Market Focus

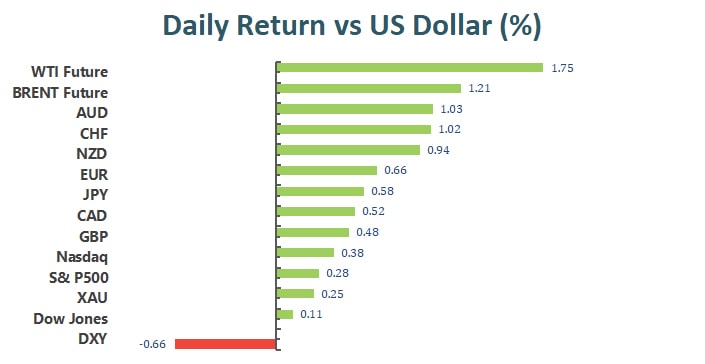

The consumer price index rose 0.5% in December, slightly above expectations, taking the year-over-year consumer price index increase to 7% through December, in line with expectations and the fastest pace of growth since 1982. A drop in longer-dated U.S. Treasury yields on Wednesday also helped for most stock sectors. A sharp rise in U.S. 10-year yields has weighed on stocks in recent weeks, especially in interest-rate-sensitive growth sectors such as technology. At the end of the market, the Dow Jones Industrial Average rose 0.11% to 36,290.32 points, the S&P 500 index rose 0.28% to 4,726.35 and the Nasdaq Composite Index added 0.23% to 15,188.39 points.

Among the S&P 500 sectors, the biggest gainer on the day was materials, up nearly 1%, consumer discretionary up 0.6% and technology up 0.4%, while healthcare was the only loser. In the tech sector,

Tesla rose 3.9%, ahead of Microsoft, Google, the latter rose more than 1%. The healthcare index was weighed down by shares of drugmakers Eli Lilly and Biogen, which fell 2.4% and 6.7%, respectively. On the other hand, the biggest drags on the Dow on the day were Goldman Sachs, down 3% on the day, Morgan Stanley down 2.7% and their smaller rival Jefferies down 9% after missing quarterly earnings estimates .

Main Pairs Movement:

The dollar plummeted and fell to a two-month low after the release of U.S. inflation data. December CPI was confirmed as expected at 7% year-on-year growth, while the core reading beat expectations by a whopping 5.5%. The news usually sparks risk aversion, but this time it had the opposite effect. Because the data failed to provide any new impetus to the Fed’s policy normalization efforts. At the end, the dollar index was down 0.7 % at 94.987, after falling to 94.907, its lowest since Nov. 11.

Sterling rallied on a weaker dollar and continued to move north, having jumped to the 1.3700 level, its highest level since October.

EUR/USD also gained momentum from a weaker dollar, breaking out of a consolidation zone to hit 1.1400, its highest level since November.

Gold edged higher to settle at around $1,827 per ounce. Crude oil prices also rose, with WTI at $82.60 a barrel and Brent at $84.72 a barrel.

Technical Analysis:

