The stock market rallied strongly, particularly in the tech sector, with the S&P 500 rising by 1.41% and the Nasdaq Composite surging 2.2%, rebounding from a challenging prior week. Notable tech giants like Nvidia, Amazon, Alphabet, and Apple experienced gains, fueling investor confidence. However, Boeing’s 8% stumble due to 737 Max 9 inspections impacted the Dow Jones Industrial Average. As traders anticipate crucial data releases, including CPI and PPI, this week, the focus shifts to the Fed’s inflation control measures and their influence on market sentiment. The currency market saw varied movements, with the USD index declining slightly, affecting currency pairs differently, as the EUR/USD and GBP/USD surged, while USD/JPY and USD/CAD faced challenges. Precious metals like Gold dipped amid a reassessment of Fed policies, contrasting with Silver’s rebound.

The stock market witnessed a significant rebound on Monday as major indices surged, led by a robust performance in the technology sector. The S&P 500 rallied by 1.41% to close at 4,763.54, and the Nasdaq Composite surged by 2.2%, reaching 14,843.77, marking its most impressive day since mid-November. Investors displayed renewed confidence in tech companies after a challenging prior week that saw a 4% decline in the sector, primarily driven by falling yields. Notable tech giants like Nvidia, Amazon, Alphabet, and Apple experienced notable gains, with Nvidia hitting an all-time high, Amazon climbing nearly 2.7%, Alphabet advancing 2.3%, and Apple rising by 2.4% post an Evercore ISI recommendation to buy the recent dip. The VanEck Semiconductor ETF (SMH) also surged by 3.5%, its most robust performance since November, further indicating a broader tech resurgence. However, Boeing’s shares tumbled by 8% due to the temporary grounding of Boeing 737 Max 9 planes for inspections after an Alaska Airlines fuselage incident, impacting the Dow Jones Industrial Average, which managed a 0.58% increase at the close.

Last week marked the market’s first downturn in ten weeks, primarily influenced by underperforming mega-cap tech stocks like Apple and rising Treasury yields, resulting in a 0.59% slide in the Dow, a 1.52% drop in the S&P 500, and the Nasdaq Composite witnessing its worst weekly performance since September with a 3.25% decline. As the new week progresses, traders are eagerly anticipating upcoming data releases, particularly the December consumer price index and the producer price index scheduled for Thursday and Friday, respectively. These crucial figures are expected to shed light on the Federal Reserve’s potential moves regarding interest rates, offering insights into the efficacy of their measures in reining in inflation towards the 2% target. This information could significantly influence market sentiment and trading strategies in the days ahead.

