Tuesday witnessed a rollercoaster ride in the stock market as the S&P 500 and Dow Jones ended with declines while the Nasdaq managed a slight gain, primarily propelled by tech stocks’ resurgence. Despite the market’s recovery, with notable companies like Nvidia and Amazon showing gains, uncertainties loom as investors brace for crucial inflation data and upcoming earnings reports from major corporations. Simultaneously, the currency market saw the US Dollar Index surge, impacting major pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD, and USD/CAD, while precious metals faced headwinds amidst dollar demand and market uncertainties.

The stock market on Tuesday experienced a fluctuating day, with the S&P 500 initially dropping but later recuperating slightly thanks to a surge in tech stocks. Despite this rebound, the S&P 500 closed with a 0.15% decrease at 4,756.50, following a volatile day where it had plunged by 0.7% at its lowest point. Similarly, the Dow Jones Industrial Average ended down by 0.42%, recovering from a 310-point deficit earlier in the session. Conversely, the Nasdaq Composite managed to reverse a 0.9% decline, finishing with a marginal gain of 0.09% at 14,857.71. Notably, Nvidia and Amazon both saw gains of over 1.5%, with Juniper Networks surging by almost 22% due to potential acquisition news by Hewlett Packard Enterprise.

Tech stocks, which had been performing strongly in 2023, faced challenges at the beginning of 2024, impacting the broader market. Despite this setback, healthcare emerged as one of the day’s winners, marking a 3% increase for the year and ranking as the top-performing sector. The recent market movements followed a positive session on Monday, where both the S&P 500 and Nasdaq Composite rebounded, particularly driven by the recovery of mega-cap tech stocks after previous declines. Looking ahead, investors await crucial inflation data later in the week, expecting insight into potential Federal Reserve rate adjustments. Additionally, significant companies like Infosys, JPMorgan Chase, UnitedHealth, Bank of America, and Delta Air Lines are scheduled to report earnings, contributing to market sentiment and direction.

