On Thursday, the S&P 500 and Nasdaq Composite experienced gains driven by positive quarterly results from Nvidia, leading to a surge in technology stocks. The Nasdaq rose by 1.71% to close at 12,698.09, while the S&P 500 increased by 0.88% to finish at 4,151.28. However, the Dow Jones Industrial Average declined slightly by 0.11% to close below its 200-day moving average at 32,764.65.

Nvidia’s shares soared by 24.4% after the company reported better-than-expected revenue guidance and strong performance in the previous quarter. The increasing demand for Nvidia’s chips in artificial intelligence applications contributed to its success. Following these results, several analysts raised their price targets for Nvidia, bringing the company’s market capitalization close to $1 trillion. Other semiconductor and artificial intelligence stocks, such as Advanced Micro Devices, Taiwan Semiconductor, Alphabet, and Microsoft, also experienced notable gains.

Despite the positive market performance, concerns about market breadth persisted, with some companies and sectors driving the market higher while others struggled. Additionally, negotiations to raise the U.S. debt ceiling continued, causing some uncertainty in the market. Talks between congressional leaders and President Joe Biden showed progress, but concerns remained as the default deadline approached. Fitch Ratings put the U.S.’ AAA long-term foreign-currency issuer default rating on a negative watch, citing the risk of missed payments on government obligations.

Data by Bloomberg

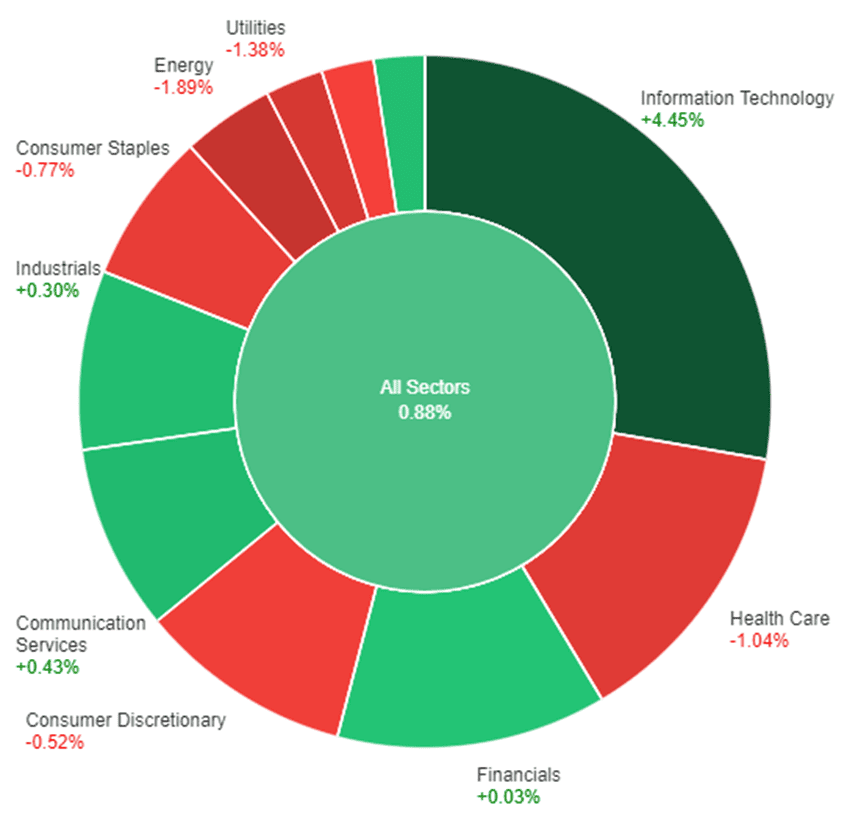

On Thursday, the overall market experienced a positive price change of 0.88%. The Information Technology sector performed exceptionally well, with a significant increase of 4.45%. Communication Services also saw a modest gain of 0.43%, followed by Industrials and Real Estate sectors, which both experienced slight increases of 0.30% and 0.28%, respectively. The Financials sector showed minimal growth with a 0.03% increase.

However, several sectors experienced declines on Thursday. The Materials sector saw a decrease of 0.38%, while the Consumer Discretionary sector suffered a larger decline of 0.52%. The Consumer Staples sector had a notable drop of 0.77%. The Health Care sector experienced a significant decrease of 1.04%, and Utilities and Energy sectors had the largest declines, with decreases of 1.38% and 1.89%, respectively.

