On Monday, the stock market witnessed mixed fortunes as the Nasdaq Composite edged higher while the Dow Jones and S&P 500 experienced declines, influenced by fluctuations in Treasury yields. The 10-year Treasury yield breached the 5% mark, sparking worries of further monetary tightening and its potential impact on the economy. As Wall Street endured a challenging week, major tech giants like Alphabet, Amazon, Meta, and Microsoft’s upcoming earnings reports were eagerly anticipated for insights into the market’s trajectory. Meanwhile, the currency market saw the US dollar weaken, the euro showing strength, and the British pound gaining ground, as expectations of central bank policies and upcoming economic data played a pivotal role in shaping market sentiment.

Stock Market Updates

On Monday, the Nasdaq Composite saw a slight increase in value as Treasury yields eased from their recent highs. Investors were eagerly anticipating the release of corporate earnings reports from tech industry giants. The Dow Jones Industrial Average, however, experienced a decline of 190.87 points, amounting to a 0.58% drop, closing at 32,936.41. The S&P 500 also dipped, falling by 0.17% to reach 4,217.04. In contrast, the Nasdaq Composite, known for its tech-heavy components, managed to gain 0.27%, concluding the session at 13,018.33. The benchmark 10-year Treasury note yield briefly exceeded the significant 5% level before slightly receding, ultimately settling at around 4.85%.

Interest rates have surged in recent weeks, with the 10-year Treasury yield surpassing the 5% threshold for the first time since July 2007. Federal Reserve Chair Jerome Powell’s comments suggested further monetary policy tightening, increasing investor concerns and contributing to the rise in Treasury yields. Some analysts predict that the benchmark yield may continue to rise. The rapid increase in yields has raised concerns about its impact on the economy, with Canaccord Genuity chief market strategist Tony Dwyer noting that it could accelerate an already weakening economic situation masked by higher rates. After a challenging week, which saw the S&P 500 ending 2.4% lower, the Dow Jones losing 1.6%, and the Nasdaq experienced its second consecutive weekly decline of 3.2%, Wall Street now awaits a series of major tech companies’ earnings reports, including Alphabet, Amazon, Meta, and Microsoft, which are expected to provide crucial insights for the stock market.

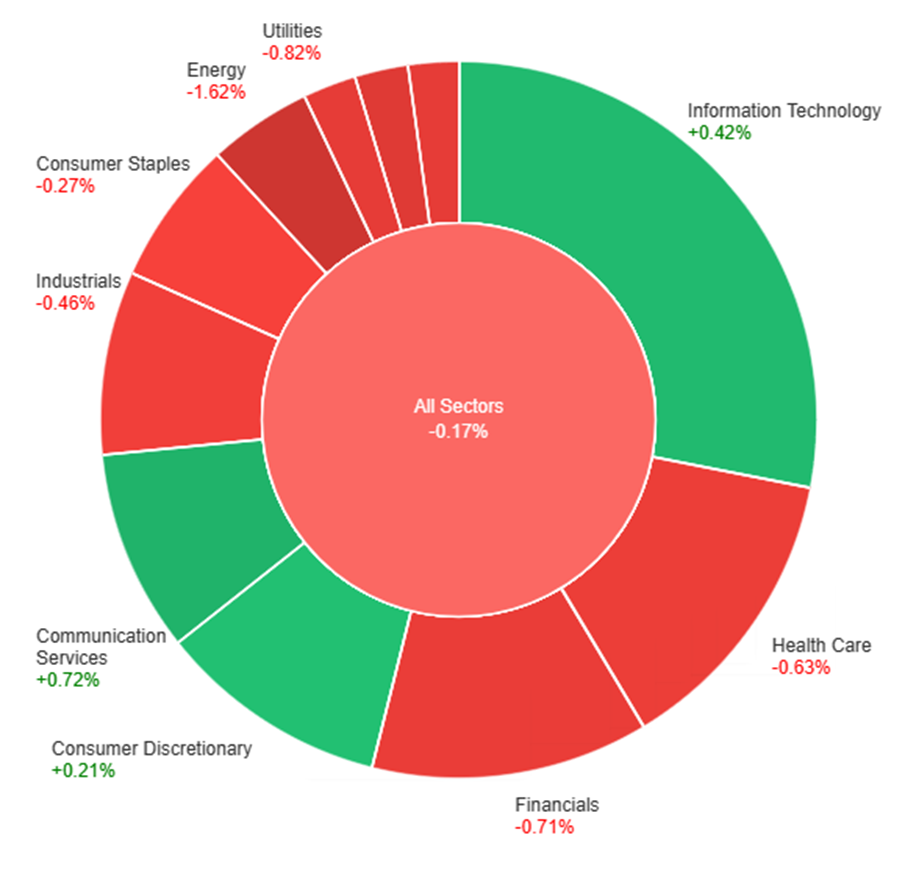

Data by Bloomberg

On Monday, the overall market experienced a slight decline, with a decrease of 0.17%. Among the individual sectors, there were variations in performance. Communication Services and Information Technology sectors saw gains of +0.72% and +0.42%, respectively. Consumer Discretionary also showed a modest increase of +0.21%. Conversely, Consumer Staples and Industrials experienced declines of -0.27% and -0.46%, respectively. Health Care and Financials sectors declined by -0.63% and -0.71%, respectively. Utilities and Real Estate sectors had larger declines of -0.82% and -0.84%, respectively. Materials and Energy sectors saw the most significant declines with -1.07% and -1.62%, respectively.

