Daily Market Analysis

Market Focus

Technology shares led U.S. stocks lower as surging commodity prices stoked concern about whether inflation will derail a growth rebound in the world’s largest economy and spoil a record stock rally.

The tech-heavy Nasdaq 100 Index tumbled 2.6% amid the growing anxiety over inflation, which can threaten longer-horizon revenues typical of the sector. Tesla and Apple were among the biggest decliners. The ARK Innovation ETF resumed its slide. The Dow Jones Industrial Average briefly topped 35,000 for the first time. The benchmark S&P 500 fell from an all-time high. Treasury yields edged higher as traders brace for a busy week of auctions.

Copper jumped to a record while iron ore futures surged more than 10%, adding to concern about inflation. West Texas Intermediate fluctuated after a cyberattack forced the closure of a key U.S. pipeline, which operators hope to reopen by the end of the week.

The run-up in raw materials is intensifying debate ahead of a U.S. CPI report Wednesday that is forecast to show price pressures increased in April. The data will be closely watched by policy makers at the Federal Reserve trying to gauge the speed of the recovery after job growth significantly undershot forecasts.

Main Pairs Movement:

The dollar pared losses as equities weakened and some commodities fell. The British pound jumped to its highest since late February against the greenback after the Scottish National Party’s election showing pushed back risk of an imminent vote on independence.

Currency price action may be influenced by cross-border bond issuance including Canada announcing its first U.S. Dollar bond sale since pandemic and as China Railway Construction eyes debut euro bond.

GBP/USD rose as much as 1.2% to 1.4158, the highest since Feb. 25. Pound was also buoyed by corporate and option buying and interest from macro accounts to reestablish long sterling positions.

Commodity-linked currencies from Australia, Canada and New Zealand pared intraday gains. AUD/USD was little changed after earlier advancing by as much as 0.6 to the highest since late February; AUD saw interest in 2-month 0.8025 call options. NZD/USD rose as much as 0.1% to 0.7272. USD/CAD slid by 0.3% to 1.21, the lowest since September 2017.

Technical Analysis:

