Stocks experienced a decline on Tuesday, influenced by Home Depot’s underwhelming forecast. The financial market also focused on a crucial meeting between President Joe Biden and congressional leaders regarding the U.S. debt ceiling. The Dow Jones Industrial Average closed below its 50-day average for the first time since March 30, with a drop of 336.46 points or 1.01% to 33,012.14. Similarly, the S&P 500 decreased by 0.64% to 4,109.90, while the Nasdaq Composite fell 0.18% to 12,343.05.

The disappointing performance of Home Depot, a Dow member, contributed to the overall decline. The company reported lower-than-expected quarterly revenue and revised its full-year guidance due to consumers postponing major home improvement projects. Furthermore, April’s retail sales figures were weaker than economists predicted, with a 0.4% increase instead of the anticipated 0.8%.

The financial market has remained stuck within a range of 3800 to 4200 on the S&P 500 since November, indicating the uncertainty felt by investors regarding policy outcomes. Questions surrounding the economy’s response, consumer spending sustainability, and the duration of these conditions have contributed to this stagnant state, according to U.S. Bank Wealth Management’s Bill Merz.

Investors are anxiously awaiting progress on debt ceiling negotiations, with Treasury Secretary Janet Yellen warning of a potential default as early as June 1 if no agreement is reached. Yellen emphasized the severe consequences of a default, including a potential breakdown of financial markets and worldwide panic.

President Biden maintains optimism about the ongoing negotiations, while House Speaker Kevin McCarthy highlights significant obstacles that still need to be overcome. Biden has stood firm on his position that raising the debt ceiling is non-negotiable, while McCarthy has advocated for a deal linking the increase to spending cuts. In response to the pressing matters, Biden will curtail his upcoming international trip and prioritize the debt ceiling negotiations.

Data by Bloomberg

On Tuesday, the overall market experienced a decline of 0.64% in price change across all sectors. However, some sectors managed to show positive gains, with Communication Services leading the way with a 0.59% increase, followed by Information Technology with a modest gain of 0.16%.

On the other hand, several sectors faced notable losses, with Real Estate taking the biggest hit, declining by 2.61%. Energy and Utilities also struggled significantly, with both sectors experiencing declines of 2.54% and 2.30%, respectively. Industrials and Materials also faced notable losses, dropping by 1.36% and 1.64%, respectively. Other sectors that experienced negative price changes include Consumer Staples (-0.88%), Financials (-0.97%), Health Care (-0.82%), and Consumer Discretionary (-0.25%).

Major Pair Movement

The dollar index rebounded on Tuesday, recovering from initial losses as strong U.S. data and opposition to rate cuts by Federal Reserve speakers lifted Treasury yields. However, the dollar’s gains were limited as 2- and 10-year rates faced resistance from their 200-day moving averages, resulting in modest pullbacks.

While U.S. data showed solid performance, it was marred by downward revisions to previous months and April’s retail sales rise of 0.4% fell short of the forecasted 0.8%. However, the control group’s 0.7% increase, surpassing the 0.3% forecast, provided some offsetting positive news. Industrial production was revised down, almost offsetting the beat in April.

As a result, EUR/USD remained largely unchanged, while sterling experienced a 0.36% loss. USD/JPY surged after the U.S. data release, reaching a high of 136.69 on EBS. Despite this, the pullback in Treasury yields limited USD/JPY’s gain to only 0.15%.

