Stock futures edged higher after a recent market pause, with S&P 500, Nasdaq 100, and Dow Jones futures indicating slight upticks. Micron’s notable postmarket leap of over 4% propelled optimism after surpassing Wall Street’s projections for its first fiscal quarter. However, the prior day marked a downturn as investors seized profit opportunities, reflecting the S&P 500’s worst performance since September. Looking forward, attention is on forthcoming economic indicators like jobless claims and GDP figures, alongside Nike’s imminent earnings release. In currency markets, Sterling declined by 0.5% due to disappointing UK CPI, while the dollar, euro, and yen stabilized. Ongoing central bank comments continue to sway sentiment, impacting the EUR/USD pair and hinting at potential shifts in global monetary policies tied to upcoming data releases like Japan’s core CPI and the U.S. core PCE.

Stock Market Updates

Stock futures indicated a modest upward trend following a pause in the recent market surge. S&P 500 futures rose by 0.16%, Nasdaq 100 futures by 0.24%, and Dow Jones Industrial Average futures climbed 0.15%. Micron experienced a significant postmarket increase, jumping over 4% after surpassing Wall Street’s expectations for its first fiscal quarter and providing a stronger-than-expected outlook for the current quarter. The day prior witnessed a downturn in the markets as investors seized the opportunity to capitalize on recent profits, resulting in the S&P 500’s worst performance since September and the Dow and Nasdaq marking their most significant drops since October. These declines marked a breather from a robust market rally that saw substantial gains in the Dow, S&P 500, and Nasdaq Composite over the past few months.

Looking ahead, investors are eyeing upcoming data releases such as jobless claims and third-quarter gross domestic product figures, along with the closely watched personal consumption expenditures price index, known as an essential measure of inflation. Additionally, market watchers are anticipating Nike’s earnings announcement after the closing bell on Thursday, which is likely to influence market sentiment and direction.

