3607, 1.3698

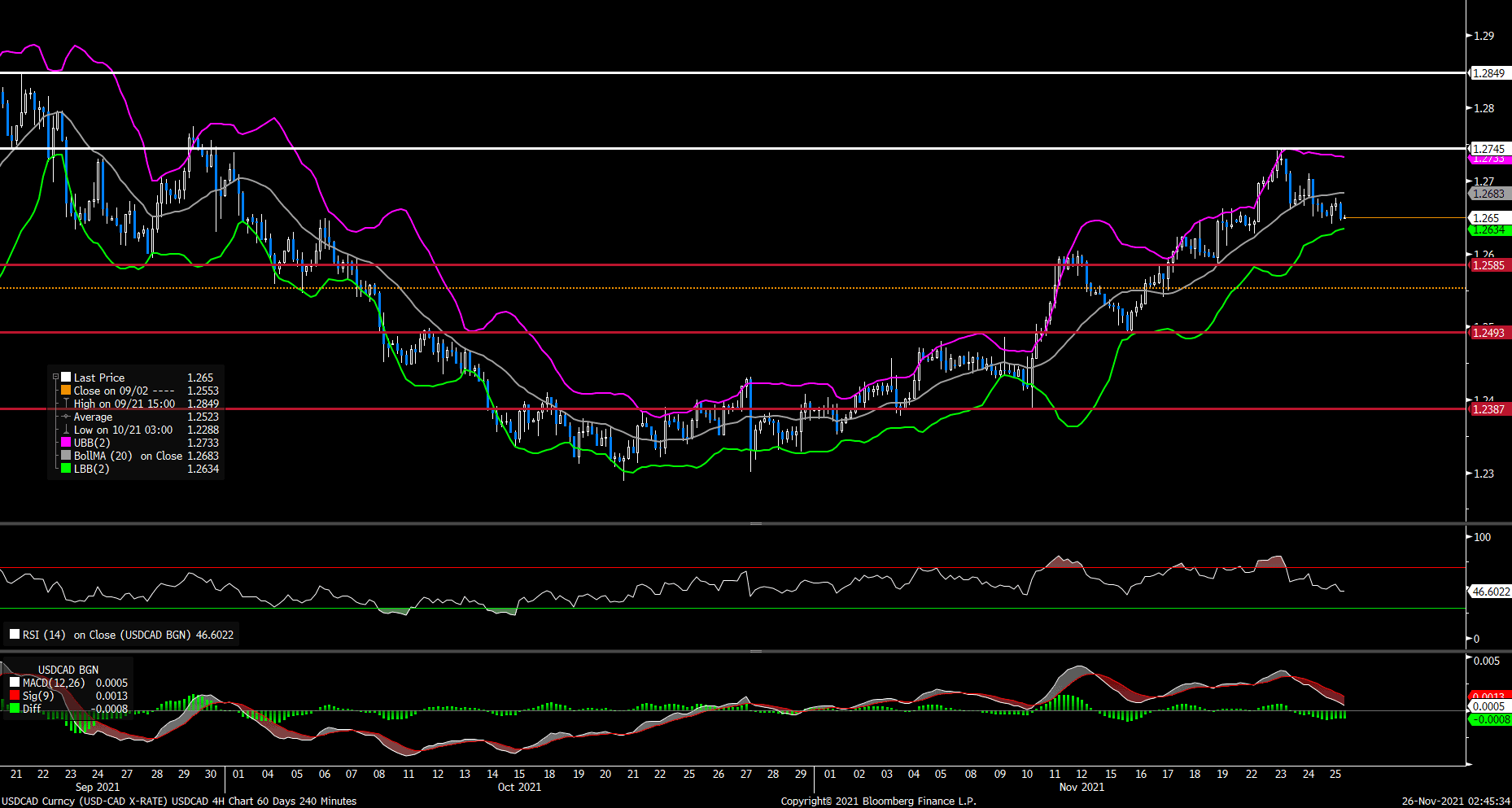

The pair USD/CAD declined on Thursday, continuing its slide from a monthly high near 1.275 area that touched earlier this week. During early European session, the pair started to see fresh buying and reached daily top above 1.267 level. USD/CAD had pulled back since then and surrendered its intraday gains, currently posting a 0.14% loss on a daily basis. Weaker US dollar across the board today dragged the pair lower, though market conditions are currently very thin amid the Thanksgiving holiday. On top of that, the recovery in oil prices acted as a tailwind for the commodity-linked loonie.

For technical aspect, RSI indicator 46 figures as of writing, suggesting tepid bear movement ahead. Looking at the MACD indicator, the MACD is now sitting below the signal line, which means a downward trend for the pair. As for the Bollinger Bands, the price dropped off the upper band and then crosses below the moving average, the lower band then becomes the loss target. In conclusion, we think market will be bearish as the pair is eyeing a test of the 1.2585 support.

Resistance: 1.2475, 1.2849

Support: 1.2585, 1.2493, 1.2387

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

AUD |

Retail Sales (MoM) (Oct) |

08:30 |

2.5% |

||||

|

EUR |

ECB President Lagarde Speaks |

16:00 |

|||||