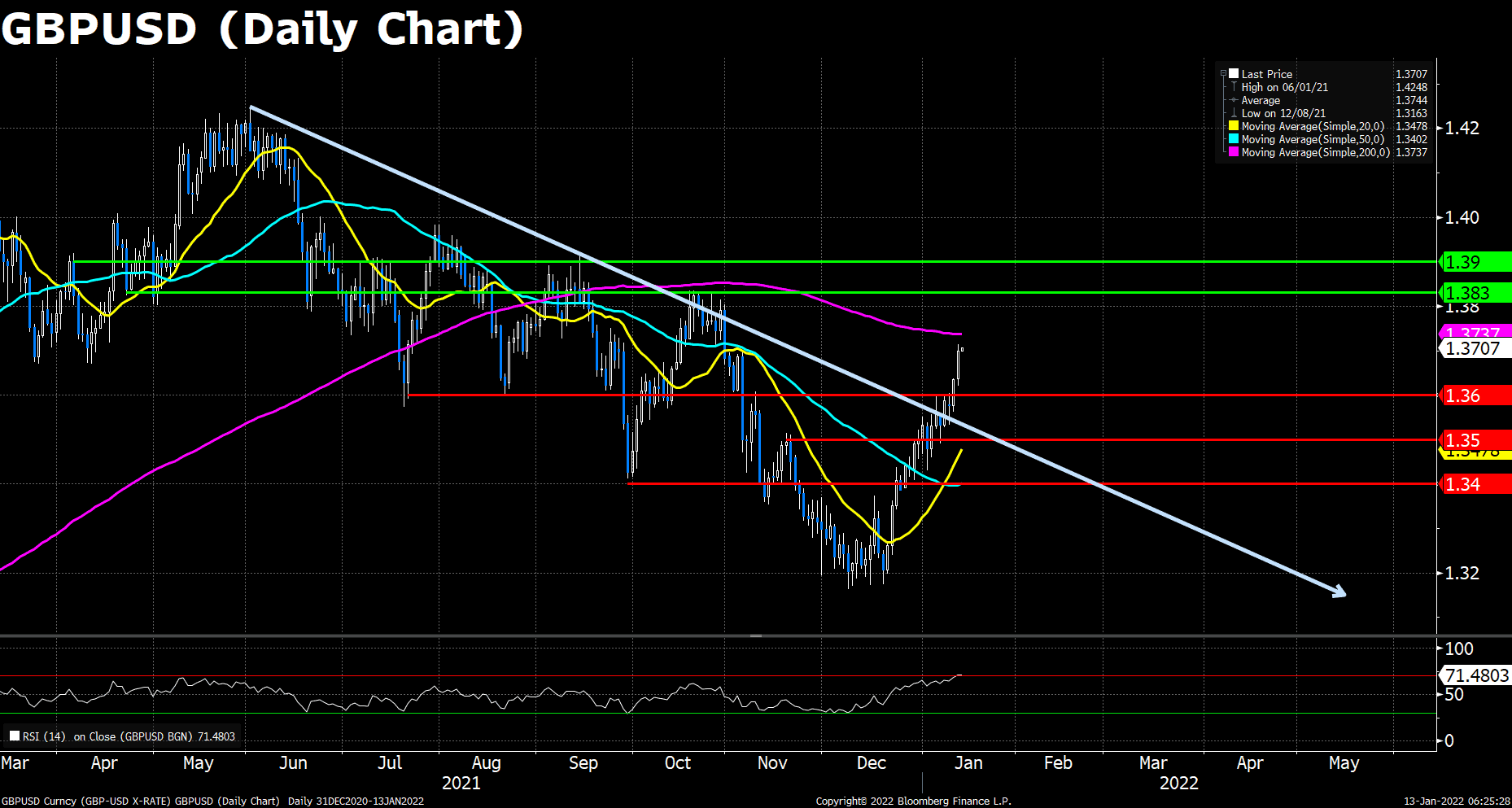

Cable extended further north during the Wednesday’s trades and is eyeing on the next resistance level at 1.3830. The pair consolidated around the similar levels in the Asian and European session, and surged aggressively after the US CPI data released, which is generally in line with the expectations and thus pushed the rate sensitive currencies like Sterling to gain value. The pair now trades at around 1.3707, up around 0.44% from today’s open price.

On the technical front, GBP/USD price has been further away the long-term downside trajectory and is heading to its 200 DMA. The RSI indicator has just entered the overbought territory, and the correction pressure is expected to appear at around 1.3700. Cable is now experiencing a stream of short term optimistic buying amid the dollar’s weakness, and this risk-off market mood may last until March when the scheduled US rate hike is in effect.

Resistance: 1.3830, 1.3900

Support: 1.3600, 1.3500, 1.3400

After two months’ consolidation, the euro pair finally crossed over the robust 1.1400 resistance as the decent US CPI data lowered the investors’ guard about additional tightening potentials from the Fed. Despite no news from the ECB, market participants seem to bet high inflation and the spillover effect of the Fed’s dynamic will force the ECB to act. This is providing the shared currency with some degree of support by limiting the extent of US – euro area rates discrepancy.

On the technical, the Euro pair surprisingly managed to break through the persistent downtrend line and the meaningful 1.1400 resistance. We can see that the RSI for EUR/USD have come above 60, indicating an overall bullish sentiment around the market. If the pair successfully closed beyond the 1.1400 threshold at the end of the week, then a fresh upside trend could be confirmed, heading the pair all the way to the next resistance level at 1.620; however, if failed, Euro will be back to the previous consolidation phase and keep falling in the near future when Fed raise rates.

