Key Points

- The Fed’s rate decision and Powell’s guidance will set the tone for global markets this week.

- Traders should monitor BOJ commentary closely as yen carry-trade risks continue to rise.

- Key data releases include JOLTS, the Federal Funds Rate, and UK GDP.

The charts may look calm, but the underlying risk is building. Any shift in tone from BOJ policymakers could trigger a rapid unwinding of the yen carry trade, one of the major engines behind global market strength this year.

With the Fed now in blackout mode, markets are left with one dominant assumption: easing is imminent. Although a 3.75% policy rate is widely priced in, the Summary of Economic Projections and Powell’s tone will determine how far markets extend the easing narrative into 2026.

The dot plot will be especially important. Traders want confirmation that the Fed’s outlook aligns with the aggressive path markets have already priced. Any hesitation may lead to broad repricing across currencies and risk assets.

QT Ends and Liquidity Turns

The end of QT marks a shift back toward supportive liquidity conditions.

The Fed’s recent $13.5 billion repo injection, its second largest since the pandemic, signals renewed strain in the financial system. Historically, when QT ends under pressure, QE soon follows. While consensus expects QE to return in 2026, much depends on Fed leadership, as Powell’s term ends in May 2026.

Prediction markets currently place Kevin Hassett as the frontrunner for the next Fed chair with a 74% probability. If the nomination is announced early, markets may begin reacting to the expected policy stance of the incoming chair rather than Powell’s current tone, potentially accelerating expectations of earlier, deeper cuts.

Central Bank Highlights: BOJ, RBA & BOC

While US policy shifts toward easing, overseas central banks introduce additional layers of uncertainty, especially the BOJ.

Should the BOJ raise rates from 0.5% to 0.75% on 19 December, the narrowing yield spread between Japan and the US would make yen-funded carry trades more expensive to maintain. This could force investors to unwind positions by selling US assets, creating conditions for a rapid, disorderly correction, similar to past carry-trade squeezes.

A BOJ-driven shock could prompt the Fed to ease more aggressively or even accelerate its path toward QE to stabilize liquidity. Short-term volatility would contrast with a longer-term bullish backdrop for risk assets.

In addition, traders should keep an eye on the RBA’s policy tone and the BOC’s rate decisions, both of which may shape global sentiment depending on whether they reinforce or contradict the broader easing narrative.

Key Symbols to Watch

USDX | USDJPY | EURUSD | XAUUSD | SP500 | BTCUSD

Upcoming Events

| Tue 09 Dec | JPY | BOJ Gov Ueda Speaks | – | – | Hawkish tone may pressure USDJPY lower. |

| Tue 09 Dec | USD | JOLTS Job Openings | 7.14M | – | Weak data could strengthen Fed easing expectations. |

| Thu 11 Dec | USD | Federal Funds Rate | 3.75% | 4.00% | Market priced in the cut; Powell’s tone will drive movement. |

| Fri 12 Dec | GBP | GDP m/m | 0.10% | -0.10% | Potential recovery from prior contraction. |

| Tue 16 Dec | USD | NFP & Unemployment Rate | – | – | A soft print may accelerate expectations for deeper cuts. |

Key Movements of the Week

USDX

USDX holds near the 99.10 monitored area with bearish price action anticipated.

A move toward 99.40 may provide fresh selling opportunities, while continued downside targets 98.50.

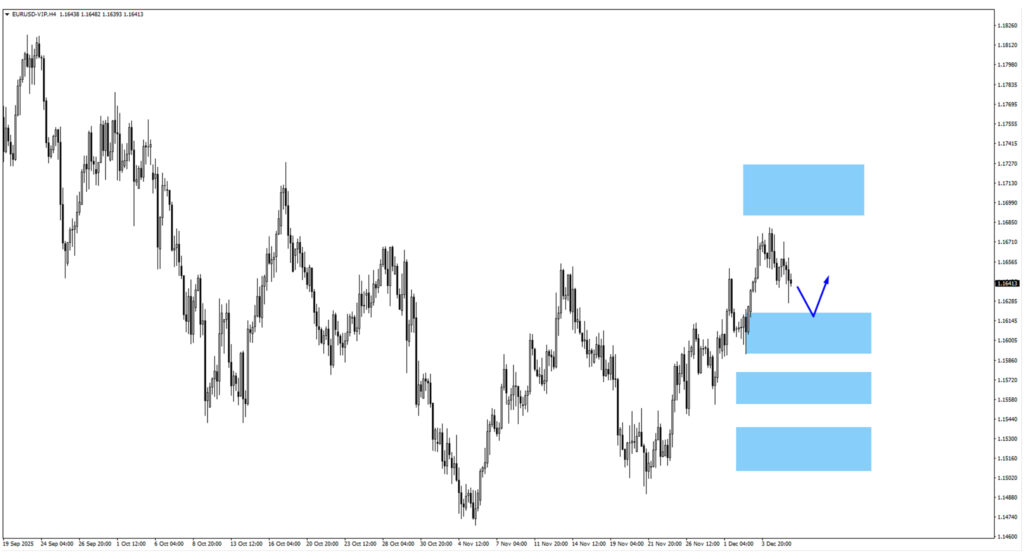

EURUSD

A decline into 1.1605 could invite bullish responses.

Resistance is expected near 1.1710.

GBPUSD

GBPUSD rejected the 1.3405 monitored region.

Further downside may test 1.3250, a potential bullish setup zone.

USDJPY

USDJPY trades above the descending trendline.

If the price climbs further, traders should watch 156.00 for bearish reactions.

Gold (XAUUSD)

Gold moved higher before reversing.

The key level remains 4175, with a deeper consolidation possibly forming a bullish structure near 4070.

SP500

The SP500 broke above the 6888 swing high.

Traders should observe behavior inside the ascending channel for directional cues.

Bitcoin (BTCUSD)

BTC pulled back after breaking the 93156 swing high.

Upside structure may return if the price reclaims 90277.

Bottom Line

This week stands at the intersection of shifting US policy and escalating global risks.

The anticipated Fed cut, combined with the end of QT, brings liquidity back into focus, while the BOJ’s next step could challenge positions built on years of cheap yen funding.

Market conditions may tighten or open rapidly as these forces collide.

Traders should monitor the Fed’s message, signals from global financial plumbing, and key price levels across major assets to navigate this decisive period.