Daily market analysis

September 30, 2021

Daily Market Analysis

Market Focus

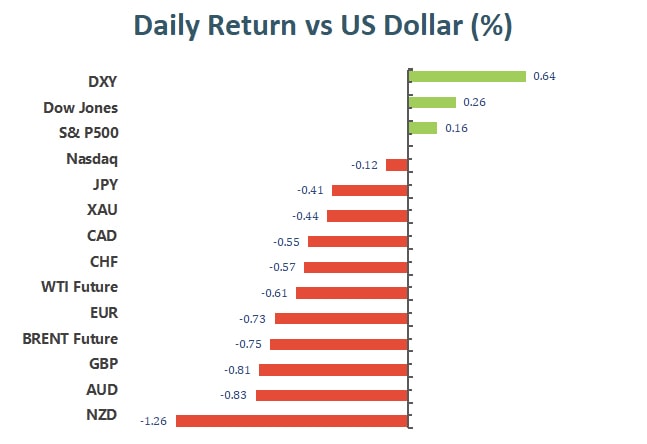

There were both ups and downs for US stock on Wednesday, as the decline in technology stocks weighed on equity markets and pared most of their gains into the close. Markets focus on the ongoing debt ceiling debate in Washington, where President Joe Biden tries to break a impasse among Democrats and hope to avoid a government default before Treasury potentially runs out of capacity. Nevertheless, the stock market did not mind amid the risks of negotiation failures on Capitol Hill over funding the government.

The benchmarks, the S&P 500 and the Dow Jones both advanced on Wednesday. The S&P 500 was up 0.2% on a daily basis, finishing in positive territory for the first time this week. Dip buyers helped push the index higher. The material sectors continued its bearish momentum, losing 0.39% on Wednesday. The utilities and consumer staples sectors are the best performing among all groups, climbed 1.30% and 0.87%, respectively. The Nasdaq, on the contrary, declined for the third straight day and posted a 0.2% loss for the day.

On top of that, the high inflation is also harming market sentiment, as investors worry that the high figure will persists. But Fed Chair Jerome Powell, who joined other central bankers at a European Central Bank event, seems optimistic about the issue and said that supply-chain disruptions lifting inflation would ultimately prove temporary. The concerns about slowing growth and elevated levels of inflation may continue for a while, furthermore, the US debt ceiling discussions will also be a critical issue for investors.

Main Pairs Movement:

Lead by technology firms, who suffered yesterday due to rising short term bond rates, the broad U.S. equity markets were able to recover slightly on Wednesday’s trading. The yield on a 10-year Treasury note dropped back to 1.51%, compared to 1.534% yesterday, snapping a six-day gain streak. Rising yields and rising commodity prices still pose enormous threat to the short-term outlook of equities and foreign exchange markets.

Technical Analysis:

