Market Focus

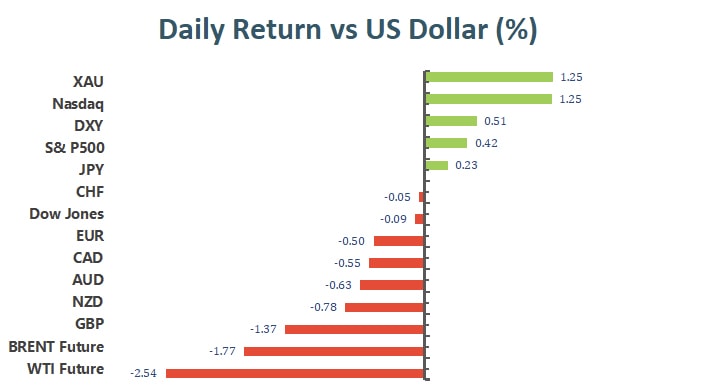

Another day, the S&P 500 index and the Nasdaq 100 index once again set a record closing. This marked the close of six records of the two indexes in the past six trading days. The S&P 500 index rose 0.42% to close at 4680 points, while the Nasdaq 100 index rose 1.25% to close at 16346. The Dow Jones Index fell slightly by 0.1%, but it was still above the 36000 level. The CBOE Volatility Index (VIX), often referred to as the fear indicator on Wall Street, stabilized above 15.00, not far from the post-pandemic low of around 14.00 set in June.

The Philadelphia Semiconductor Index surged 3.5% with strong gains from Qualcomm, which

Qualcomm rose strongly by 12.7%, causing the Philadelphia Semiconductor Index to soar 3.5%. Despite severe disruptions in the global supply chain, its business is still booming. Moreover, technology stocks benefited from the sharp drop in U.S. Treasury yields, the main catalyst for the decline was the dovish attitude of the Bank of England, this triggered a historic decline in UK yields, which has spread to international markets.

The Wall Street Journal reported that the automaker and Hertz are negotiating how quickly the car rental company can receive deliveries from a large order for 100,000 Tesla vehicles. Hence, Tesla shares rose slightly by 16.05 US dollars, or 1.3%, to $1,229.91. After the British health regulator approved the Covid-19 drug developed by it and its partner Ridgeback Biotherapeutics, Merck’s stock price rose 1.86 US dollars, or 2.1%, to 90.54 US dollars. After lowering its forecast for the delivery of the Covid-19 vaccine for the full year of 2021, Moderna’s stock price plummeted by US$61.90, or 18%, to US$284.02, citing the longer delivery cycle of international transportation.

Main Pairs Movement:

On Thursday, the US dollar was the overall winner, regaining its gains, setting new weekly highs against high-yield opponents. On the other hand, safe-haven assets rose slightly against the U.S. dollar but did not break through any key levels.

After the BOE held a monetary policy meeting and decided to keep the interest rate unchanged at 0.1%, disappointing the market expected to raise interest rates and further boosting demand for the dollar. The GBP/USD exchange rate plummeted to 1.3470 and closed around 1.3500.

After the announcement of the PMI on Thursday, the data was lower than expected and could not provide any momentum for the euro against the dollar. Therefore, the EUR/USD faced pressure near 1.1615 for the third consecutive day, and the bulls gave up and tested the previous support at 1.1527.

Technical Analysis:

