The Nasdaq Composite closed higher as investors turned to tech stocks following a relatively modest inflation report. The tech-heavy index gained 1.04% to reach a closing value of 12,306.44, while the S&P 500 added 0.45% to close at 4,137.64. In contrast, the Dow Jones Industrial Average dipped slightly by 0.09% to end at 33,531.33.

April’s consumer prices rose 4.9% compared to the previous year, falling short of economists’ expectations of a 5% increase. This news, along with the in-line month-over-month inflation rate of 0.4% in April, caused Treasury yields to decline. The 2-year Treasury yield fell by around 11 basis points to 3.91%, and the 10-year rate declined by 8 basis points to 3.44%.

While the market reacted positively to the tempered inflation report, cyclical stocks linked to the economy traded lower, with companies like Nike and Caterpillar ending the session in negative territory. Additionally, Airbnb and Twilio saw significant declines of 10.9% and 12.6%, respectively, following weak forecasts. Rivian, an electric vehicle maker, closed 1.8% higher after reporting a narrower-than-expected loss. The focus also turned to earnings reports from Disney and Robinhood.

Investors remained cautious about a potential full-fledged rally despite the more favorable inflation figures. Concerns over the U.S. debt ceiling also weighed on traders’ minds, as the possibility of an agreement being reached before June 1—when the U.S. Treasury Department says a default could occur—became uncertain. President Joe Biden met with congressional leaders, but limited progress was reported. Another meeting is scheduled for Friday to address the issue.

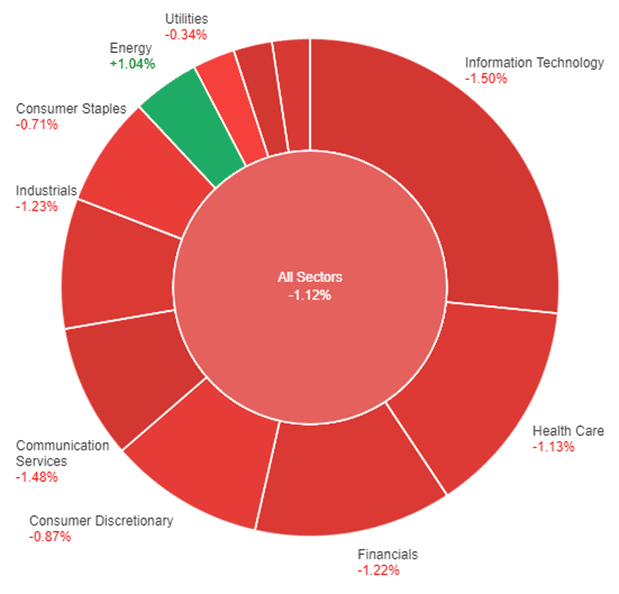

Data by Bloomberg

On Wednesday, the overall market showed a positive trend, with all sectors experiencing a 0.45% gain. The Communication Services sector had the highest increase of 1.69%, followed by Information Technology with a gain of 1.22%. Real Estate and Utilities also performed well, rising by 0.98% and 0.94% respectively.

Consumer Discretionary showed a modest increase of 0.63%, while Health Care and Materials had smaller gains of 0.27% and 0.05% respectively. On the other hand, Consumer Staples experienced a slight decline of -0.15%. Industrials and Financials sectors faced larger decreases of -0.32% and -0.58% respectively. The Energy sector experienced the most significant decline, dropping by -1.15%.

Major Pair Movement

The U.S. dollar initially weakened in response to the Consumer Price Index (CPI) data, which fell short of some expectations, indicating that it may not support the Federal Reserve’s position against rate cuts in the second half of the year. However, risk-off sentiment and book-squaring helped the dollar recover from its early losses, except against the safe-haven Japanese yen. The decline in Treasury yields, driven by the weaker-than-expected inflation data and renewed weakness in regional bank stocks, contributed to the dollar’s recovery.

The Japanese yen benefited the most from the stock market decline and falling yields, as Japanese Government Bond (JGB) yields are influenced by the Bank of Japan’s (BoJ) yield curve control and quantitative easing measures. Speculation is growing that the BoJ’s policy review, amid inflation levels surpassing its target, may lead to higher JGB yields. Additionally, a report highlighting Japanese life insurers’ inclination to reduce their Treasury holdings in favor of JGBs further fueled the exit of long positions in USD/JPY and yen shorts.

Meanwhile, the euro initially rebounded against the dollar following the CPI release but later experienced a modest 0.15% increase as risk-off flows supported demand for the safe-haven dollar. Similarly, sterling’s post-CPI rally to new one-year highs dissipated due to derisking and ahead of the Bank of England’s meeting on Thursday.