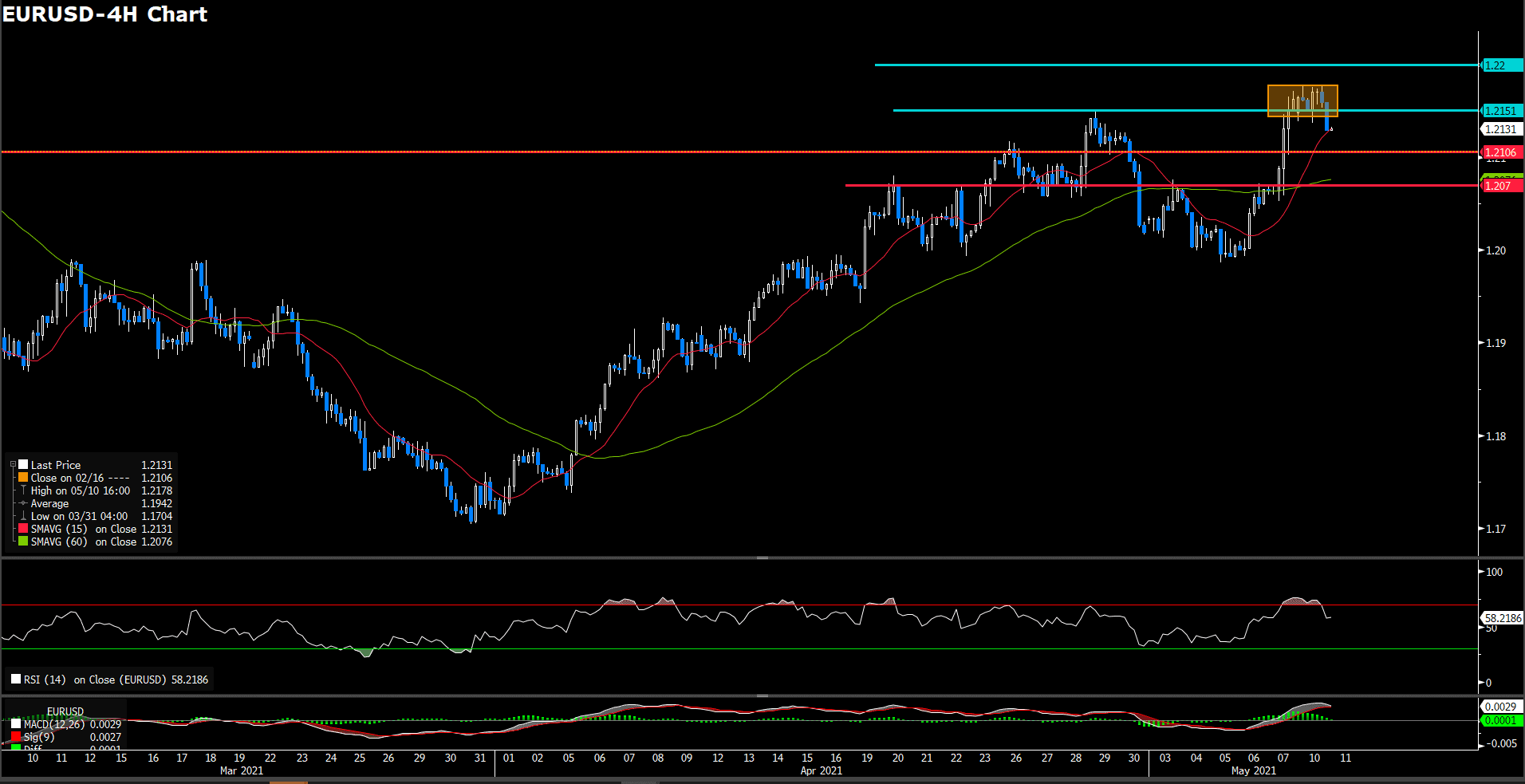

EURUSD (4 hour Chart)

Euro fiber once touched topped of the day at 1.2171 level before trims intraday gains, holding negative territory while close to the end of the day, trading below 1.215 level at 1.213 as of writing. At the same time, greenback remains the weakest currency across the boarded-FX market. For technical aspect, RSI indicator shows 58 figures, which alleviate recent over bought sentiment that push down to smooth threholds. On average price view, 15-long SMA accelerating it ascending slope and 60-long SMA turned it slope to teeny-tiny upside in day market.

We foresee market it pretty optimistic for gain traction market seems to buiding upward momentum despite euro dollar correction it bull movement. On down way, the first immediately support level is eye on 1.2105 level, 1.207 and 1.2 following. On up way, we see 1.215 level will be the first tackle resistance as market tamp down which formed by price cluster area.

Resistance: 1.215, 1.22

Support: 1.2105, 1.207, 1.2

GBPUSD (4 Hour Chart)

Sterling has raised overall among the top performance on Monday, following last week’s elections. After touching its highest level since Feb at 1.415 around in early Amerian session, the pair holding a slightly move phase, trading at 1.4122 with 1% rising. For RSI side, indicator has breached to 78 figures which show market is experiencing a torrid sentiment. On the other hands, 15 and 60-long SMAs indicator are accelerating it upward slope.

In the near-term, the sterling is likely to eye on this week’s U.K. data releases and BoE governor speaking after good news of main party pushing for independence in Scotland failed to win. At current stage, we believed pound could challenge for higher stack to toward last peak at 1.42 around as market is piling into long position. However, BoE Govornor will speaking at tommorrow for prospect the eco outlook that could drive wrong-foot flucutation. For bull favour, the first immediately support is tracking psychologically spot on 1.4 level.

Resistance: 1.4155, 1.42

Support: 1.3959, 1.4

USDCAD (Daily Chart)

Loonie had another downside tractions which step down 1.21 level as greenback remains poor movement and broadly stronger commodities prices in the day market, trading day to day low at 1.2092 as of writing. Meantime, WTI crude oil traveling at bear step with slightly move in the day but industry material are edged higher stage as expectation of price inflation seems on the trajectory. For RSI side, indicator shows 22 figures which suggest an over sought sentiment, moreover, it consecutive for days long. For moving average side, 15 and 60-long SMAs indicator are remaining it descending movement.

We see price momentum seemingly gird around 1.21 level after it touched down in day market. Therefore, we expect market will eye on downside correction movement as it fell down to current stage.

Resistance: 1.2264, 1.238, 1.2491

Support: 1.21

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

EUR |

German ZEW Economic Sentiment (May) |

17:00 |

72 |

||||

|

Oil |

EIA Short-Term Energy Outlook |

20:00 |

– |

||||

|

USD |

JOLTs Job Openings (Mar) |

22:00 |

7.5 M |

||||

|

GBP |

BoE GoV Bailey Speaks |

22:30 |

– |

||||

This site uses cookies to provide you with a great user experience.

By using vtmarkets.com, you accept our

cookie policy.