Amidst optimistic Federal Reserve comments signaling a possible pause in interest rate hikes, the stock market continued its climb, with the Dow Jones, S&P 500, and Nasdaq closing at record highs. Notable contributors included Boeing, Nike, and Walmart, while Newmont Corporation and Synchrony Financial surged in the S&P 500. Concurrently, currency markets responded to a more dovish Fed sentiment, leading to fluctuations in the dollar, euro, pound sterling, and USD/JPY. Speculations around potential rate cuts and pivotal economic data releases like U.S. GDP revisions and eurozone inflation figures maintain market focus as expectations lean towards a more accommodative stance from the Fed.

On Tuesday, the stock market continued its upward trend from November, buoyed by optimistic remarks from a Federal Reserve official suggesting a possible halt in interest rate hikes. The Dow Jones Industrial Average closed at 35,416.98, up 0.24%, while the S&P 500 edged up by 0.10% to 4,554.89, and the Nasdaq Composite gained 0.29% to reach 14,281.76. Fed Governor Christopher Waller’s affirmation that current policy is well positioned to manage economic growth and inflation helped reassure markets ahead of the Federal Open Market Committee’s upcoming meeting.

Key contributors to the market’s rise included Boeing, lifting the Dow by 1.4%, alongside retailers like Nike and Walmart, which gained 0.7% and 1.2%, respectively. The S&P 500 saw boosts from Newmont Corporation and Synchrony Financial, surging by 6.3% and 5.1%. November showcased a robust rally, with the Dow and S&P 500 tracking towards gains of approximately 7.2% and 8.6%, while the Nasdaq surged by 11.1%. Meanwhile, U.S. Treasury yields experienced a decline, notably with the 10-year note slipping nearly 6 basis points to 4.33%.

Additionally, positive consumer confidence data released indicated an increase in November, with The Conference Board’s index rising to 102, surpassing both the downwardly revised October figure of 99.1 and the Dow Jones estimate of 101. Looking ahead, CrowdStrike was anticipated to report earnings after the market close, adding to the ongoing market dynamics and investor sentiment.

Data by Bloomberg

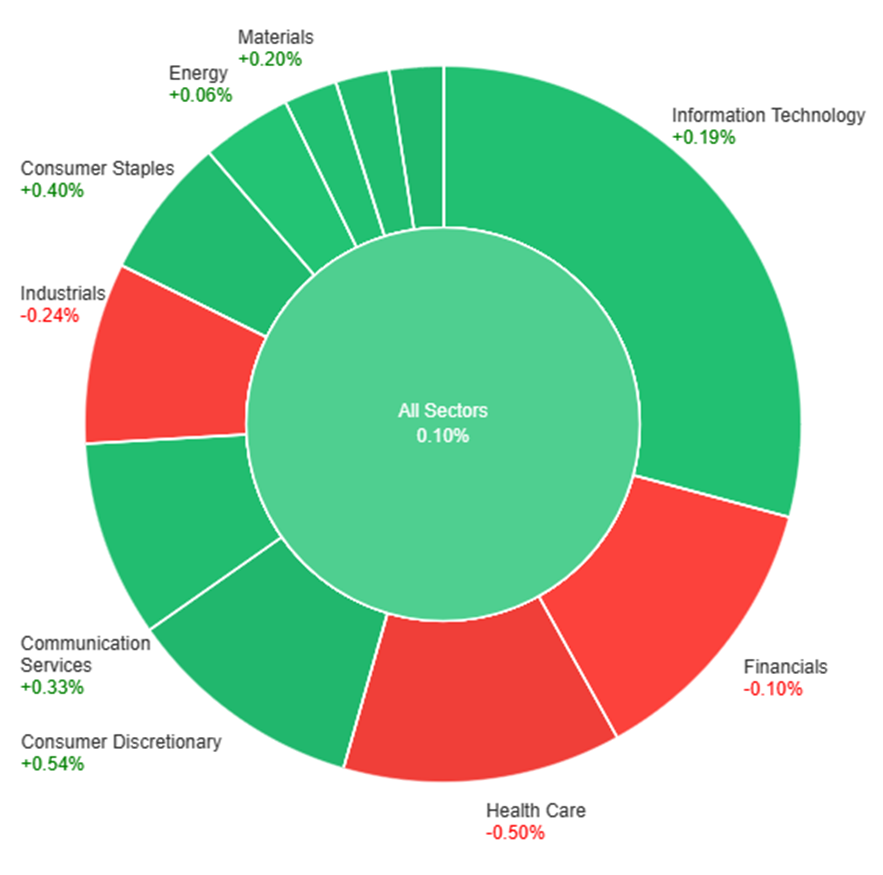

On Tuesday, the market showed a mixed performance across sectors. Consumer Discretionary and Real Estate sectors led the gains with increases of 0.54% and 0.52%, respectively, followed closely by Consumer Staples and Communication Services with gains around 0.40% to 0.33%. Utilities and Materials also saw modest upticks of 0.31% and 0.20%. Conversely, Financials and Industrials experienced declines of -0.10% and -0.24%, respectively, while Health Care faced the most significant downturn, dropping by 0.50%. Energy and Information Technology sectors had more moderate gains, with increases of 0.06% and 0.19% respectively.

