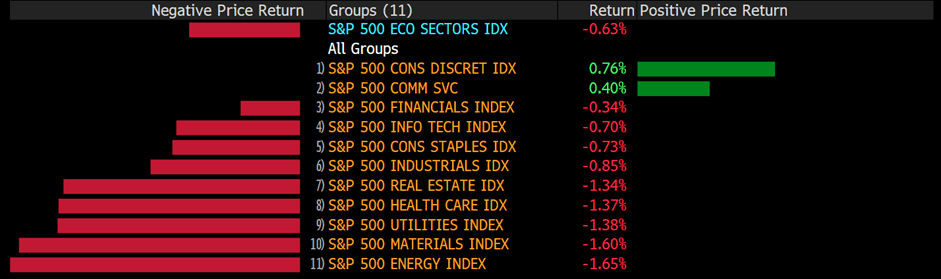

US shares edged lower to start the week following a major rebound from last Friday. The Dow Jones Industrial Average dropped 0.2%, to 31,438.26. The Nasdaq Composite declined 0.7% while the S&P 500 fell 0.3% at the end of the day. US stocks struggled to turn upside down on Monday as investors weighed whether the bottom has been reached and stocks have been oversold in this bear market.

Russia has entered its first major foreign debt default as the payment period expires. Interest payments of $100 million that Russia needed to pay were due on May 27 with the grace period on June 26. However, several bondholders have indicated that they have not received the payments after Russia attempted to pay in Ruble, which is blocked by international sanctions. The next test would be further 2 billion payments are due before the end of the year. If Russia continues to default, it would effectively ostracize the country from the global financial system; however, so far Russia has managed to find ways to get payments to bondholders.

Main Pairs Movement

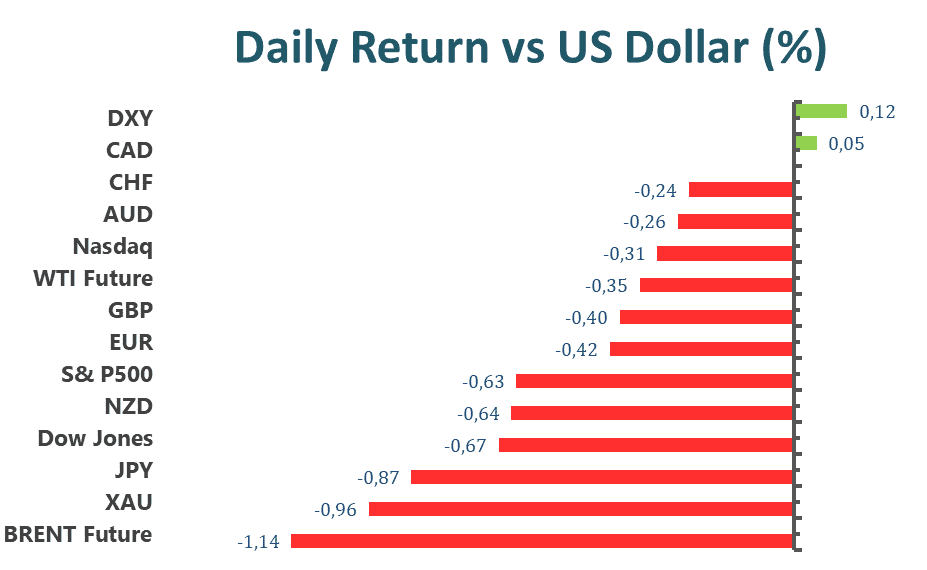

AUD/USD edged 0.31% lower on Monday. The Aussie traded in the tight range in the absence of domestic data this week other than Retail Sales. At the end of the day, AUD/USD finished at 0.69213.

Gold turned downside after attempting to sustain above the resistance level above $1,840. Mixed US economic data undermined the market sentiment, bringing gold down to $1,822.75; the US Durable Goods Orders were up 0.7%, better- than- expected; in the meantime, Pending Home Sales dropped 13.6 YoY.

EUR/USD advanced 0.24% to 1.05820. The ECB will host the Forum on central banking in Portugal, this week; ECB President Christine Lagarde will offer a speech during the commencement.

GBP/USD consolidated, dropping 0.06% on Monday as there were no major economic events. The UK parliament members will vote on legislation that would possibly allow members to amend or rewrite Brexit deals.

WTI oil price was up 2.39% on Monday, advancing two- consecutive days. Oil prices turned upside as OPEC+ decided to cut the 2022 market surplus from 1.4 million to 1 million BPD. Moreover, due to the political turmoil in Libya, the crude oil output will shrink by approximately 600 K BPD in the oil market.