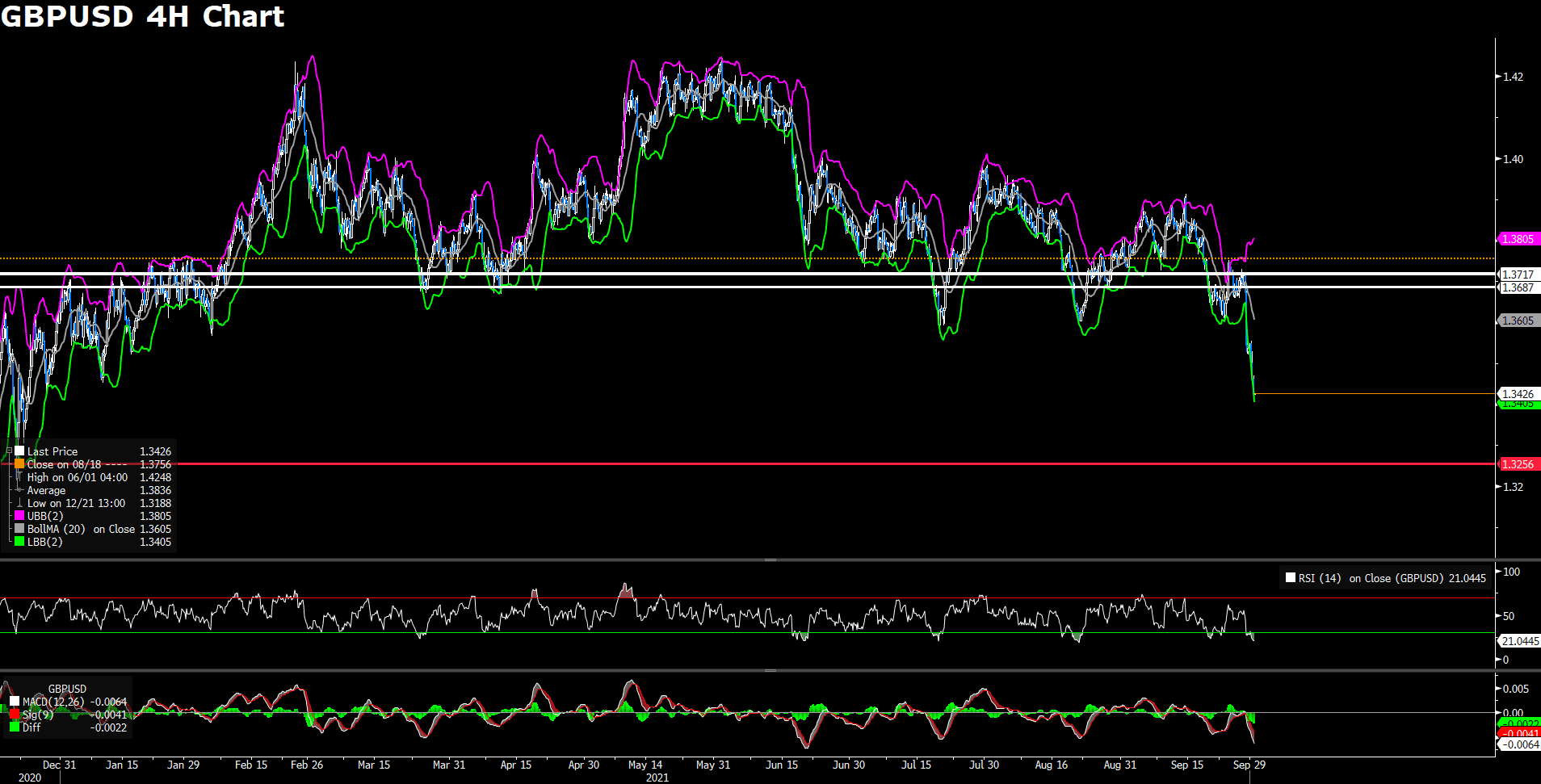

GBPUSD (4 Hour Chart)

The Sterling continued to depreciate against the Greenback for the second straight day; in fact, Cable has dropped to a fresh low for the year. As of writing, Cable is trading at 1.3422, below the year long support level of 1.3446. Fed chair Jerome Powell’s speech on late Wednesday of the North American trading session boosted the Dollar further, as the Dollar index gained more than 0.2% post Powell’s speech. Supply chain disruption in the U.K. further added to the selling pressure on Cable.

From a technical perspective, Cable has broken through our previously estimated support level of 1.35281; furthermore, the key support level of 1.3446 has also been broken as the Dollar continues to surge. RSI for the pair has dropped through to over sold territory and is indicating 21, as of writing. Cable is trading well below its 50, 100, and 200 day SMA.

