Overview

The dominant theme this week is dollar resilience as expectations for a December Federal Reserve rate cut continue to fade.

Traders will be watching ISM manufacturing and services PMIs, along with the Bank of England’s rate decision, for new market cues.

A potential rotation from growth to value stocks and from euro/dollar pairs to commodity-linked currencies could emerge.

The Reserve Bank of Australia (RBA) is expected to hold rates steady at 3.6%, while its policy tone will be closely analyzed for signs of regional divergence.

Key data to watch:

- ISM (3 Nov)

- RBA Cash Rate & JOLTS Job Openings (4 Nov)

- BoE Rate Decision (6 Nov)

- US Non-Farm Payrolls (8 Nov)

Markets are likely to face a week of hesitation rather than conviction.

The Fog Before the Cut

The Fed’s late-October communication shifted sentiment sharply , a December rate cut is no longer a given.

Chair Powell reiterated that policy remains data-dependent, yet the ongoing federal government shutdown has disrupted key data releases. With limited visibility, the Fed is “driving in fog,” prompting traders to reassess how soon policy easing might resume.

The result: a conflicted dollar, cautious equities, and investors leaning toward safety until clarity returns.

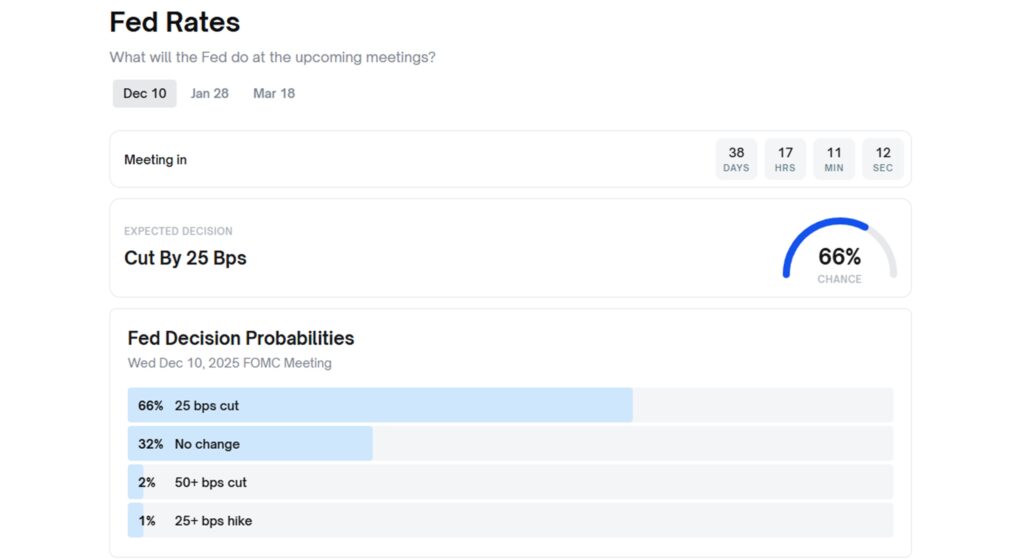

Before the October FOMC meeting, futures markets overwhelmingly expected a cut in December. Now, sentiment has cooled.

- CME FedWatch: Cut odds fell from ~90% to 63%

- Polymarket: 66% probability of a cut, 32% chance of no change

The message is clear: “Markets still expect easing but with less conviction.”

With policymakers divided and data missing, volatility pricing signals markets are preparing for a slower, more uncertain path into December.

A Case for Patience

If inflation keeps trending lower, the Fed will have room to cut but not urgency.

- September CPI: +3.0% y/y (slightly higher due to energy)

- Core CPI: +0.3% m/m, indicating a gradual cooldown

- Shelter costs: Lowest in over a year at +0.16% m/m

- Over 51% of CPI components are now deflating from peaks (vs long-term 32%)

This broad disinflation suggests the inflation battle is largely won.

While the Fed projects core PCE near 3% by year-end, overall price pressures are easing significantly.

The takeaway: Inflation is cooling rapidly, but the Fed is cautious not to move too soon and reignite it.

From Euphoria to Hesitation

Markets reacted swiftly after Powell’s remarks:

- Equities retreated from highs as fewer cuts were priced in

- US Dollar Index (USDX) rebounded toward 99.00–100.00

- Gold stalled near $4,070, caught between softer inflation and stronger yields.

- Yields edged lower but not enough to lift stocks.

Prediction platforms like Polymarket show investors still lean dovish—but heavily hedged.