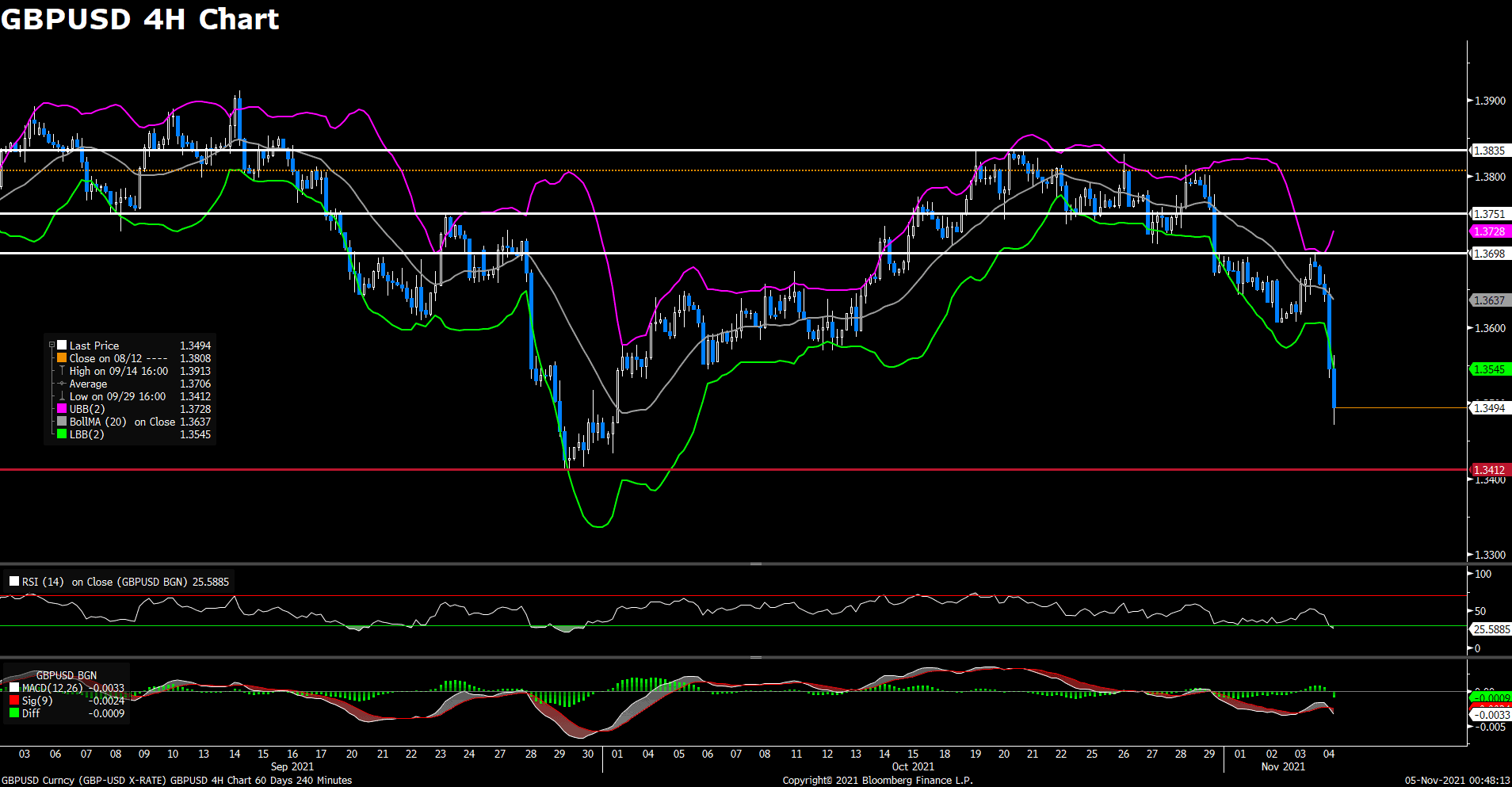

The pair GBP/USD tumbled on Thursday amid dovish Bank of England, dropping to the lowest level since October 1. The pair was trading lower in early Asian session and then declined sharply right after BoE announcement. GBP/USD is currently sitting just above 1.350, hoping to rebound back from today’s slide. The Bank of England released their latest rate decision and monetary policy statement today as the bank decided to keep UK’s interest rate unchanged at 0.10%. The dovish decision not to hike rates surprised the market and meanwhile dampened investor’s expectations of the coming BoE rate hiking cycle. On top of that, the stronger US dollar also weighed on the cable, as the DXY index preserve its upside momentum and climb further above 94.00 level.

For technical aspect, RSI indicator 25 figures as of writing, suggesting that the pair is in oversold zone, investors should be aware of a trend reversal. The MACD indicator showed a death cross on the histogram, which means the pair is likely to experience downward momentum. If we take a look at the Bollinger Bands, the price price is moving out of the bands so a strong trend continuation can be expected. In conclusion, we think market will be bearish as the pair is now heading to test the 1.3412 support.