Resistance: 1.3687, 1.3717

Support: 1.3256

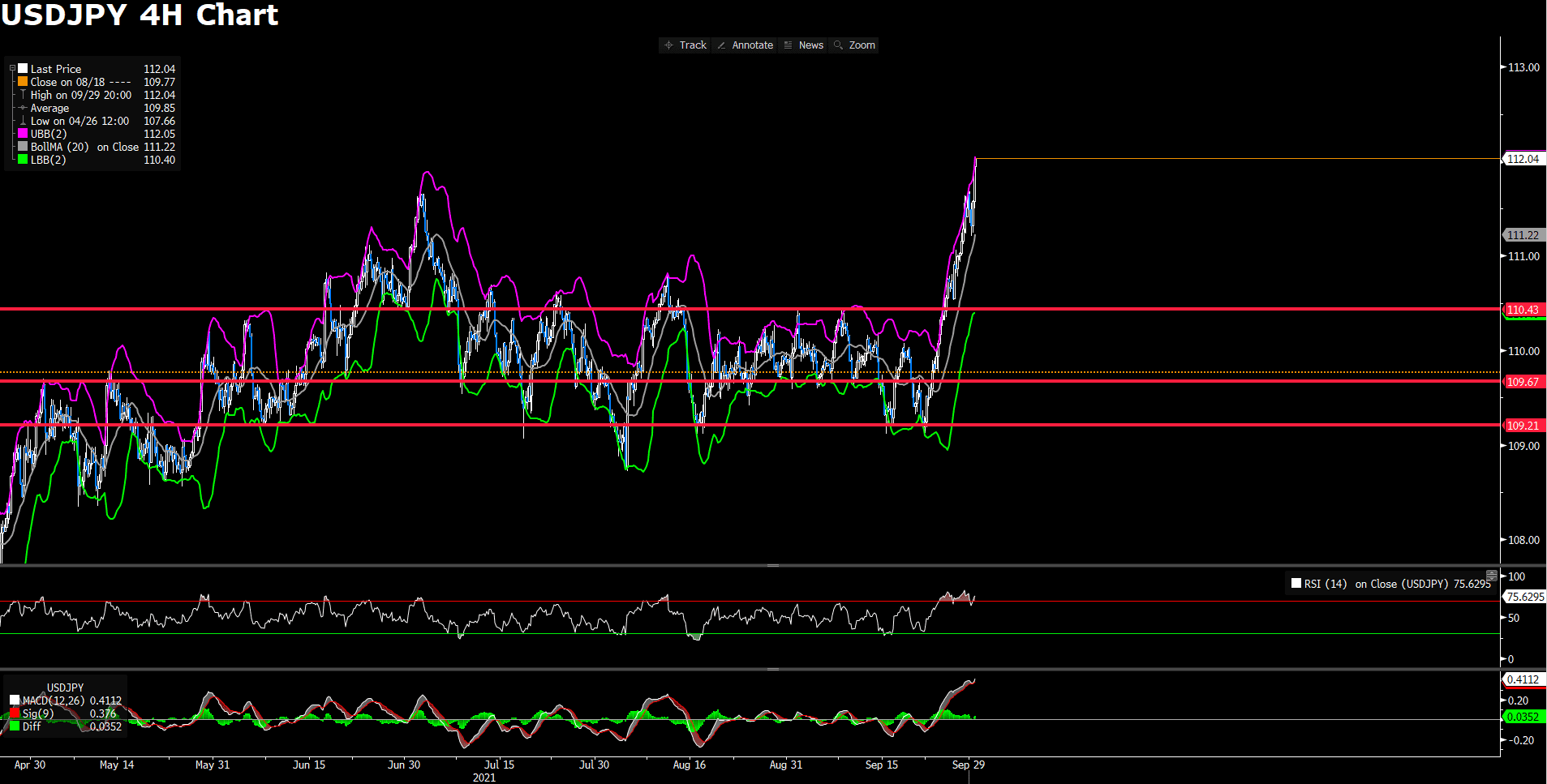

USDJPY (4 Hour Chart)

USD/JPY rose to new heights as the Dollar continues to rally after Fed chair Jerome Powell’s speech. Recent U.S. bond yield rally has widened the nominal yiel difference between the U.S. and Japanese government bonds, thus posing as head wind for the short term outlook for the Yen. The Bank of Japan’s yield curve control has worked against the Yen as global central banks eye on lifting pandemic era monetary measures and prepare for rate hikes.

From a technical perspective, USD/JPY posted an annual high today as the pair trades at 112, as of writing. RSI for USD/JPY has reached over baught territory and is currently at 75.36. With 2020’s annual high of 112.22 in sight, USD/JPY faces minimal headwind as there are no significant resistance levels above 112 until . USD/JPY is currently trading above its 50, 100, and 200 day SMA.