Picks of the Day Analysis

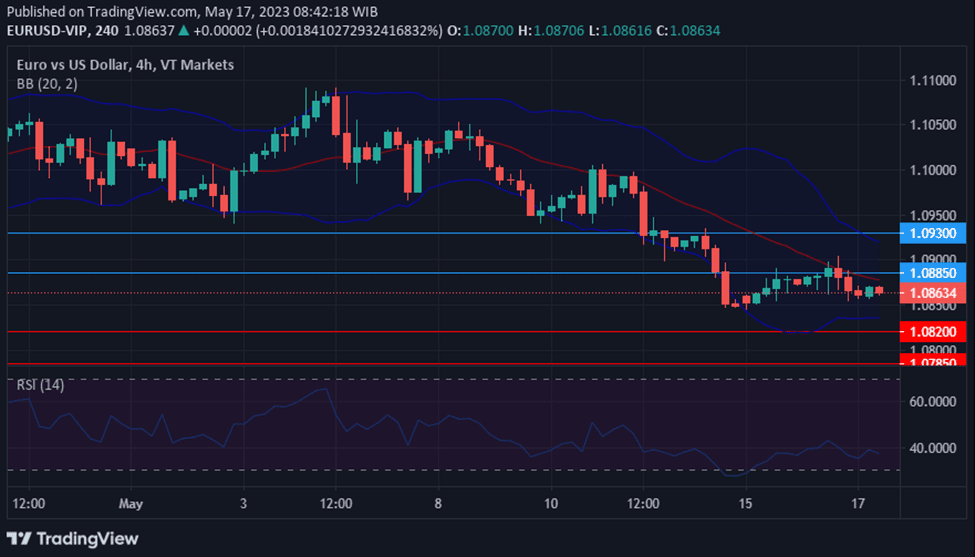

EUR/USD (4 Hours)

EUR/USD Retreats as Stronger US Dollar and Hawkish Sentiment Drive Market Dynamics

On Tuesday, the EUR/USD briefly surpassed 1.0900 but retreated to 1.0855 due to a stronger US Dollar. The Dollar gained strength due to risk aversion, higher US yields, and hawkish comments from Federal Reserve officials, despite mixed US data. In Europe, the German ZEW Economic Sentiment index declined, while Eurozone Preliminary GDP data showed modest growth.

The Euro was largely unaffected by these numbers. Market participants anticipate another rate hike in June, and upcoming releases include Eurostat’s final inflation for April and a speech by the European Central Bank’s De Guindos. In the US, Retail Sales and Industrial Production had mixed results. Fed officials’ remarks supported the Greenback, pushing US yields higher and impacting the EUR/USD exchange rate. At present, the US Dollar maintains its dominant position.

According to technical analysis, the EUR/USD pair is moving in consolidating mode and keep moving between the lower and middle band of the Bollinger band. It is anticipated that the EUR/USD will make a lower move and push the lower band and reach the support level. The Relative Strength Index (RSI) is currently at 38, indicating an overall bearish trend in the EUR/USD market.

Resistance: 1.0885, 1.0930

Support: 1.0820, 1.0785

XAU/USD (4 Hours)

Gold (XAU/USD) Drops Below $2,000 as US Dollar Strengthens on Retail Sales

On Tuesday, Spot Gold (XAU/USD)experienced a decline, falling below the $2,000 mark due to increased buying of the US Dollar by market participants following the release of several US economic data. While US Retail Sales in April showed a modest 0.4% monthly increase, it fell short of expectations.

However, there was some positive news as April Capacity Utilization met expectations and Industrial Production surpassed predictions with a 0.5% rise. Additionally, the NAHB Housing Market Index improved to 50 in May from its previous level of 45.

These data outcomes affected the market sentiment negatively, leading to US indexes trading in the red and European indexes ending the session with modest losses. Furthermore, government bond yields surged, with the 10-year Treasury note yielding 3.56% (up 5 basis points) and the 2-year note offering 4.10% (up 10 bps) on the day.

The ongoing debt-ceiling negotiations between President Joe Biden and lawmakers also contributed to the cautious sentiment as investors awaited updates to avoid a default.

According to technical analysis, XAU/USD fell on Tuesday after some flat movement in the last few days, creating a push lower movement for the lower band of the Bollinger Band. There’s a possibility that XAU/USD might move higher to reach the middle band of the Bollinger band. Currently, the Relative Strength Index (RSI) stands at 34, indicating that XAU/USD is in the bearish mode.

Resistance: $2,002, $2,017

Support: $1,986, $1,974

Economic Data

Currency Data Time (GMT + 8) Forecast AUD Wage Price Index q/q 09:30 0.9% GBP BOE Gov Bailey Speaks 17:50