Data by Bloomberg

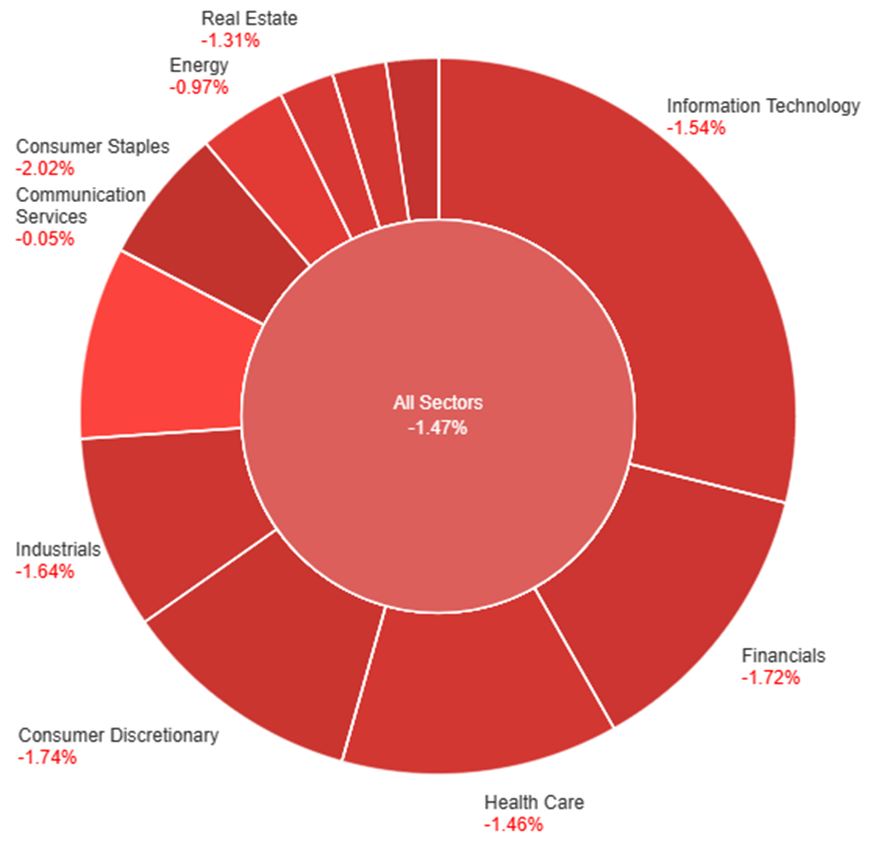

On Wednesday, the overall market experienced a decline of 1.47%. Across sectors, most industries saw negative movements, with Utilities and Consumer Staples facing the steepest drops at -1.98% and -2.02% respectively. The Information Technology sector also fell notably by 1.54%, while Financials and Consumer Discretionary both recorded decreases of 1.72% and 1.74% respectively. Other sectors such as Health Care, Materials, and Industrials followed a similar downward trend, showing declines ranging from 1.46% to 1.64%. Communication Services and Energy sectors were relatively less affected, with marginal decreases of -0.05% and -0.97% respectively. Real Estate experienced a decline of 1.31%. Overall, it was a day of widespread negative performance across various sectors, with Utilities and Consumer Staples bearing the brunt of the losses.

Currency Market Updates

In recent currency market movements, Sterling faced losses as UK CPI fell below expectations, leading to a 0.5% decline. This drop was influenced by a significant 16bp decrease in two-year gilt yields, impacting the market and offsetting risk-on flows. Conversely, the dollar, euro, and yen stabilized within specific ranges following fluctuations post-recent central bank meetings. However, these adjustments were insufficient to extend the EUR/USD’s attempt to surpass November and December highs or bolster USD/JPY after its post-Fed pivot retreat.

The market sentiment remains influenced by ongoing post-meeting comments from the Fed and ECB. Eurozone dynamics saw ECB hawks challenging aggressive rate cut expectations while grappling with declining German producer prices amidst forecasts of increased German inflation in early 2024 due to budget constraints. As a result, the EUR/USD pair experienced a 0.2% decline, nearing 1.0950 from its late 2023 peaks. Additionally, the focus now shifts towards upcoming data releases, including Japan’s core CPI, predicted to drop to 2.5%, potentially influencing the BoJ’s policies. Meanwhile, the U.S. core PCE is expected to decrease to 3.3%, aligning with futures pricing indicating a decline in Fed rates to 3.85% by the next December. These impending reports stand poised to shape future currency movements.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Teeters Amid US Dollar Recovery: Key Data Points Influence Direction

The EUR/USD faced a dip amidst a recovering US Dollar Index, struggling to break the 1.1000 mark as it moved directionlessly. Supported by a weak US Dollar and a hint of risk appetite, the pair showed resilience. Positive US data, including a rise in Existing Home Sales and Consumer Confidence, countered the Eurozone’s moderate uptick in Consumer Confidence and the ECB’s resistance to early rate cuts. While the bias leans towards an upward trajectory, the EUR/USD needs to breach 1.1000 swiftly to mitigate focus on the diverging economic performances of the US and Eurozone. Thursday’s upcoming data, including Jobless Claims and Q3 GDP, followed by Friday’s Core PCE report, will likely steer the pair’s direction.

On Wednesday, the EUR/USD moved slightly lower reaching the middle band of the Bollinger Bands. Currently, the price moving slightly above the upper band, suggesting a potential for another upward movement. Notably, the Relative Strength Index (RSI) maintains its position at 55, signaling a neutral outlook for this currency pair.

Resistance: 1.1017, 1.1138

Support: 1.0946, 1.0830

XAU/USD (4 Hours)

XAU/USD Holds Steady Amidst USD Strength and Inflation Concerns

Spot Gold, represented by XAU/USD, navigated within a tight range as the US Dollar gained momentum earlier in the day, buoyed by upbeat US data like the CB Consumer Confidence report. Despite hitting an intraday high before retracing, Gold settled near its daily low. Market sentiment shifted during the European session on news of easing UK inflation, alleviating some concerns. Eyes now turn to the upcoming US Personal Consumption Expenditures Price Index, anticipated to influence markets significantly and potentially affirm or challenge the Fed’s recent policy stance.

On Wednesday, XAU/USD moved slightly lower and reached the middle band of the Bollinger Bands. Currently, the price moving just above the upper band, suggesting a potential upward movement. The Relative Strength Index (RSI) stands at 56, signaling a neutral outlook for this pair.

Resistance: $2,050, $2,068

Support: $2,031, $2,008

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Final GDP q/q | 21:30 | 5.2% |

| USD | Unemployment Claims | 21:30 | 214K |