Resistance: 1.3698, 1.3751, 1.3535

Support: 1.3412

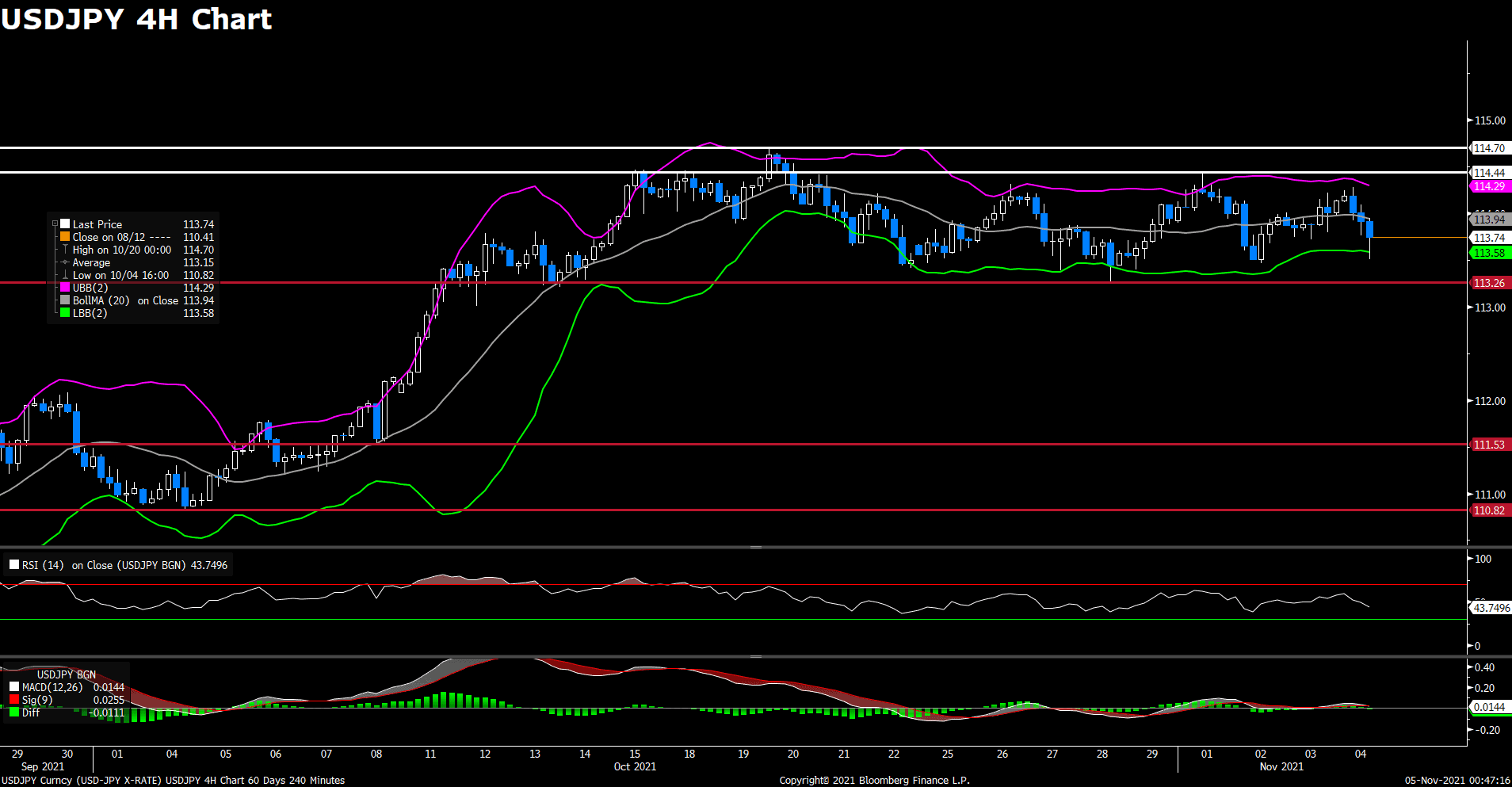

After rising above 114.20 level on Thursday, the pair USD/JPY failed to preserve its bullish momentum and started to see fresh selling during European session. After American session began, the pair declined further and touched a daily low under 113.55. USD/JPY was last seen trading at 113.69, posting a 0.26% loss for the day. Despite the renewed US dollar strength, USD/JPY are still dragged down by the top performer Japanese Yen. The lower US 10-year yields also weighed on the pair. Market focus now shifts to the Nonfarm Payrolls report, as a strong report may sends USD/JPY higher.

For technical aspect, RSI indicator 42 figures as of writing, suggesting tepid bear movement ahead. As for the MACD indicator, a death cross just formed on the histogram, therefore bearish momentum is likely to persist. Looking at the Bollinger Bands, price dropped below the moving average and now moving toward the lower band, which indicate a bear market. In conclusion, we think market will be bearish as long as the 114.44 resistance line holds. If the pair dropped below the 113.26 support, some additional near-term losses can be expected.