Major Pair Movement

On Thursday, the dollar index performed strongly, supported by haven buying due to ongoing uncertainties surrounding U.S. debt ceiling negotiations. Additionally, positive U.S. economic data, including tight initial jobless claims, upbeat GDP, and core PCE data, have raised expectations of a Federal Reserve interest rate hike in July. This has diminished the previously anticipated rate cuts for the end of the year. While a resolution to the debt ceiling issue was expected by Friday afternoon, U.S. Treasury Bill rates remained elevated.

In the currency markets, the euro lost 0.2% against the dollar, primarily driven by the strength of the dollar due to rising interest rate expectations. The dollar’s safe-haven status remained intact as credit agencies warned of a possible downgrade of the U.S. sovereign rating.

USD/JPY broke above a key Fibonacci resistance level, reaching a high of 139.96, benefiting from widening U.S.-Japan rate differentials. The Bank of Japan’s Governor commented on potential adjustments to the Yield Curve Control (YCC) program, focusing on shorter maturities, but it had limited impact on the rising USD/JPY trend.

Meanwhile, GBP/USD experienced a slight decline of 0.33% as weak UK CBI data and concerns over fading UK economic performance overshadowed rising UK rates. Gold prices fell by 0.75% to $1,942 as speculators lightened their gold hedges in anticipation of a potential debt ceiling deal and took advantage of higher yields.

Bitcoin remained relatively flat at $26.4k, finding support near the lower 30-day Bolli band around $25.7k, while a close below the 50% Fibonacci level at $25.3k could potentially lead to a further decline towards the 200-day moving average at $22.7k.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Hits Two-Month Low as US Debt Ceiling Uncertainty Fuels Dollar Strength

The EUR/USD pair reached a two-month low on Thursday, trading around 1.0720 as the US dollar continued to exhibit strength due to concerns over the unresolved US debt ceiling negotiations. The absence of a deal on extending the debt ceiling created a negative sentiment, and House Speaker Kevin McCarthy’s update during the day indicated that a deal had not yet been reached.

The US data released on Thursday, including an upward revision of Q1 GDP growth to 1.3% and better-than-expected Initial Jobless Claims, further boosted the USD ahead of the Wall Street opening. Meanwhile, the Euro faced additional pressure as Germany reported a downward revision of Q1 GDP to -0.3% quarter-on-quarter. On Friday, the US is scheduled to release relevant figures, such as April Durable Goods Orders and the Personal Consumption Expenditures Price Index. No significant macroeconomic data is expected from the EU.

According to technical analysis, the EUR/USD pair is continuing to move slowly lower and has reached our support level, which is also exerting pressure on the lower band of the Bollinger Bands. It is expected that the EUR/USD will attempt a slight upward movement today and reach the middle band of the Bollinger Bands. The Relative Strength Index (RSI) is currently at 33, back above the oversold area, indicating that the bearish sentiment for the EUR/USD may be easing for today.

Resistance: 1.0788, 1.0848

Support: 1.0715, 1.0655

XAU/USD (4 Hours)

Gold (XAU/USD) Breaks Key Retracement Level as US Dollar Gains Support from Upbeat Economic Data and Debt Ceiling Concerns Persist

Gold prices (XAU/USD) broke below the 50% retracement level of the March/May rally, reaching a low of $1,930.20 during European trading hours. Although it bounced from that level, it is struggling to recover above it. The US Dollar found support due to a negative market sentiment and positive macroeconomic figures in the United States. The country revised its Q1 economic growth upward to 1.3% according to the GDP report, indicating a potential avoidance of recession but also raising the possibility of rate hikes to control inflation.

The strength of the US currency led to stock markets remaining subdued, as concerns about the US debt-ceiling limit persisted. Negotiations between President Joe Biden and top Republicans continue, with the opposition demanding spending cuts for an extension of the debt ceiling. Progress has been made, but a deal is unlikely to be reached today, according to House Speaker Kevin McCarthy.

According to technical analysis, the XAU/USD is moving lower on Thursday and exerting pressure on the lower band of the Bollinger Bands. There is a possibility that the XAU/USD will attempt to move higher and reach the middle band of the Bollinger Bands today. Currently, the Relative Strength Index (RSI) stands at 34, indicating that the XAU/USD is in a neutral but still bearish stance.

Resistance: $1,962, $1,991

Support: $1,934, $1,913

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Core PCE Price Index m/m | 20:30 | 0.3% |