Market Focus

US stock advanced on Tuesday amid risk-on market sentiment, rebounding from its biggest three-day slide since September as the market demand for risk assets increased. Despite US Democrat Senator Joe Manchin rejected Biden administration’s $1.75T Build Back Better (BBB) social spending package yesterday, President Joe Biden said that he still has a chance to strike a deal with Manchin to get his roughly $2 trillion economic plan through Congress. Therefore, the possibly reviving talks on Biden’s economic agenda lend some support to stock markets. On top of that, Biden is also considering dropping travel restrictions against South Africa, where the new Omicron variant was first identified. Another news from Bloomberg reported that the US food and Drug Administration was set to authorize their pills to treat coronavirus as soon as this week.

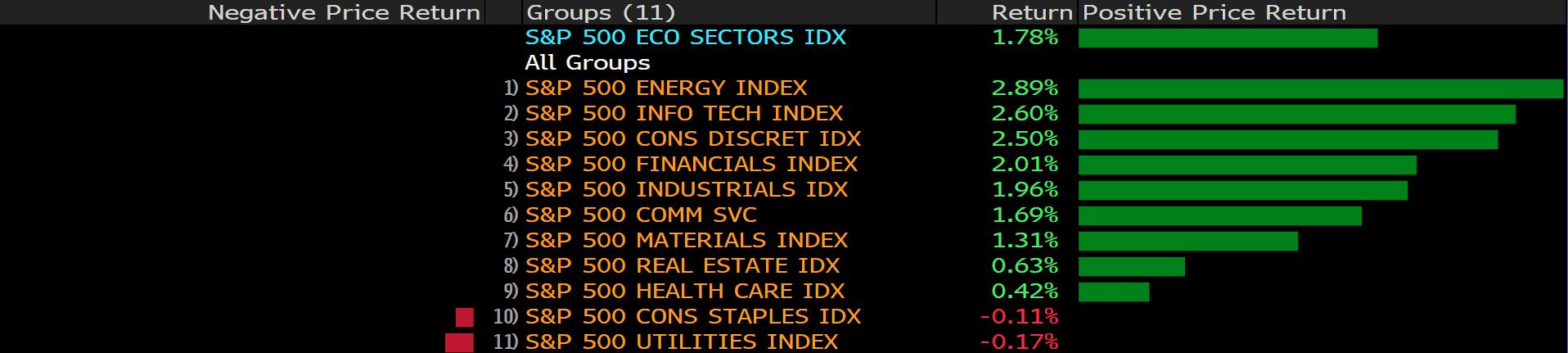

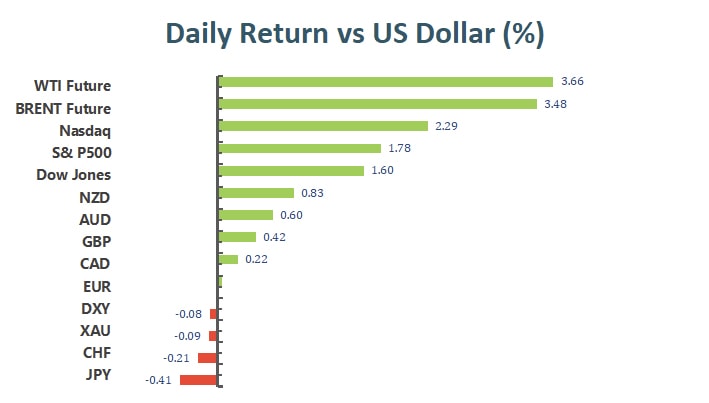

The benchmarks, S&P 500, Nasdaq 100 and the Dow Jones Industrial Average both rose on Tuesday as risk appetite flips positive in American session and the prospect of President Joe Biden’s economic plan are also improving. S&P 500 was up 1.8% on a daily basis and the Dow Jones Industrial Average also advanced with a 1.6% gain for the day. Nine out of eleven sectors stayed in positive territory as the energy and information technology sectors are the best performing among all groups, rising 2.89% and 2.60%, respectively. The Nasdaq 100 climbed the most with 2.3% gain on Tuesday due to the surge in chipmaker Micron Technology Inc., and the MSCI World index rose 1.7%.