Currency Market Updates

In recent currency market updates, the US dollar experienced a decline of 0.5% as risk aversion sentiment eased, allowing stocks to recover and oil prices to drop, primarily because the worst-case geopolitical scenarios did not materialize. Concurrently, 10-year Treasury yields retreated from their recent peak above 5%. The dollar index fell below a crucial 30-day moving average support level, heading toward October’s lows. Meanwhile, the EUR/USD pair showed strength, rising by 0.7% and surpassing its previous October recovery high at 1.0640, along with other significant resistance levels nearby. A close above 1.0643 would signify a broader correction after a 12-week downtrend, with potential upside targets at 1.0700 and 1.0740.

Furthermore, market sentiment regarding the euro was influenced by the anticipation of upcoming economic data from the eurozone and the United States. Although these data forecasts were not particularly bullish for EUR/USD, the market seemed to signal that the worst of the divergence in yield spreads between the Federal Reserve (Fed) and the European Central Bank (ECB) is over. The ECB was expected to maintain a steady course, with no further rate hikes and the possibility of rate cuts by June, which aligns with the Fed’s timeline. The British pound also gained strength for similar reasons as EUR/USD, with expectations of fewer rate cuts by the Bank of England (BoE) in comparison to the Fed. However, it remained below its downtrend line from July’s highs and October’s rebound highs. Investors were closely watching delayed UK employment data to assess the likelihood of another BoE rate hike. Additionally, USD/JPY experienced a 0.14% decline after nearly reaching a peak close to the pivotal 150 level, primarily due to a drop in 10-year Treasury yields. The market was focused on a significant amount of USD/JPY 150 option expiries on Friday, with limited pricing for substantial moves, especially above 150, before the end of the month and the Bank of Japan (BoJ) meeting. The prospects for dip-buyers would depend on the performance of Treasury-JGB yields following key US data releases later in the week. Tuesday was expected to bring global flash PMI readings for October, with most forecasts indicating continued economic challenges.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Surges to One-Month High as Weaker US Dollar Drives Momentum

The EUR/USD pair rallied significantly on Monday, breaking a downtrend line and reaching 1.0676, its highest level in a month, primarily due to a sharp decline in the US Dollar and improved market sentiment. As the Eurozone and the US prepare to release key PMI data and important monetary policy meetings are on the horizon, the Euro’s outlook remains favorable, though some consolidation may follow the 100-pip rally.

Based on technical analysis, the EUR/USD moved higher on Monday, pushing towards the upper band of the Bollinger Bands. Currently, the EUR/USD is trading at the upper band, suggesting the potential for another push higher movement. The Relative Strength Index (RSI) stands at 75, indicating that the EUR/USD is entering a bullish bias.

Resistance: 1.0705, 1.0770

Support: 1.0630, 1.0561

XAU/USD (4 Hours)

XAU/USD Retreats from Multi-Month Highs Amid Optimistic Start to the Week”

Spot Gold (XAU/USD) experienced a pullback from recent multi-month highs, briefly dipping to the $1,960 price range before finding support at around $1,977 per troy ounce during the American trading session. This retreat was attributed to easing demand for safe-haven assets, influenced by optimism in the financial markets as the situation in the Middle East, particularly the conflict between Israel and Hamas, showed signs of not escalating. The movement in gold was also influenced by changes in government bond yields and speculation about monetary policies in various countries, including Japan and the United States. As the week progresses, investors are closely watching upcoming events, such as the European Central Bank’s monetary policy decision and the release of key economic indicators in the United States.

Based on technical analysis, XAU/USD is moving in consolidation on Monday and able to reach the middle band of the Bollinger Bands. Currently, the price of gold is moving just above the middle band, suggesting a possible continuation movement. The Relative Strength Index (RSI) currently registers at 63, indicating a bullish bias for the XAU/USD pair.

Resistance: $1,985, $2,002

Support: $1,973, $1,947

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Claimant Count Change | 14:00 | 2.3K |

| EUR | French Flash Manufacturing PMI | 15:15 | 44.4 |

| EUR | French Flash Services PMI | 15:15 | 44.9 |

| EUR | German Flash Manufacturing PMI | 15:30 | 40.1 |

| EUR | German Flash Services PMI | 15:30 | 50.1 |

| GBP | Flash Manufacturing PMI | 16:30 | 44.7 |

| GBP | Flash Services PMI | 16:30 | 49.4 |

| USD | Flash Manufacturing PMI | 21.45 | 49.5 |

| USD | Flash Services PMI | 21.45 | 49.9 |