The stock market opened the year with the Nasdaq Composite facing significant losses, marking a 1.18% decrease following the tech giants’ downturn, influenced by Apple’s nearly 4% drop. This decline, paired with the S&P 500 and Dow Jones slipping, reflected a broader tech sell-off. The uncertainty surrounding the Federal Reserve’s rate cut plans triggered this market sentiment, driving the US Dollar Index to a three-week high of around 102.70. While analysts suggest a long-term bullish outlook despite the correction, the Fed’s cautious approach and speculation of rate cuts in 2023 continued to unsettle investors, impacting currency and precious metal markets as the dollar surged further.

Stock Market Updates

The stock market kicked off the year on a rough note, with the Nasdaq Composite leading the downturn. It faced a second consecutive session of losses, closing at 14,592.21, marking a 1.18% decrease. This decline followed the index’s worst day since October, influenced by major tech stocks like Apple, which experienced a nearly 4% drop after a downgrade from Barclays. The S&P 500 slipped by 0.80%, while the Dow Jones Industrial Average slid 0.76%, closing at 4,704.81 and 37,430.19 points, respectively. This downward trend was mirrored by tech giants like Nvidia, Tesla, and Meta, further affected by the U.S. 10-year Treasury yield briefly surpassing the 4% mark, settling around 3.91%. The market sentiment appeared to shift due to uncertainties surrounding the Federal Reserve’s rate cut plans resulting in a sell-off of last year’s high-flying tech winners.

Despite the short-term pessimism, some analysts maintain a long-term bullish outlook, highlighting the current market correction as part of the natural cycle, especially after the remarkable highs of the previous year. However, the release of the Fed’s meeting minutes reinforced the uncertainty, indicating the central bank’s cautious approach to policy changes and the expectation of three-quarter-percentage point cuts sometime during the year. Last year’s market performance, with the S&P 500 surging over 24% and the Nasdaq climbing 43%, marked a substantial rebound from the challenges of 2022 but set the stage for a more cautious and uncertain beginning to the new year.

Data by Bloomberg

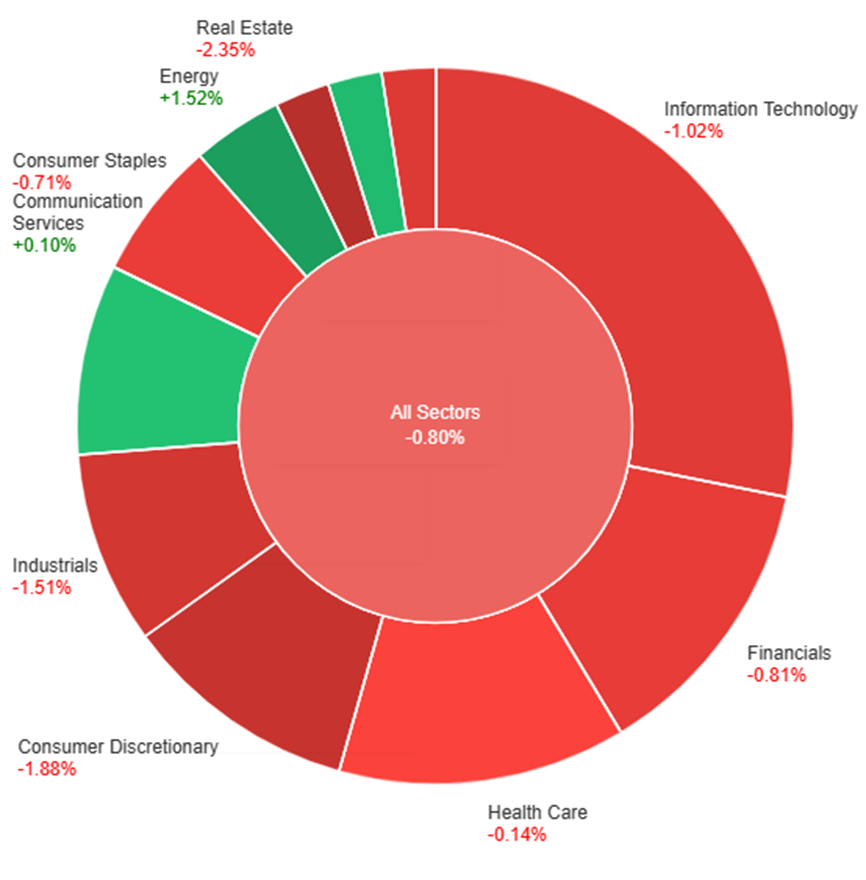

On Wednesday, across all sectors, the market experienced a general decline of 0.80%. Energy and utilities saw modest gains, with energy rising by 1.52% and utilities by 0.39%. Communication services and health care showed slight positive movements of 0.10% and -0.14%, respectively. However, the majority of sectors faced losses: consumer staples (-0.71%), financials (-0.81%), information technology (-1.02%), materials (-1.11%), industrials (-1.51%), consumer discretionary (-1.88%), and real estate (-2.35%). The day marked a mixed performance with select sectors in the positive but a notable downturn in most others.