Data by Bloomberg

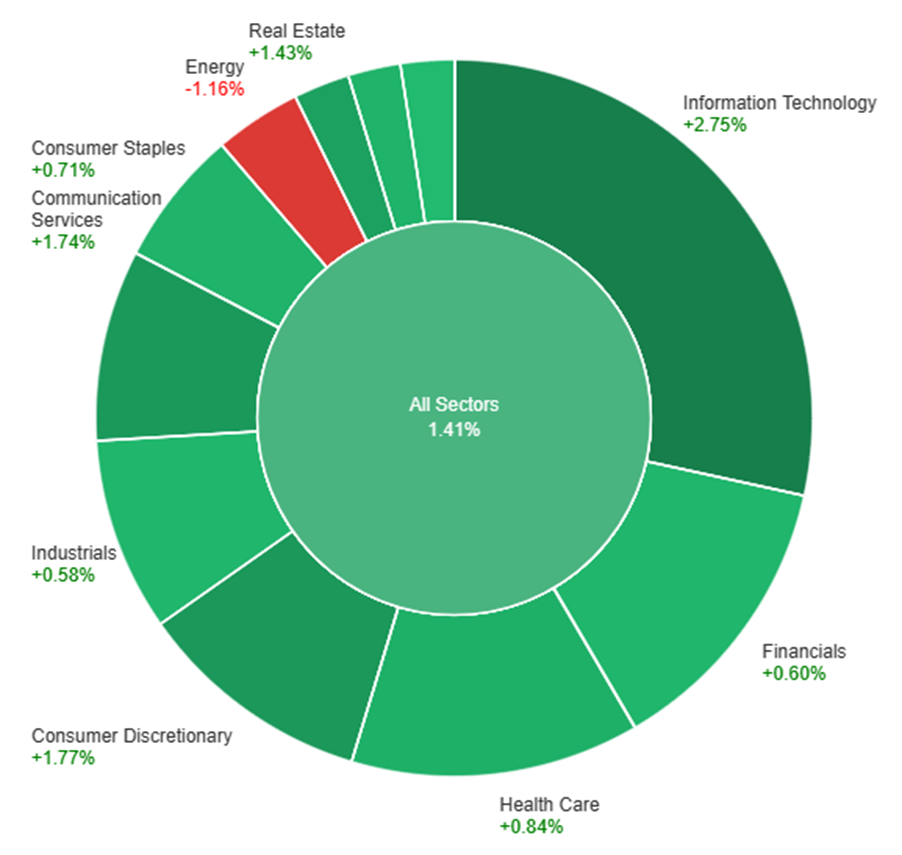

On Monday, the market saw an overall positive trend across various sectors, with a 1.41% increase across all sectors. Information Technology experienced the most significant surge at 2.75%, followed by Consumer Discretionary and Communication Services with gains of 1.77% and 1.74%, respectively. Real Estate and Health Care also showed notable growth, rising by 1.43% and 0.84%, respectively. However, Energy exhibited a decline of 1.16%, while Utilities, Consumer Staples, Financials, Industrials, and Materials sectors saw more modest increases ranging from 0.41% to 0.72%.

The currency market exhibited varied movements amidst a shifting landscape of global economic sentiments. The US Dollar Index (DXY) saw a modest decline, hovering just above the 102.00 threshold as investors favored riskier assets and US yields underwent a corrective downturn. This decline in the dollar bolstered the performance of several currency pairs, notably the EUR/USD, which made significant gains reaching around 1.0980. Factors contributing to this uptick included a marginal increase in Investor Confidence tracked by the Sentix Index and better-than-expected Retail Sales figures in the eurozone. Similarly, GBP/USD continued its bullish trajectory for the fourth consecutive session, surging past the 1.2700 mark, largely supported by positive risk sentiment.

Conversely, the USD/JPY pair experienced a daily pullback to the 143.60 region due to declining US yields and a temporary weakening of the greenback, yet it managed to recover and surpass the 144.00 hurdle by the end of the North American session. AUD/USD showcased resilience by regaining the 0.6700 level, despite the broader bearish performance in the commodity market. However, USD/CAD faced challenges to maintain momentum beyond 1.3400, eventually retreating to the mid-1.3300s amidst a consolidative market environment. Amidst these currency fluctuations, precious metals like Gold saw a retreat to three-week lows, approximately $2015 per troy ounce, influenced by traders reassessing the potential for a prolonged restrictive stance by the Fed, especially in light of December’s Non-Farm Payrolls (NFP) data. In a similar vein, Silver rebounded from two consecutive sessions of losses, yet remained below the $23.00 mark.

EUR/USD Gains Ground Amidst USD Index Decline and Fed Rate Cut Speculation

EUR/USD saw a promising rise early in the week, reaching around 1.0975/80 against a weakening USD Index (DXY), sparked by uncertainties despite strong December Payrolls. Investor demand for bonds drove yields down on both sides of the Atlantic, slightly dimming the optimistic start to the trading year. The market’s focus remains on the Federal Reserve’s potential rate cuts versus the more restrained stance of the ECB, with consensus leaning towards a later rate cut by the ECB. Factors contributing to the euro’s strength included an uptick in Investor Confidence and stable Consumer Confidence, while Retail Sales in the bloc showed a slight contraction.

On Monday, the EUR/USD moved slightly higher and reached the upper band of the Bollinger Bands. Currently, the price moving just below the upper band, suggesting a potential downward movement. Notably, the Relative Strength Index (RSI) maintains its position at 51, signaling a neutral outlook for this currency pair.

Resistance: 1.0980, 1.1068

Support: 1.0892, 1.0814

XAU/USD Finds Support Amid Dollar Weakness and Fed Speculation

During American trading, XAU/USD managed to recover from early losses, hovering around $2,030 per ounce after hitting a mid-December low of $2,016.61. The weakening US Dollar spurred this turnaround, fueled by market optimism driven by expectations of a potential Federal Reserve rate cut in March. Additionally, Bank of America analysts’ predictions of a tapering in Treasury holdings by the Fed further influenced the market sentiment. As government bond yields dipped and stock indexes fluctuated, attention turned to the upcoming US inflation update, with the December Consumer Price Index anticipated to show a 3.2% YoY increase, potentially impacting the future trajectory of gold prices.

On Monday, XAU/USD moved lower and reached the lower band of the Bollinger Bands. Currently, the price moving higher and trying to reach the middle band. The Relative Strength Index (RSI) stands at 42, signaling a neutral but bearish outlook for this pair.

Resistance: $2,050, $2,070

Support: $2,030, $2,009