Overview

- Venezuela’s political shock is reshaping oil supply expectations and influencing Fed policy pricing.

- Oil prices may remain supported in the short term but continue to carry a structurally deflationary outlook over the longer run.

- Fed policy expectations may tilt more accommodative as markets look through near-term inflation noise.

- Equities stay underpinned by liquidity, fiscal support, and earnings growth, despite rising volatility risks.

Just as markets were settling into the new year, a geopolitical shock reverberated across global assets.

On January 3, the US launched a military operation that resulted in the capture of Venezuelan President Nicolas Maduro, who has since been moved to New York as Washington weighs its next steps and regional governments respond.

This single development has materially altered expectations for oil markets, the Fed’s policy trajectory, and the broader global outlook for 2026.

Oil: The Long-Term Deflationary Force

Venezuela holds the world’s largest proven oil reserves, yet production has declined from roughly 3.5 million barrels per day (bpd) in the 1990s to around 1 million bpd today, following years of sanctions and operational decline. Rebuilding capacity is a capital-intensive process that could take 12–24 months, limiting any immediate supply response.

As a result, traders anticipating an abrupt collapse in oil prices may be disappointed in the near term. In fact, prices could remain firm as markets factor in reconstruction costs and lingering uncertainty.

The longer-term picture, however, remains bearish for the energy sector. Venezuelan crude is heavy and sour, making it a near-ideal input for US Gulf Coast refineries, unlike domestically produced light shale oil. Once supply chains are restored, refineries can operate more efficiently with lower-cost feedstock, ultimately pressing gasoline and diesel prices lower. That longer-term outcome positions Venezuelan oil as a powerful deflationary influence.

The Fed, Interest Rates, and the “Lame Duck” Powell

This oil dynamic complicates the Fed’s policy outlook. A near-term rise in energy prices could lift inflation expectations, encouraging Chair Powell to remain cautious on aggressive easing as his term approaches its end in Q2.

Markets, however, are forward-looking. As expectations shift toward cheaper Venezuelan oil and stronger US capital investment, a Trump-appointed successor would likely have greater flexibility to ease policy more decisively.

If the “Lame Duck Powell” narrative gains traction, markets may begin to front-run rate cuts. Historically, non-recessionary rate cuts near market highs have been supportive for equities, with the S&P 500 posting gains 12 months later in every instance since 1980.

Tailwinds and Headwinds for the S&P 500 in 2026

Beyond Venezuela, several factors continue to support a constructive equity backdrop. The Fed ended quantitative tightening in December 2025, removing a major liquidity headwind.

Fiscal policy is also turning supportive, with significant infrastructure spending, deregulation efforts, and a combined $237 billion in corporate and household tax cuts. Earnings growth remains a core pillar, with S&P 500 profits projected to rise around 15% in 2026, driven by tangible AI adoption and productivity gains.

That said, risks persist. Unemployment has climbed to 4.6%, reflecting efficiency gains linked to AI rather than recessionary stress, but it may still pressure the Fed to accelerate easing. A June Supreme Court ruling on the legality of the 2025 tariffs could trigger refunds, higher yields, a weaker dollar, and upside pressure on gold.

Volatility is also likely to increase heading into the midterms. However, should elections result in gridlock, such as Democrats taking the House while Republicans retain the Senate, markets may respond positively, as legislative gridlock tends to limit disruptive policy shifts.

Key Symbols to Watch

USOUSD | NG-C | SP500 | XAUUSD | USDX

Upcoming Events

| 7 Jan | USD | JOLTS Job Openings | 7.65M | 7.67M | Hiring demand easing amid slower growth |

| 8 Jan | USD | Unemployment Claims | 216K | 199K | Seasonal effects lifting short-term claims |

| 9 Jan | USD | Non-Farm Employment Change | 57K | 64K | Labour demand cooling |

| 9 Jan | USD | Unemployment Rate | 4.50% | 4.60% | Participation effects may offset job losses |

Key Movements of the Week

USOUSD

After breaking down from the 58.50 monitored resistance zone, US Oil swept liquidity at 56.716 before rebounding higher. To assess whether upside momentum can sustain, watch price action on a retest of 57.75 or 58.18. Ongoing geopolitical developments around Venezuela’s leadership may remain a short-term volatility catalyst.

NG-C

Natural gas consolidated briefly before gapping lower on Monday, sliding into the 3.57 monitored demand zone. If price consolidates below the recent structure, watch for bearish reactions near 3.86. Continued downside momentum would shift focus toward the 3.22 support area.