Resistance: 114

Support: 110.43, 109.67, 109.21

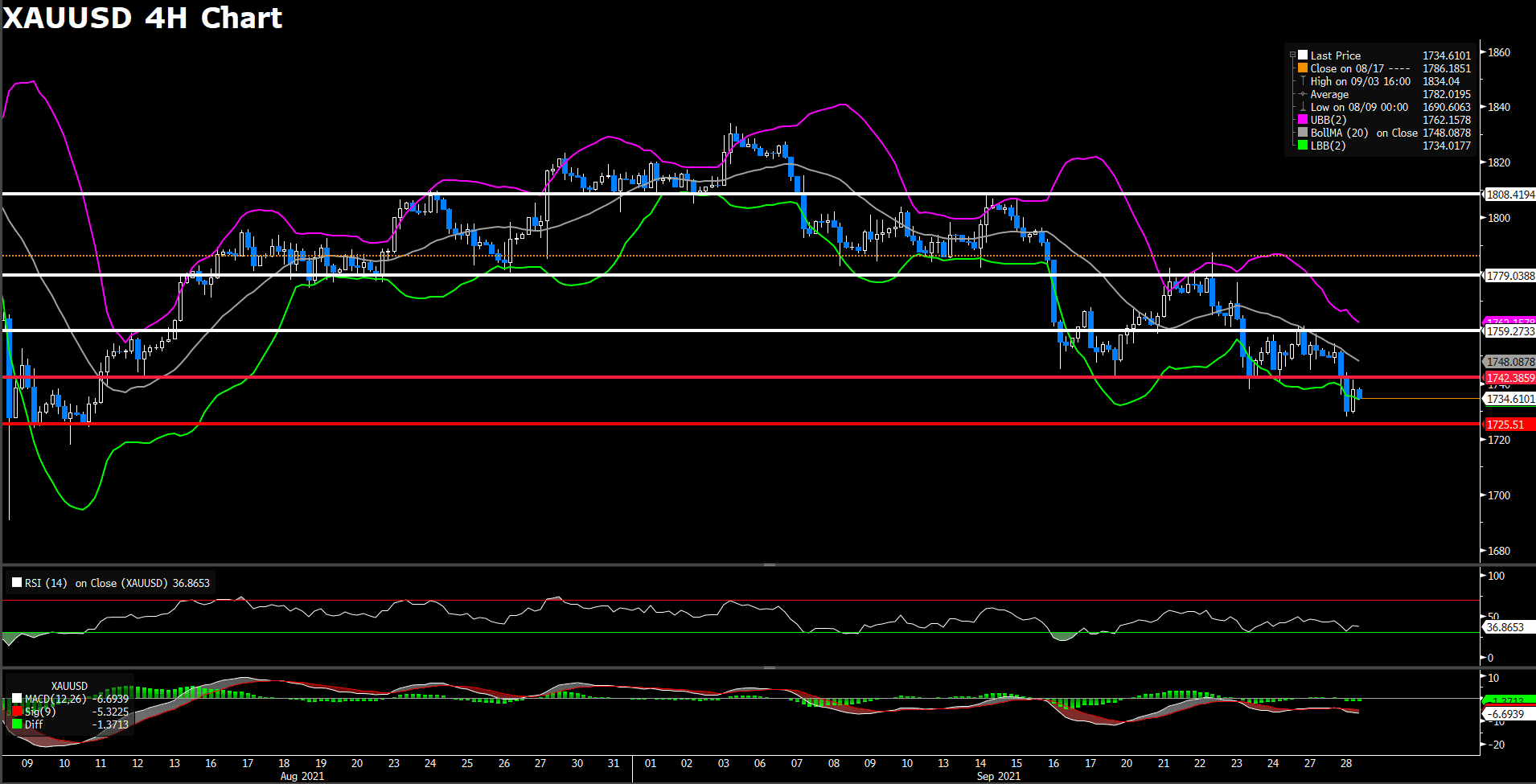

XAUUSD (4 Hour Chart)

XAU/USD continues to slide lower as the Dollar gains strength. Gold was able to gain during the Asia and Europe trading hours, but the pair was unable to hold on to gains as investors turned their attention to Fed chair Jerome Powell’s speech. The pull back on U.S. Treasury bond yields have limited the downside for XAU/USD. Energy crisis in China has helped the Greenback gain back its global reserve currency status. Today’s “risk on” sentiment, evident from the rebound of U.S. equity markets, have also limited any gains for XAU/USD.

From a technical perspective, XAU/USD has dropped below our previously estimated support level of 1725.51, following Fed chair Jerome Powell’s speech and the subsequent Dollar rally. If XAU/USD breaks below the 1725.51 support level, the pair will struggle to find support until around the 1680 price region. RSI for the pair is at 34.8, indicating modest over selling in the market. As of writing, XAU/USD is trading below its 50, 100, and 200 day SMA.

Resistance: 1759.27, 1779.04, 1808.42

Support: 1742.39, 1725.51

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

CNY |

Manufacturing PMI (Sep) |

09:00 |

50.1 |

||||

|

GBP |

GDP (Q2) |

14:00 |

4.8% |

||||

|

GBP |

GDP (YoY) |

14:00 |

22.2% |

||||

|

GBP |

Nationwide HPI (YoY) |

14:00 |

10.7% |

||||

|

EUR |

German Unemployment Change |

15:55 |

-33K |

||||

|

USD |

GDP (Q2) |

20:30 |

6.6% |

||||

|

USD |

Initial Jobless Claims |

20:30 |

335K |

||||

|

USD |

Chicago PMI (Sep) |

21:45 |

65 |

||||

-

Global - English

-

United Kingdom - English

-

France - Français

-

Spain - Español

-

Portugal - Português

-

Italy - Italiano

-

Germany - Deutsch

-

Turkey - Türkçe

-

MENA - العربية

-

MENA - English

-

Asia - English

-

India - English

-

Indonesia - Indonesia

-

Japan - 日本語

-

South Korea - 한국어

-

Malaysia - Bahasa Malaysia

-

Malaysia - English

-

Philippines - English

-

Vietnam - Tiếng Việt

-

Thailand - ไทย

-

China - 简体中文

-

China - 繁體中文

This site uses cookies to provide you with a great user experience.

By using vtmarkets.com, you accept

our cookie policy.