Key Points:

- Brent crude futures fell toward $83 per barrel due to Middle East developments.

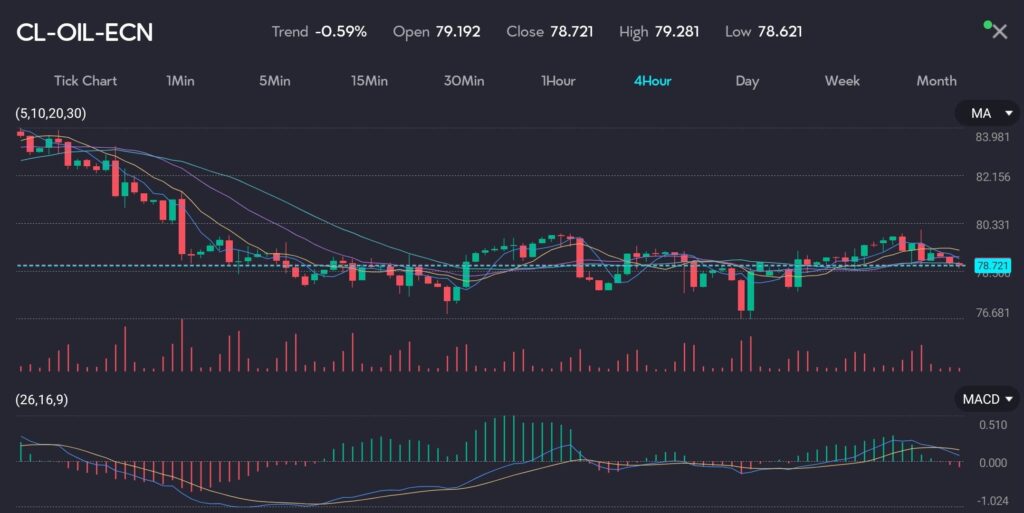

- WTI crude futures also declined to $78 per barrel.

- The OPEC meeting on June 1 is crucial for potential production cut rollovers.

On Tuesday, both Brent and WTI crude oil futures experienced declines. Brent crude oil futures (Symbol: UKOUSDft-V) fell toward $83 per barrel, while the WTI crude oil futures (Symbol: CL-OIL) dropped to $78 per barrel, marking continued losses.

SEE: Crude oil experiences downward trend on the VT Markets app.

Market participants are closely monitoring developments in the Middle East, where the death of the Iranian president in a helicopter crash and emerging health concerns of the king of Saudi Arabia have heightened geopolitical tensions.

Further, attacks by Ukraine on Russian refineries and a Houthi missile strike on a China-bound oil tanker in the Red Sea have introduced new risks on oil supply chain.

On the demand side, hawkish comments from Atlanta Fed President Raphael Bostic suggest that US interest rates might trend higher than expected.

Higher interest rates typically dampen economic activity, potentially reducing oil demand as businesses and consumers adjust to increased borrowing costs.

Read also: US stocks pulled back with hawkish comments from Fed

All in all, the upcoming OPEC meeting on June 1 is crucial. Analysts are speculating whether OPEC will maintain its production cuts. Any decision to extend these cuts could support prices, while a rollback might pressure them further.

What traders should pay attention to

Given these dynamics, market participants should remain cautious. Key factors to look out for include the uncertainty surrounding next moves from OPEC and the ongoing geopolitical tensions. Staying informed about how to trade oil CFDs, sticking to a trading strategy and keeping up on risk management will be crucial for navigating the oil markets.