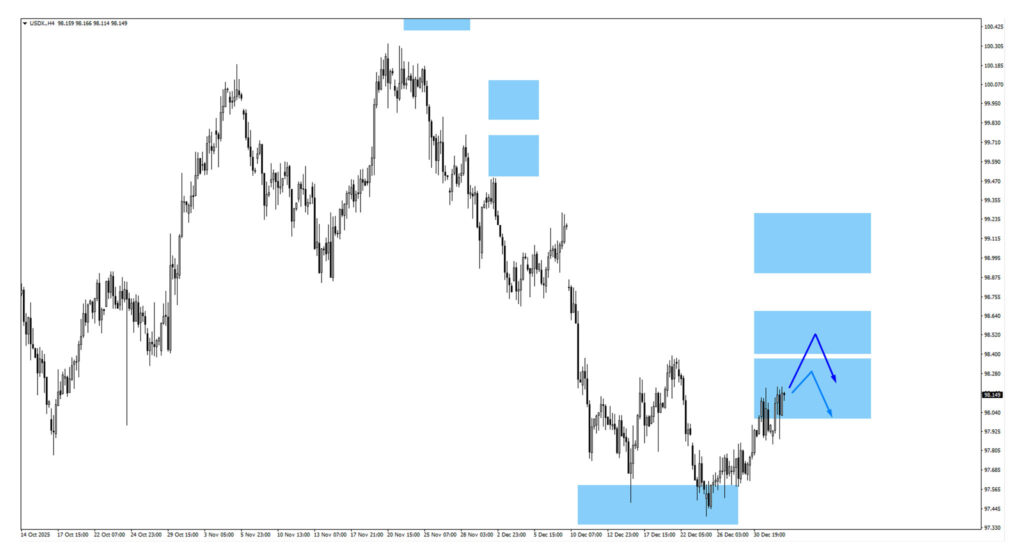

USDX

USDX is trading near the 98.20 area, approaching a key reaction zone. Failure to sustain above this level could invite bearish price action and a move back toward 98.55, now acting as a rejection zone. Geopolitical developments may add short-term volatility.

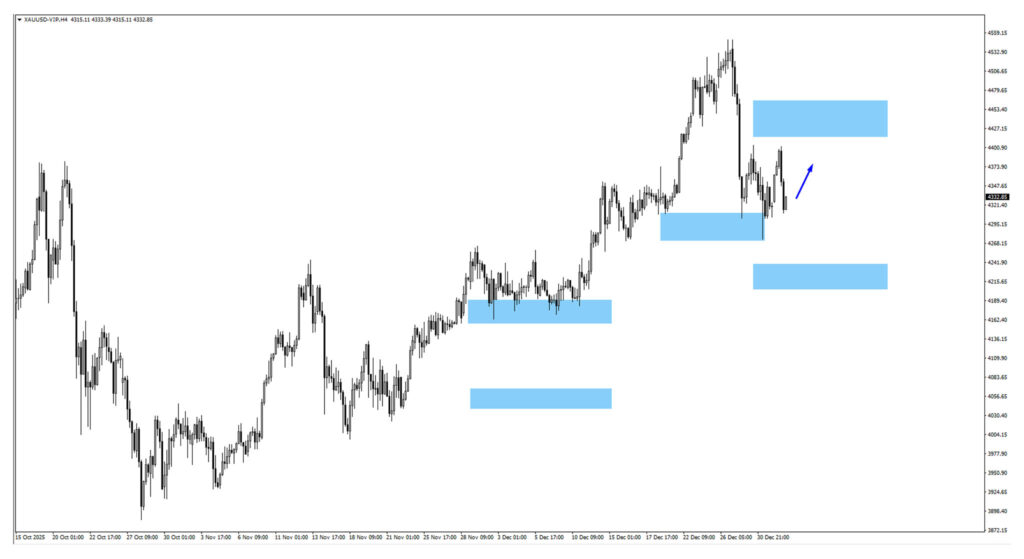

XAUUSD

Gold is consolidating after rallying from the 4,290 monitored demand zone, signaling a pause following strong upside momentum. If the price resumes higher, watch 4,445 as potential resistance. Pullbacks toward 4,215 may attract dip buyers amid heightened uncertainty.

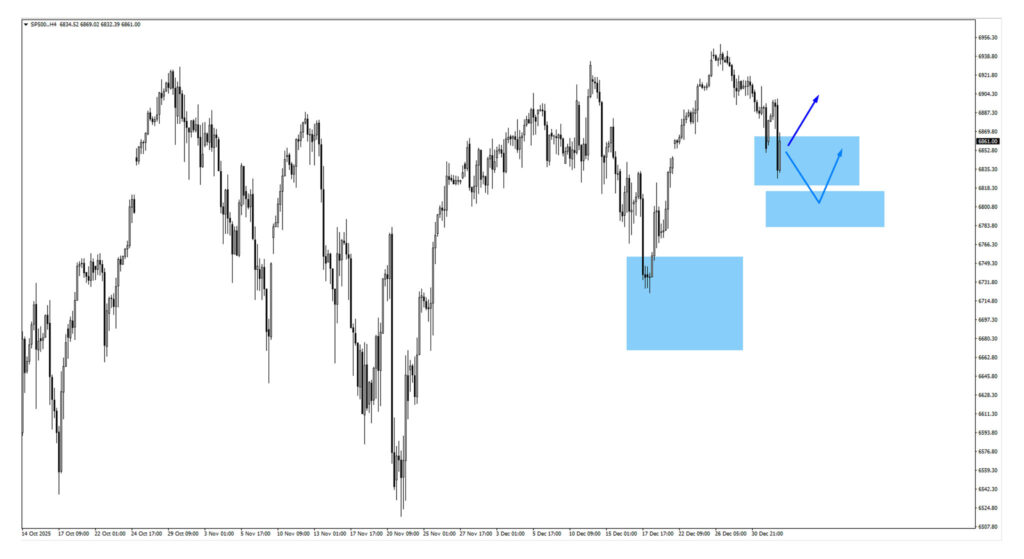

SP500

The S&P 500 is trading around the 6,840 monitored area, making this a key near-term inflection zone. If price pulls back, bullish reactions may emerge near 6,795.

Bottom Line

Energy prices may remain elevated in the short term as rebuilding costs and uncertainty persist, but the longer-term impact remains deflationary once Venezuelan heavy crude normalizes into US refinery systems.

For monetary policy, this creates a two-stage dynamic. Near-term inflation expectations may stay sticky, limiting aggressive action from current Fed leadership. Beyond that window, expectations of cheaper energy and stronger capital investment could open the door to deeper rate cuts later in 2026—an environment that has historically supported equities.

Expect higher volatility across oil, the dollar, gold, and indices, with price behavior around key technical levels offering clearer signals than headlines alone.