Resistance: 1.1620, 1.1700

Support: 1.1200, 1.1000, 1.0780

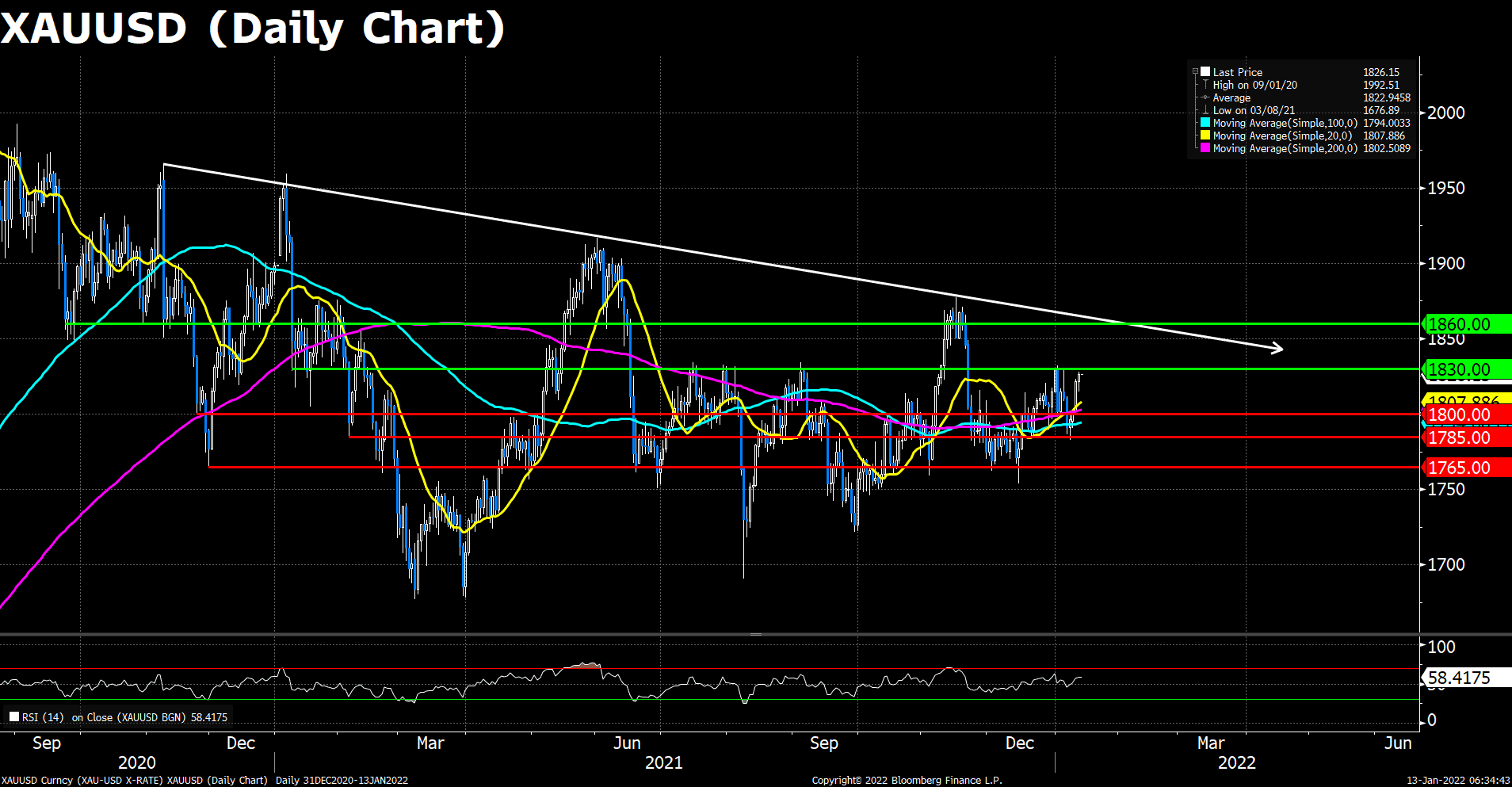

XAU/USD buoyed for the fourth consecutive day as the revealed US inflation is generally as expected, easing the rates hike fears and causing a decline to the US yields. The US 10-year Treasury yield is down almost two basis points, weighing on the greenback. At the time of writing, gold is trading at $1,826 per troy ounce post New York trading hours.

As to technical, Gold’s price seems to be neutral-bullish biased, but downside risks remain, with the long-term downward sloping resistance still capping its upside outlook. The continuation of the dollar weakness and the cautious market mood keep pushing gold price to its resistance at $1,830. The RSI for gold reads 58.92, showing that there are still rooms for the gold’s uplift. The pair now lies above its 20, 50 and 200 DMAs.

Resistance: 1830, 1860

Support: 1800, 1785, 1765

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

USD |

Initial Jobless Claims |

21:30 |

200 K |

|

|

USD |

PPI (MoM) (Dec) |

21:30 |

0.4% |

|