Currency Market Updates

The currency market experienced notable movements amid a strengthening US Dollar Index (DXY), which surged to a three-week high of around 102.70. This uptrend was propelled by persistent risk aversion in the market and a concurrent increase in US yields across various maturities, reinforcing a bullish sentiment around the dollar. The EUR/USD pair dipped below the 1.0900 mark for the first time since mid-December, reflecting the greenback’s strength and broader weakness in risky assets. Meanwhile, GBP/USD bucked the trend, reclaiming ground above 1.2600 after enduring three consecutive sessions of losses. The USD/JPY pair climbed to approximately 143.70 due to the ongoing uptrend in US yields and a lack of direction in Japan’s JGB 10-year yields. Additionally, AUD/USD faced continued pressure, sliding for the fourth consecutive session amid overall bearish sentiment in high-beta currencies and the commodity complex.

Amidst these fluctuations, the Canadian dollar weakened for the fifth consecutive session, propelling USD/CAD to a two-week high near the 1.3370 zone. The surge in the greenback and US yields impacted precious metals negatively, driving gold prices to multi-day lows around $2030 per ounce and causing silver to breach the $23.00 mark per ounce, reaching a new two-week low. The absence of impactful revelations in the FOMC Minutes sustained the positive momentum for the US Dollar, despite the committee’s indication that rates might reach their peak cycle soon and projections hinting at a potential rate reduction by 2024, a move already anticipated by the market. Some members expressed the possibility of maintaining the policy rate at its current level for an extended period beyond initial expectations, contributing to the ongoing dollar strength.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Dips Below 1.0900 Amidst Resilient USD Strength: Weekly Insights

Throughout the week, the EUR/USD maintained a bearish trajectory, extending its decline below the 1.0900 mark due to a robust US dollar surge, driven by a resurgence in the USD Index to three-week highs around 102.70/75. Despite a positive German job report, the euro struggled against the dollar’s dominance, remaining susceptible to US economic dynamics. Factors contributing to the dollar’s strength included a recovering US yield curve, lower-than-expected JOLTs Job Openings, and surprising upward movement in the ISM Manufacturing PMI. The absence of new information from the FOMC Minutes, which hinted at a potential slowing of interest rate hikes, coupled with remarks from Richmond Fed’s T. Barkin supporting a soft landing for the US economy, further bolstered the greenback’s position midweek.

On Wednesday, the EUR/USD moved lower creating a lower push to the lower band of the Bollinger Bands. Currently, the price moving slightly above the lower band, suggesting a potential upward movement. Notably, the Relative Strength Index (RSI) maintains its position at 30, signaling a bearish outlook for this currency pair.

Resistance: 1.0980, 1.1068

Support: 1.0892, 1.0814

XAU/USD (4 Hours)

XAU/USD Slides Amid USD Strength: FOMC Minutes Awaited for Fed’s Rate Cut Signals

XAU/USD experienced a continued decline, hovering near $2,031.20 during the mid-US afternoon as the US Dollar maintained its upward momentum against major currencies. The boost in the USD stemmed from positive US news, including a better-than-expected ISM Manufacturing PMI and steady job openings reported by the BLS. These indicators hint at a stabilizing labor market, influencing the Federal Reserve’s stance. As the market anticipates the FOMC Minutes, expected to offer insights into rate cut discussions and potential timing, traders await cues on the Fed’s trajectory, currently pricing in a potential rate cut by May.

On Wednesday, XAU/USD moved lower and reached the lower band of the Bollinger Bands. Currently, the price moving just above the lower band, suggesting a potential upward movement. The Relative Strength Index (RSI) stands at 37, signaling a bearish outlook for this pair.

Resistance: $2,050, $2,070

Support: $2,030, $2,009

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | German Prelim CPI m/m | All Day | 0.2% |

| USD | ADP Non-Farm Employment Change | 21:15 | 120K |

| USD | Unemployment Claims | 21:30 | 217K |