Technical Analysis

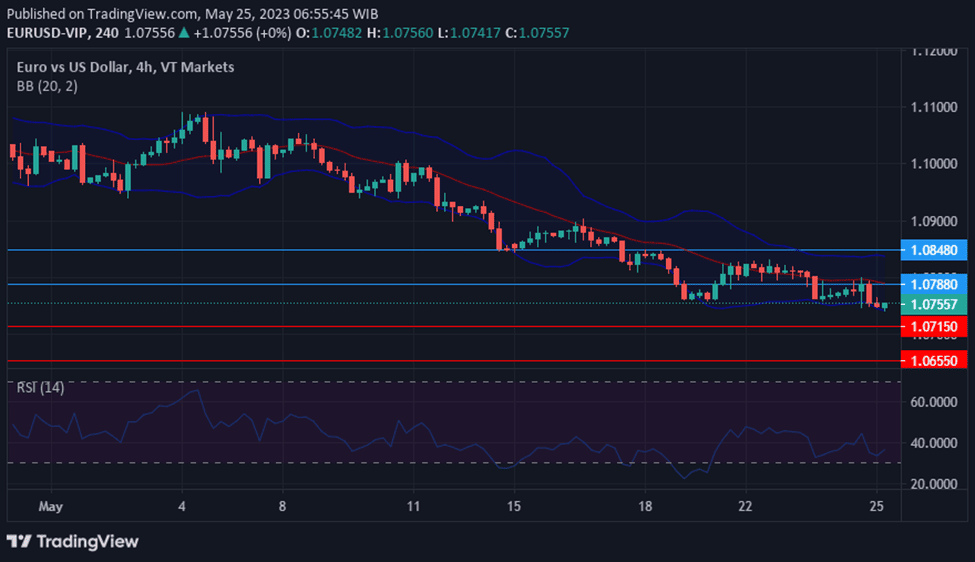

EUR/USD (4 Hours)

EUR/USD Lacks Direction as US Dollar Recovers Despite ECB Hawkish Comments

The US dollar initially weakened in response to US inflation data, causing the EUR/USD pair to briefly surpass 1.1000. However, the US dollar later regained its footing, pushing the pair back below that level. The EUR/USD pair is currently moving sideways without a clear direction, despite the European Central Bank (ECB) members’ hawkish comments.

ECB Governing Council member Mario Centeno stated that policy would remain tight for some time, but interest rates might start to decline in 2024. Bloomberg reported that some ECB members are considering a rate hike in September, assuming earlier hikes in June and July. Meanwhile, German inflation data confirmed a 7.2% annual increase in April.

In the US, the Consumer Price Index (CPI) showed a slight decrease to 4.9% in April from 5% in March, while the Core CPI dropped to 5.5% from 5.6% in March. Initially, the US dollar faced significant losses but eventually rebounded and turned positive. Market participants are pricing in a potential pause in rate hikes from the Federal Reserve in June. On Thursday, the US will release additional inflation data with the Producer Price Index (PPI).

According to technical analysis, the EUR/USD pair is currently trending lower after reached the middle band of the Bollinger band. It is expected that the EUR/USD will continue to move back lower to reach the lower band of the Bollinger band. The Relative Strength Index (RSI) is presently at 42, suggesting a neutral trend but lower in the EUR/USD market.

Resistance: 1.0990, 1.1032

Support: 1.0965, 1.0939

XAU/USD (4 Hours)

XAU/USD Retreats as US Inflation Data Spurs Speculation on Fed Rate Hike Chances

Following the announcement of US inflation data, spot gold initially reached a peak of $2,048.14 per troy ounce but has since declined and is currently trading around $2,025. The rise in the US Consumer Price Index (CPI), with a 4.9% year-on-year increase in April and a 0.4% month-on-month increase in line with expectations, led to a surge in XAU/USD. However, the inflation rate has been gradually easing from its previous record highs in mid-2022.

The release of the inflation figures prompted speculators to factor in reduced chances of a rate hike by the Federal Reserve (Fed) in July. This resulted in a rally in stock markets as investors hoped that the Fed would maintain its current stance, reducing the risk of an economic downturn. Consequently, the US dollar initially weakened across the foreign exchange (FX) market.

Although Wall Street opened on a positive note, sentiment quickly shifted, allowing the US dollar to recover its losses against major currencies. Similarly, US Treasury yields initially rose but subsequently fell back to their pre-announcement levels, remaining at the lower end of the daily range. Currently, stock markets are trading with mixed results, with the Dow Jones Industrial Average (DJIA) in negative territory, the S&P 500 struggling to stay afloat, and the Nasdaq Composite performing the best, showing a gain of 78 points.

The technical analysis indicates that XAU/USD is moving higher on Wednesday. The price is currently just above the middle band of the Bollinger Band, indicating the potential for a consolidating movement with higher potential. Moreover, the Relative Strength Index (RSI) is currently at 54, indicating that XAU/USD is considered neutral but slightly bullish.

Resistance: $2,038, $2,052

Support: $2,015, $2,003

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | BOE Monetary Policy Report | 19:00 | |

| GBP | MPC Official Bank Rate Votes | 19:00 | 7-0-2 |

| GBP | Monetary Policy Summary | 19:00 | |

| GBP | Official Bank Rate | 19:00 | 4.50% |

| GBP | BOE Gov Bailey Speaks | 19:30 | |

| USD | Core PPI m/m | 20:30 | 0.2% |

| USD | PPI m/m | 20:30 | 0.3% |

| USD | Unemployment Claims | 20:30 | 245K |