The recent movements in the currency market have been influenced by a shift in Fed sentiment towards a more dovish stance. The dollar index dipped by 0.3% as Treasury yields slid following comments from Fed speakers indicating a willingness to consider rate cuts if disinflation persists. This sentiment contrasts with the Fed’s prior messaging, prompting the futures market to anticipate a rate cut in May as twice as likely as a hold, with potential cuts of up to 100 basis points by December 2024. Consequently, the euro gained against the dollar, reaching levels above its 61.8% retracement for the year, driven by a rise in 2-year bund-Treasury yield spreads and risk-on flows due to lower U.S. and European yields.

In tandem with these developments, the pound sterling rose but halted before reaching its 61.8% Fibo of its July-October slide, with expectations that the Bank of England might delay rate cuts compared to the Fed, potentially reducing rates by 67 basis points in the coming year. Conversely, USD/JPY experienced a decline of 0.75%, continuing its reversal from 2023’s uptrend, driven by falling 2-year JGB yields and potential bearish signals if certain technical levels, like a close below the daily cloud base and last month’s low, are breached. The Bank of Japan faces pressure to reconsider negative rates and the efforts to cap JGB yields due to concerns about the weak yen’s impact on Japan’s economy and persistent low inflation.

Looking ahead, key events like German CPI, U.S. GDP revisions, and the beige book are expected to offer further insights. The market’s focus also centers around Thursday’s session with pivotal data releases including euro zone inflation figures and U.S. core PCE, income, consumption, savings rate data, jobless claims, and pending home sales. Forecasts lean towards a more dovish Fed stance and potentially weaker dollar amidst these upcoming releases.

EUR/USD Hovers Within Familiar Territory Amid Cautious Investor Sentiment

The EUR/USD pair remained steady within established ranges as investors exercised caution ahead of pivotal data releases and central bank speeches scheduled in the coming days. While reaching a high of 1.0962, the pair saw a dip to 1.0934 during European trading hours. The US Dollar’s declining appeal for the fourth consecutive day amid speculation around the Fed’s potential halt to rate hikes by May 2024 has lent support, but concerns about inflation updates in the US and Eurozone have curbed the EUR/USD rally. Key data releases, including Germany’s November HICP and the US October PCE Price Index, are anticipated, alongside speeches from Fed officials, heightening the market’s vigilance.

On Tuesday, the EUR/USD moved higher, attempting to reach the upper band of the Bollinger Bands. Currently, the price is hovering just around the upper band, showing potential for consolidation and a possible move toward the middle band. The Relative Strength Index (RSI) remains at 74, indicating a bullish stance for the currency pair.

Resistance: 1.1041, 1.1087

Support: 1.0968, 1.0930

XAU/USD Surge as Fed Signals Dovish Tone Amidst Inflation Debate

Gold prices soared, reaching $2,038.45 against the USD following a shift in sentiment from Federal Reserve officials. Governor Waller’s dovish remarks on the recent economic slowdown, suggesting an adequate monetary policy stance against inflation, set the tone. Chicago Fed President Goolsbee echoed progress on inflation, hinting at a potential substantial drop in rates. Meanwhile, Governor Bowman maintained a hawkish stance, leaving room for a rate hike if inflation stagnates. This shift toward dovish sentiments weakened the US Dollar, driving Treasury yields down—10-year government notes now offer 4.36%, while 2-year notes yield 4.80%, signaling market reactions to the Fed’s evolving stance.

On Tuesday, the XAU/USD moved higher and managed to create a push to the upper band of the Bollinger Bands. Currently, the price is just below the upper band, indicating potential consolidation and a possible move downward toward the middle band. The Relative Strength Index (RSI) remains at 83, reflecting a bullish stance for the pair.

Resistance: $2,052, $2,079

Support: $2,038, $2,012

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | CPI y/y | 08:30 | 4.9% (Actual) |

| NZD | Official Cash Rate | 09:00 | 5.50% (Actual) |

| NZD | RBNZ Rate Statement | 09:00 | |

| NZD | RBNZ Press Conference | 10:00 | |

| EUR | German Prelim CPI m/m | All Day | -0.1% |

| EUR | Spanish Flash CPI y/y | 16:00 | 3.6% |

| USD | Prelim GDP q/q | 21:30 | 5.0% |

| GBP | BOE Gov Bailey Speaks | 23:05 |