Main Pairs Movement:

The US dollar edged lower on Tuesday, staying in negative territory amid upbeat market mood despite the US 10-year yields ending 3.7% higher. The DXY index dropped to a daily low under 96.35 level during European session, then rebounded back above 96.62 to offset most of its intraday’s losses. Investors now considered that vaccines helped tame the Omicron virus outbreak and the news that the US FDA is ready to authorize pills from Pfizer and Merck also favored US stock market and acted as a headwind for the safe-haven greenback.

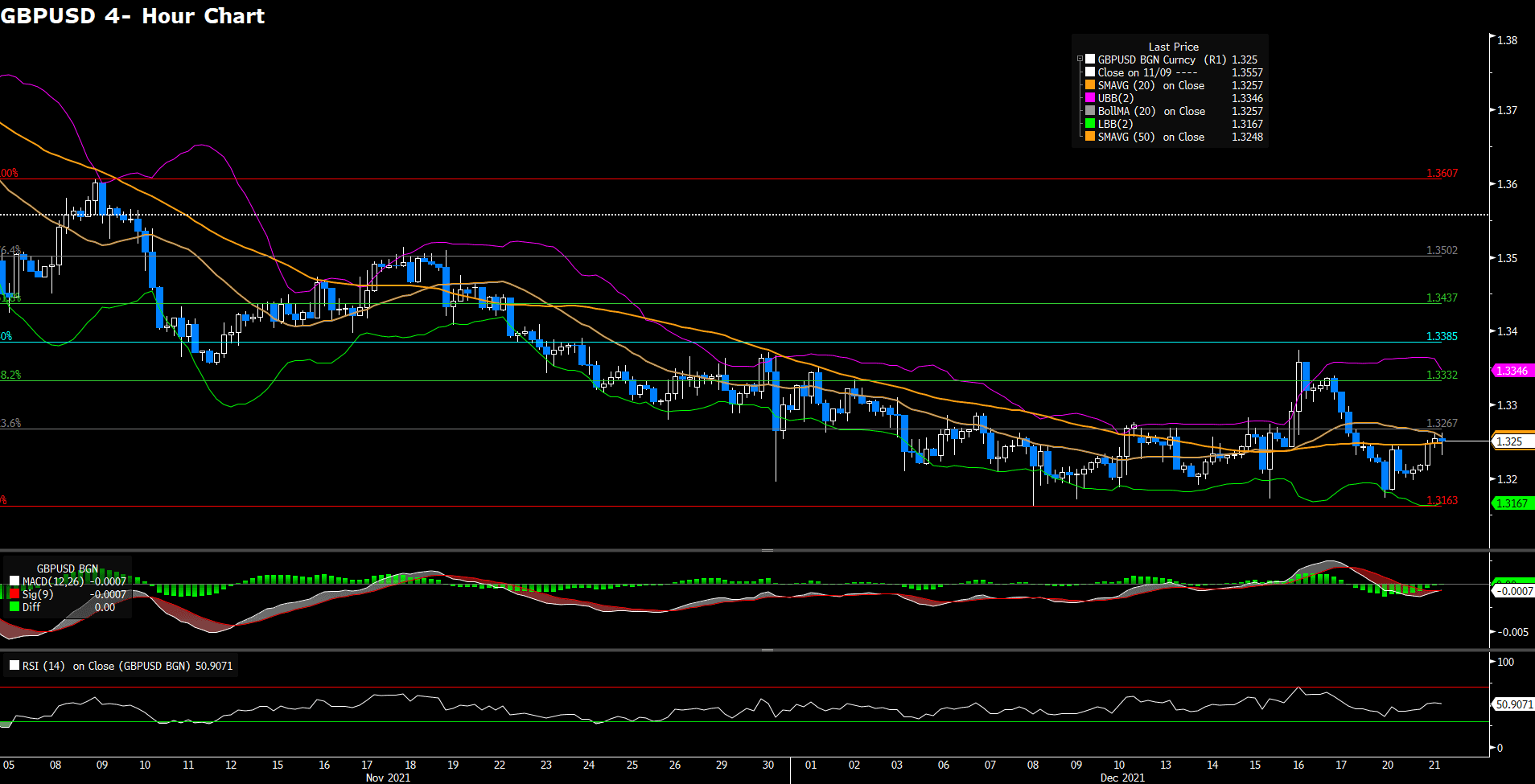

GBP/USD advanced 0.47% on Tuesday as a broader recovery in risk appetite across markets favored risk currency like British pounds. But traders will remain on notice for an new lockdown announcement that could come later in the week. The cable kept being pushed higher through out the session, touching daily highs around 1.326 area. Meanwhile, EUR/USD climbed to a daily top above 1.130 level but then retreated back to surrender some of its intraday’s gains. The pair gained 0.09% for the day, as volumes are thinning ahead of Christmas holidays.

