Daily Market Analysis

Market Focus

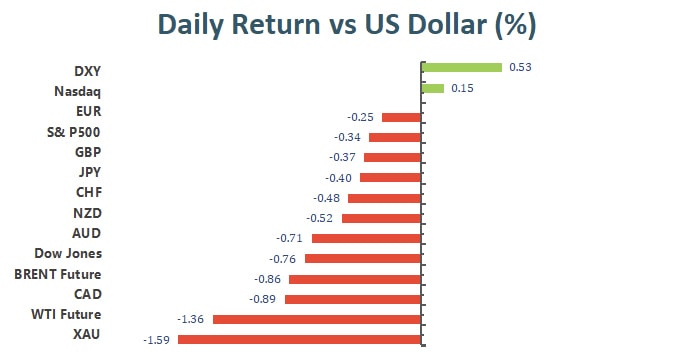

The S&P 500 and Dow Jones Industrial Average declined, while gains in heavyweight tech stocks including Netflix Inc., Amazon.com Inc. and Apple Inc. pushed the Nasdaq 100 higher even as about seven out of every 10 stocks in that gauge dropped. European markets slipped as investors speculated that euro-zone policy makers may get ready to roll back stimulus. The greenback strengthened for a second day amid rising bond yields and softer commodity prices. Bitcoin plunged as El Salvador became the first country to adopt it as legal tender Tuesday.

The largest cryptocurrency fell as low as $43,050 in New York Tuesday, before paring losses. Bukele said his country had taken advantage of the crash to “buy the dip”, adding 150 coins to take its total holding to 550, worth about $26 million.

El Salvador’s plan represents the biggest test for Bitcoin in its 12-year history. Both enthusiasts and detractors of cryptocurrencies are monitoring the experiment to see if a significant number of people want to transact with Bitcoin when it circulates alongside the U.S. dollar, and whether it brings any benefits to the violent, impoverished Central American nation.

If the experiment is a success, other countries may follow El Salvador’s lead. Its adoption will get an initial boost from the government’s Bitcoin wallet Chivo, which comes pre-loaded with $30 worth of the currency for users who register with a Salvadoran national ID number.

Businesses will be required to accept Bitcoin in exchange for goods and services and the government will accept it for tax payments. The plan is the brainchild of El Salvador’s 40-year-old president, who says it will draw more people into the financial system and make it cheaper to send remittances

“This is brave new world stuff,” said Garrick Hileman, head of research for the London and Miami-based Blockchain.com. “We are in unchartered waters with this launch, but I’m glad to see this experiment happen overall, and I think we’ll learn a lot from it.”

Main Pairs Movement:

The US dollar traded higher after surge in delta-variant infections weigh on risky currencies, the dollar index climbing 0.37% on Tuesday. According to Reuters’ data, there were more than 20,800 people died from the coronavirus in the United States in the last two weeks, that is a 67% increase from prior two weeks. Situations in Australia and New Zealand are not so encouraging as both governments look to extend lockdowns further in the second half of 2022.

USDCAD surged 0.9% amid weaker oil prices. The Bank of Canada will announce its interest rate decision on Wednesday. Though Governor Tiff Macklem hinted their intention to lift interest rate in the second half of this year, but investors doubt that they will act in September. That said, BoC is likely to path their way toward a rate hike during tomorrow’s meeting.

Euro was the most resilient currency against the dollar greenback during Tuesday’s session albeit dropped 0.25%. The shared currency was underpinned by market optimism surrounding ECB’s meeting on Thursday. Analysts expect ECB to undergo a debate to cut its current PEPP weekly purchase of 80 billion euros to 60 billion euros. Given ECB’s past unpleasant experience at failing to achieve 2% inflation target, July’s overshoot of 2.2% Harmonized Index of Consumer Index marked a milestone for policy makers. And with the PEPP comes to an end on March 22, 2022, central bankers need to the afterlife of a ultra-loose monetary policy.

Technical Analysis:

EURUSD (Daily Chart)

Euro dollar was restrained from advancing beyond 1.189, retreated mildly on Tuesday. It successfully capalized on decent upside gains after conquering a dynamic resistance at SMA20. However, the stubborn road block at 32.8% Fibonacci of 1.189 continues to ward off bulls’ attempt to break above.

We expect the single currency to trade marginally lower against the dollar prior to ECB’s critical policy announcement on Thursday. With market participants look to hear a less dovish tone from the ECB, a lower price could provide some leeway for upward surge.

On the downside, nearest support line sits around 1.18, followed by 1.166. Up in the north, bulls could contest 1.198 and 1.1207 if they could take out 1.189.

Resistance: 1.189,1.196, 1.2

Support: 1.18, 1.166

NZDCHF (Daily Chart)

NZDCHF remains bullish despite snapping a ten-winning streak. This pair broke above a seven-months downward tunnel with robust buying bias. Though some may think current price is overstreched, and some sort of pullback should unfold soon. But we believe bulls could at least challenge resistance at 38.3% Fibonacci of 0.6567 before it could stage a retreat toward 0.65 or 0.644. The RSI indicates price is on the cusp of stepping into overbought zone, which provides incentive for buyers to continue to drive price higher, and as soon as price is overheated, they could exit current longs.

The fact that NZDCHF had a convincing breakthrough on SMA20 on the weekly chart has signaled a bullish reversal. All in all, we see further upside gains in NZDCHF in a longer investment horizon. A modest retreat could be very healthy to sustain such bullish trend.

Resistance: 0.6567, 0.6645, 0.677

Support: 0.65, 0.644, 0.6353

XAUUSD (Daily Chart)

Gold plunged to two weeks’ low at $1795 after failing to surpass a stern resistance at $1835.

Current retreat could be seen as a validation of $1795 support, which acted as a neckline for previous double-top pattern. This horizontal support could also collaborate with dynanmic SMA20 to eke out Gold price. That said, the odds are favouring buyers, and we expect another contest of $1835 to take place soon.

However, it is still unclear whether it could gather enough momentum for a solid upward breakout in the near term. We would not be surprised if the yellow metal enters consolidation mode for the rest of September given the lack of price movers in the market. Investors already knew the Federal Reserve will not taper until November or December.

Resistance: 1860, 1910, 1950

Support: 1797, 1768, 1728

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

JPY |

GDP (QoQ) (Q2) |

7:50 |

0.4% |

||||

|

USD |

22:00 |

10.000M |

|||||

|

CAD |

22:00 |

0.25% |

|||||

|

CAD |

Ivey PMI (Aug) |

22:00 |

|||||

|

GBP |

23:00 |

||||||

|

CAD |

BOC Press Conference |

Tentative |

|||||