Resistance: 114.44, 114.70

Support: 113.26, 111.53, 110.82

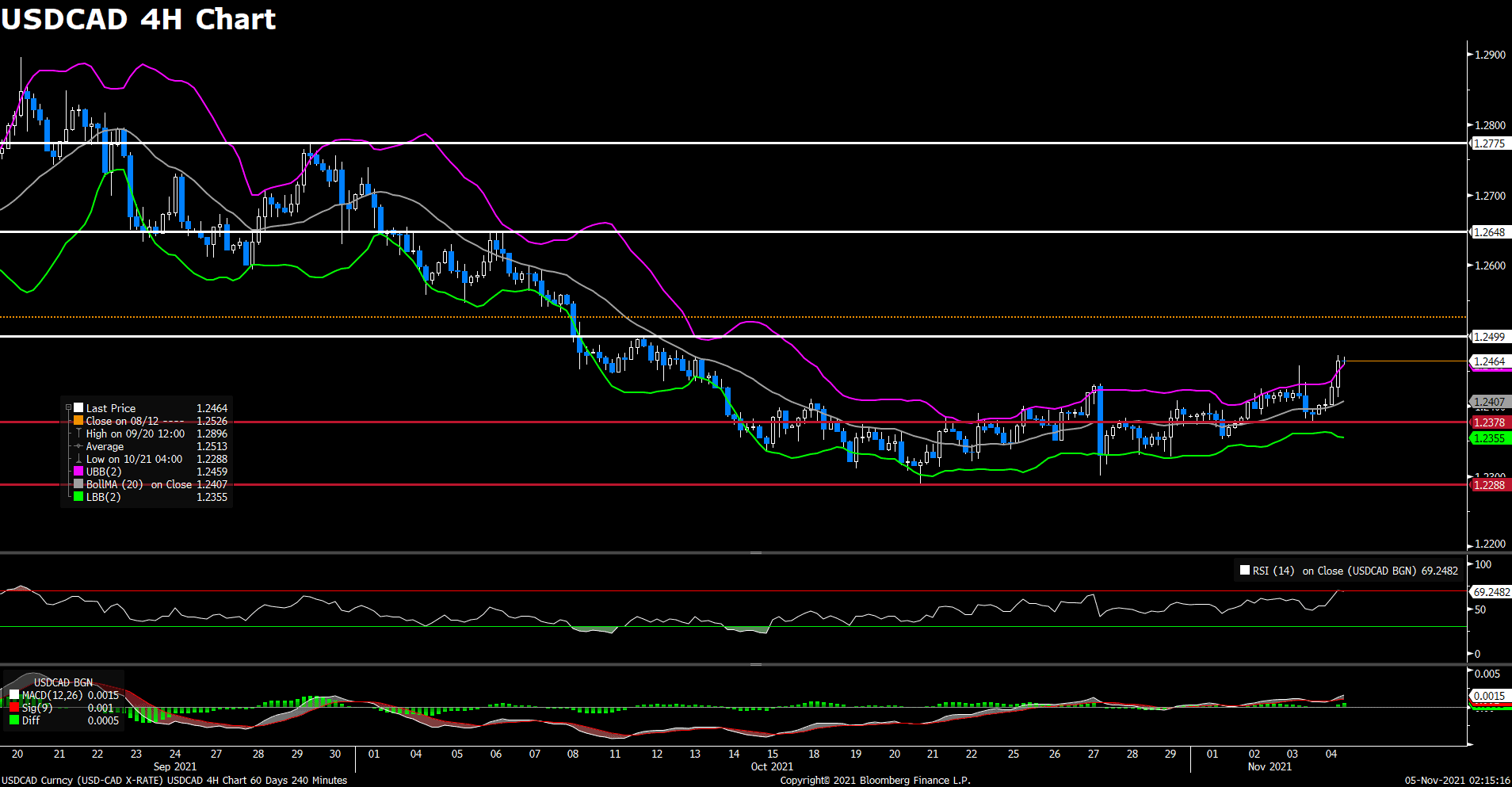

The pair USD/CAD advanced on Thursday, extending its recovery for the second day as WTI oil pulls back from a daily top around 83.50. The oil prices has dropped sharply due to an output hike plan from OPEC+, who agreed to increase output by 400K barrels per day/month in December. The bearish momentum witnessed in oil keep weighing on the commodity-linked Canadian dollar. On top of that, stronger US dollar across the board also lift the pair further.

For technical aspect, RSI indicator 70 figures as of writing, suggesting that the pair is in overbought zone, investors should be aware of a trend reversal. The MACD is now sitting above the signal line, which indicates a bull market. As for the Bollinger Bands, price is moving out of the bands so a strong trend continuation can be expected. In conclusion, we think market will be bullish as the pair is trying to test the 1.2499 resistance.

Resistance: 1.2499, 1.2648, 1.2775

Support: 1.2378, 1.2288

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

USD |

Nonfarm Payrolls (Oct) |

20:30 |

450K |

||||

|

USD |

Unemployment Rate (Oct) |

20:30 |

4.7% |

||||

|

CAD |

Employment Change (Oct) |

20:30 |

50K |

||||

|

CAD |

Ivey PMI (Oct) |

20:30 |

|||||