Technical Analysis

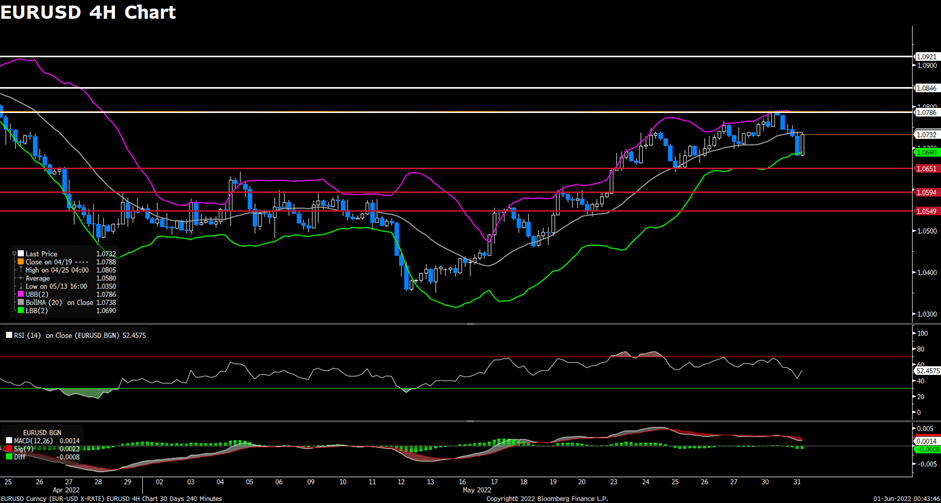

EURUSD (4-Hour Chart)

EURUSD edged higher on the first trading day of the week. The U.S. Greenback witnessed broad-based weakness as mixed data from the U.S. came in and market participants remain worried over a slowing U.S. economy. U.S. pending home sales decreased by a staggering 13.6%, year over year, for May. On the economic docket, U.S. GDP is set to release on the 29th, while EU CPI is scheduled to be released on July 1st.

On the technical side, EURUSD has traded above our previously estimated resistance level of 1.05754, but upward momentum seems to be fading. The next level of resistance sits at around the 1.06315 price region. RSI for the pair sits at 50.33, as of writing. On the four-hour chart, EURUSD currently trades near its 50-day SMA and below its 100 and 200-day SMA.

Resistance: 1.05754, 1.06315

Support: 1.0493

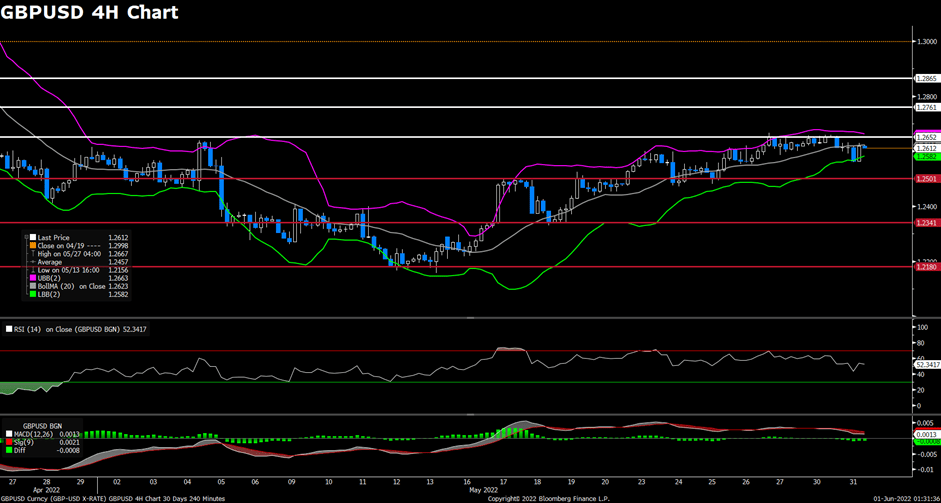

GBPUSD (4-Hour Chart)

GBPUSD traded mostly sideways over the first trading day of the week. Brexit continues to weigh on the British economy as members of parliament will vote on legislation that would allow ministers to rewrite parts of the post-Brexit deal and remove checks on goods entering Northern Ireland from the rest of the U.K. Market sentiment continues to put the British Pound and the U.S. Greenback in contention as the haven currency of choice as global economies show signs of recession.

On the technical side, GBPUSD continues to trade below our previously estimated resistance level of 1.2381. The support level at 1.2173 remains firm. RSI for Cable sits at 44.31, as of writing. On the four-hour chart, GBPUSD currently trades below its 50, 100, and 200-day SMA.

Resistance: 1.2381

Support: 1.2173, 1.20824

USDJPY (4-Hour Chart)

USDJPY built on last Friday’s upward momentum and continued to trade higher throughout Monday’s trading. Despite a broad-based weakness of the U.S. Greenback, the Japanese Yen continues to experience strong selling. The export-reliant country, Japan, continues on its course of a supportive monetary environment to keep exchange rates low. The benchmark U.S. 10-year Treasury yield has resumed trading above 3.2%.

On the technical side, USDJPY has rebounded strongly from our previously estimated support level of 134.6. Resistance at 136.57 remains close by and could be challenged. RSI for the pair has climbed to 62.63, as of writing. On the four-hour chart, USDJPY currently trades above its 50, 100, and 200-day SMA.

Resistance: 136.57

Support: 134.6

Economic Data

Currency Data Time (GMT + 8) Forecast EUR ECB President Lagarde Speaks 02:30 – EUR ECB President Lagarde Speaks 16:00 – USD CB Consumer Confidence (Jun) 22:00 100.4