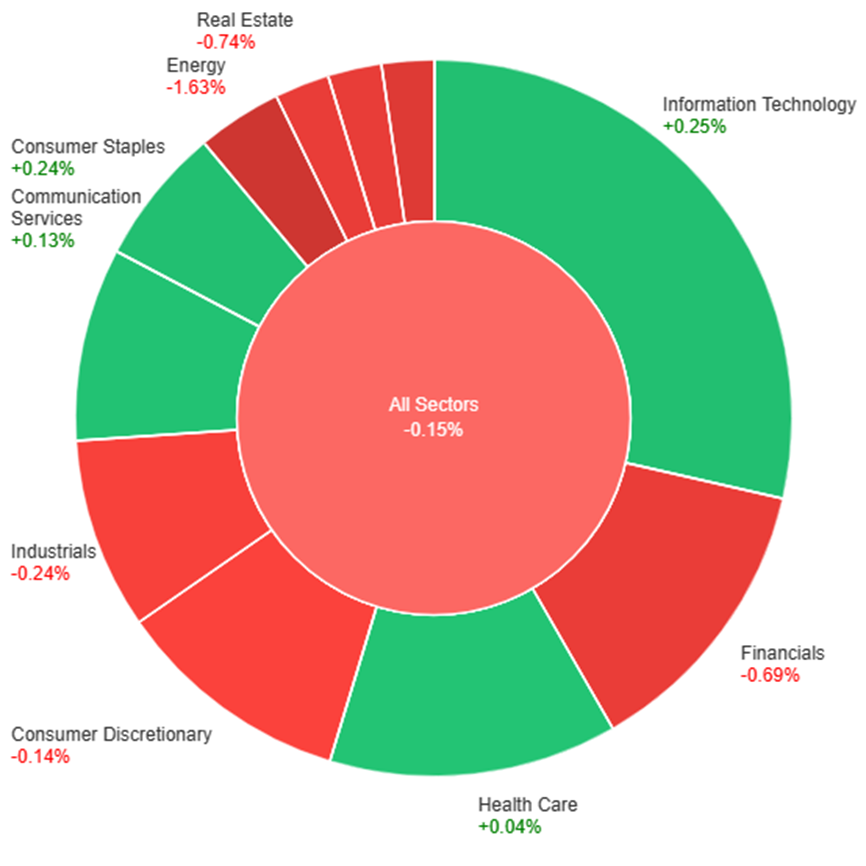

Data by Bloomberg

On Tuesday, the overall market experienced a slight decrease of 0.15%. However, there were sectoral variations, with Information Technology (+0.25%), Consumer Staples (+0.24%), and Communication Services (+0.13%) showing modest gains. Health Care (+0.04%) also saw a marginal increase. Conversely, Consumer Discretionary (-0.14%), Industrials (-0.24%), Financials (-0.69%), Real Estate (-0.74%), Utilities (-0.76%), Materials (-1.10%), and Energy (-1.63%) sectors faced declines, with Energy and Materials exhibiting the most significant decreases among the sectors.

In the currency market, the US Dollar Index (DXY) surged to two-day highs, hitting the 102.70 zone, buoyed by increased demand for the greenback despite the lack of clear direction in US yields. This propelled EUR/USD downwards, nearly touching the critical support level of 1.0900 as the dollar gained traction alongside safe-haven assets. GBP/USD also faced downward pressure, slipping below 1.2700 and reversing gains from earlier in the week. Conversely, USD/JPY saw a notable recovery, surpassing the key barrier at 144.00 after consecutive sessions of losses, driven by inconclusive movements in US yields and a dip in JGB 10-year yields. Meanwhile, AUD/USD experienced a sharp decline to the 0.6680/75 region following two days of slight gains, ahead of the release of pivotal inflation data in Australia.

Additionally, the robust performance of the greenback pushed USD/CAD to fresh four-week highs beyond 1.3400 amid weak results in Canadian trade balance and building permits, sustaining selling pressure on the Canadian dollar. Precious metals faced headwinds as gold closed around $2030 per troy ounce due to heightened demand for the dollar and uncertain sentiments in US money markets. Silver prices echoed this trend, grappling with the significant $23.00 mark as they continued a negative trend from the beginning of the week. The currency market witnessed a shift in dynamics driven by the dollar’s resurgence, impacting major pairs and commodities alike as traders closely monitored key economic data releases and fluctuations in yields.

EUR/USD Reversal and Dollar Strength Amidst Economic Indicators

The EUR/USD pair retreated from early-week gains, hovering near 1.0900 amidst a stronger USD Index reaching 102.70. Market caution ahead of US inflation data and consumer sentiment reports contributed to the dollar’s uptick. The pair’s movement was influenced by mixed US yield trends and divergent central bank policies, with the ECB possibly eyeing rate cuts while the Fed leans toward reductions. Germany’s disappointing industrial production and an unexpected jobless rate improvement in the broader Eurozone added to the euro’s bearish sentiment, shaping the currency pair’s recent downturn.

On Tuesday, the EUR/USD moved slightly lower and reached the lower band of the Bollinger Bands. Currently, the price moving just below the middle band, suggesting a potential upward movement. Notably, the Relative Strength Index (RSI) maintains its position at 44, signaling a neutral outlook for this currency pair.

Resistance: 1.0980, 1.1068

Support: 1.0892, 1.0814

XAU/USD Treads Cautiously Amidst Economic Uncertainty and Fed Rate Expectations

Spot gold, reflected by XAU/USD, remains within familiar ranges, lingering at the lower end of Monday’s spectrum. The US Dollar gains momentum amid a gloomy market sentiment as stocks dip, while anticipation builds for key macroeconomic indicators. Market optimism regarding a potential Fed interest rate trim awaits validation from forthcoming Consumer Price Index (CPI) figures. Recent employment data signaling a tight labor market raises concerns about potential inflationary pressures, posing a dilemma for the Fed’s tightening policy. With rates at multi-year highs, there’s a looming risk of an economic setback, prompting speculation on potential rate cuts as early as March. Amidst this backdrop, the surge in US Treasury yields further bolsters the USD, creating a cautious atmosphere for gold traders.

On Tuesday, XAU/USD moved lower and moving between the middle and lower bands of the Bollinger Bands. Currently, the price moving higher and trying to reach the middle band. The Relative Strength Index (RSI) stands at 42, signaling a neutral outlook for this pair.

Resistance: $2,050, $2,070

Support: $2,030, $2,009

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | CPI y/y | 08:30 | 4.3%(Actual) |