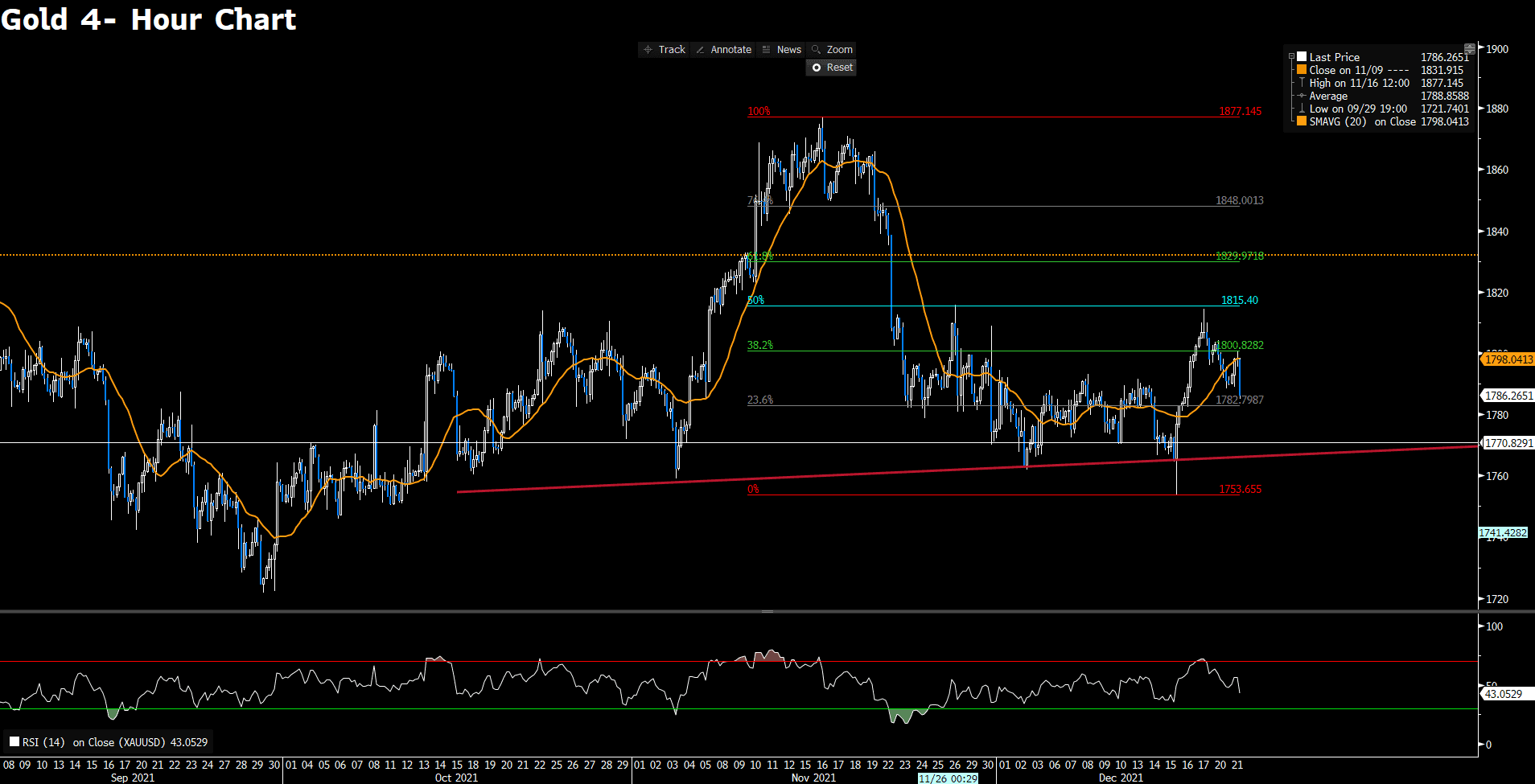

Gold declined and touched a daily low under $1785 in late American session, as the appetite for riskier assets dented demands in the precious metal. Meanwhile, WTI oil surged almost 3.0% for the day, as the risk-on market mood and positive news about Omicron variant both acted as a tailwind for the black gold.

Technical Analysis:

The precious metal, gold eases as the markets assess Omicron impact and the Fed’s plan on hiking rates. Fundamentally, gold is caught in a dilemma; although gold is considered a hedge against inflations, the Fed’s rate hikes at the same time increase the opportunity cost of holding non- yielding gold. As a result, it is expected to see a choppiness and consolidating trend for gold. From the technical perspective, gold becomes bearish in the near- term, trading at 1787, as it falls below the 20 SMA, suggesting that gold has turned weak against the US dollar. Gold is expected to consolidate within 1782 to 1800 range as the technical indicator RSI is neither in the overbought nor oversold territory, suggesting a directionless circumstance. On the upside, any subsequent move would face stiff and psychological resistance at 1800, followed by 1815. On the flip side, 1765- 1770 region seems to protect the immediate downside, followed by 1753.

Resistance: 1800, 1815, 1829

Support: 1782, 1770, 1765, 1753.

GBPUSD gains traction in the early US trading session on Brexit headline, currently trading at 1.3252. However, the markets’ focus remains on the likelihood of stricter Covid restriction amid the spread of Omicron. From the technical perspective, except the outbreak price action on last Friday, GBPUSD overall falls back, turning into a consolidation phase in the range from 1.3163 to 1.3267. From the near- term outlook, the currency pair remains bearish as it continues to trade below the 20 and 50 SMAs. In the meantime, the bears are supported by a negative MACD, lending aids to the bears, although the RSI is currently directionless. On the upside, GBPUSD needs to climb above its resistance 1.3267 in order to turn bullish in the near- term.