Over $9 million in wagers on the December Fed outcome underscores how pivotal the next move has become.

Cautious Easing Ahead

Going forward, the outlook depends less on single data points and more on how long uncertainty lasts.

If the shutdown continues into mid-November, the Fed may face incomplete data by the December meeting, making a 25 bps cut the base case, but with low conviction.

In short, markets are split:

- Macro data support a cut.

- Policy caution delays it.

- Risk assets drift sideways in the meantime.

Key Symbols to Watch

BTCUSD | XAUUSD | USDX | GBPUSD | SP500

Upcoming Events

| 3 Nov | USD | ISM Manufacturing PMI | 49.4 | 49.1 | Above 50 would indicate sector stabilization and support the USD. |

| 4 Nov | AUD | RBA Cash Rate | 3.60% | 3.60% | RBA expected to hold; tone may guide AUD volatility. |

| 4 Nov | USD | JOLTS Job Openings | 7.21M | 7.23M | Continued decline points to cooling labour demand. |

| 5 Nov | USD | ISM Services PMI | 50.8 | 50.0 | Above 51 would support USD recovery. |

| 6 Nov | GBP | BoE Rate Decision | 4.00% | 4.00% | No change expected; forward guidance will set GBP tone. |

| 8 Nov | USD | Core PCE (Tentative) | — | — | The Fed’s preferred inflation gauge; softer data could revive cut hopes. |

| 8 Nov | USD | Non-Farm Payrolls | — | — | Jobs data will drive short-term USD direction. |

| 8 Nov | USD | Unemployment Rate | — | — | A move above 4% could turn sentiment dovish. |

Key Movements of the Week

US Dollar Index (USDX)

Supported by reduced cut expectations, consolidating near 99.00.

Support: 98.50 | Resistance: 100.20

Break above 100 may extend to 100.75.

Gold (XAUUSD)

Stuck near $4,070 as traders balance inflation trends and yields.

Support: $3,930 | Resistance: $4,120

Likely range-bound until Fed clarity.

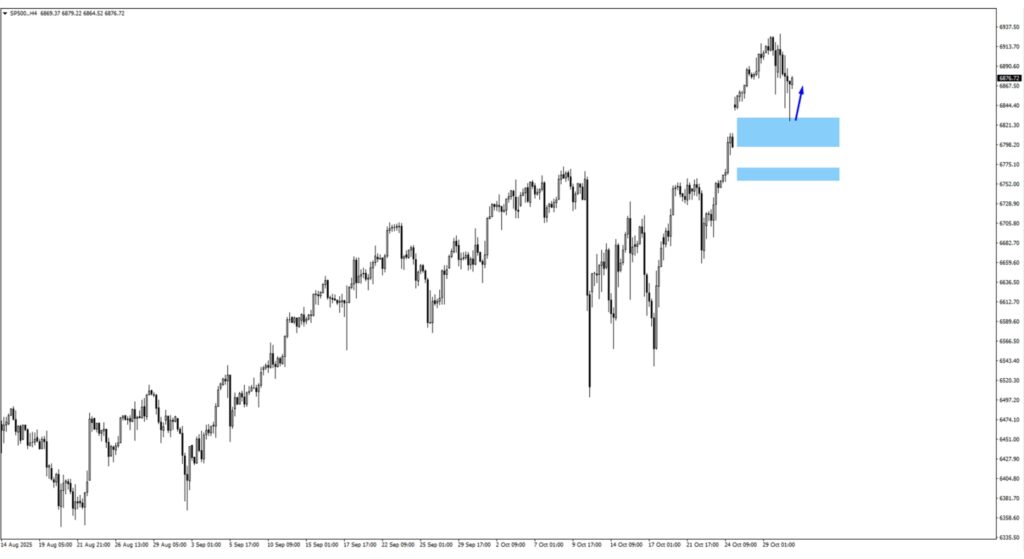

SP500

Pulled back after testing 6,950.

Support: 6,750 | Resistance: 7,000

Direction tied to rate-cut expectations and shutdown headlines.

BTCUSD

Holding above 106,000; could target 112,800–114,650 if sentiment stabilizes.

Support: 103,500

Expect higher volatility mid-month.

What is ahead

Markets have moved from confidence to caution after Powell’s remarks reinforced the Fed’s data-dependent stance.

Although inflation is easing, uncertainty over policy timing keeps investors defensive. The dollar remains firm, risk sentiment is subdued, and traders await clarity before the December meeting.