Resistance: 1.3321, 1.3419, 1.3499

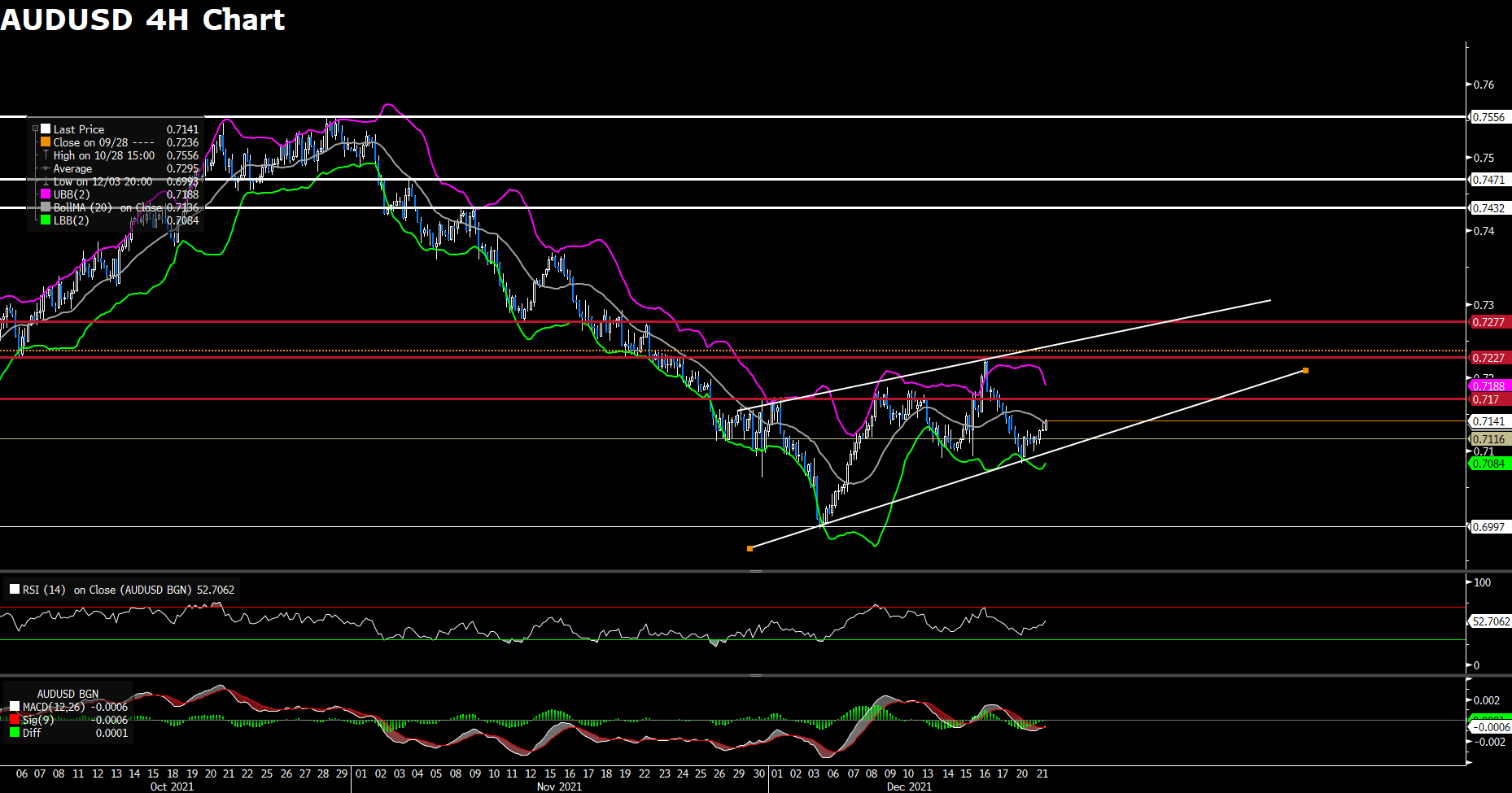

The RBA minutes seemed to deliver few surprise for the Aussie, and the markets preferably focus on the US data later this week. From the technical aspect, AUDUSD advances above the resistance at 0.7116, trading at 0.7142 as the time of writing. The four- hour outlook of the currency pair remains bullish as it continues to trade within the ascending channel. More importantly, both the MACD and RSI synchronously turn upside, meaning that buyers are taking the control. AUDUSD is expected to head toward 0.717, the immediate hurdle; if the pair successfully breaches the level, then it will re- confirm the bullish trend. On the flip side, AUDUSD needs to hold steadily above the ascending line in order to remain bullish.

Resistance: 0.717, 0.7227, 0.7277

Support: 0.6997

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

GBP |

GDP (YoY) (Q3) |

15:00 |

6.6% |

|

|

GBP |

GDP (QoQ) (Q3) |

15:00 |

1.3% |

|

|

USD |

GDP (QoQ) (Q3) |

21:30 |

2.1% |

|

|

USD |

CB Consumer Confidence (Dec) |

23:00 |

110.8 |

|

|

USD |

Existing Home Sales (Nov) |

23:00 |

6.52M |

|

|

USD |

Crude Oil Inventories |

23:00 |

-2.633M |

|